Jeffrey Gundlach says bonds are ‘wickedly low cost’ in comparison with shares — and gives one method to get a 9% return with out a lot danger

[ad_1]

You possibly can forgive Jeffrey Gundlach, a long-suffering Buffalo Payments fan, if he has the NFL on his thoughts now that the workforce he helps appears just like the Tremendous Bowl favourite. The chief govt of DoubleLine Capital says he recollects an ad for Crown Royal whisky, through which a referee tells drinkers to take a water break.

“The tagline is ‘keep within the sport,’” stated Gundlach, in a Twitter Spaces conversation hosted by Jennifer Ablan, the editor in chief of Pension and Investments. “[The Fed] began partying — which is a euphemism for tightening — one shot, two photographs, back-to-back three photographs, and now three extra … like dude, have a water, you recognize? Decelerate.”

Gundlach says there’s a critical danger the Fed will overtighten, and overshoot on the draw back simply because it overshot on the upside, significantly because it’s additionally lowering the dimensions of its steadiness sheet by means of quantitative tightening. “Since they’re making an attempt to get [inflation] down 700 foundation factors, the overshoot could also be even larger,” he says. “Possibly it strikes all the way down to adverse 4% on CPI, or adverse 2%.”

He says that’s what the bond market is saying with inflation operating at between 8% and 9%. “Why is anybody shopping for a 3.50%-ish 30-year Treasury

TMUBMUSD30Y,

? The one logic that squares the circle is that inflation will overshoot to the draw back.”

Gundlach says the S&P 500

SPX,

will fall to as little as 3,000, and perhaps “3,400 — both means, decrease than the place it’s right now.” And, maybe not shocking from the person generally known as the bond king, he sees tons of alternatives within the mounted earnings house. “Bonds are wickedly low cost to shares,” he stated. “And that is from someone who stated in January, inventory markets are means overvalued, however was low cost to bonds. Not anymore.”

“It is a excellent time to purchase bonds, and one of many methods I do know that, is no person needs to do it,” he stated.

For traders with low danger tolerance, he stated a financial institution mortgage fund made sense. He stated the unfold to short-term rates of interest is about 300 foundation factors. So if the Fed takes charges to 4%, the investor will get a yield of seven%, however should purchase the bonds under 95, with a default fee of lower than 1%.

“The best way it goes fallacious is that if the Fed collapses rates of interest all the way down to zero once more, and you then’re going to have a decrease earnings stream, however in the meanwhile, it’s a very simple means of getting earnings,” stated Gundlach.

Hear from Ray Dalio on the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. The hedge-fund pioneer has robust views on the place the financial system is headed.

Table of Contents

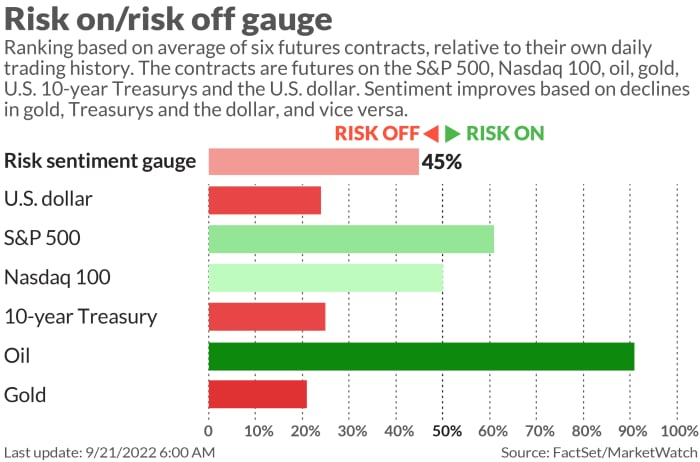

The market

U.S. inventory futures

ES00,

NQ00,

edged greater earlier than the Fed resolution. Bonds, gold

GC00,

and oil

CL.1,

caught on a bid on considerations over Russia’s mobilization of troops. The yield on the 10-year Treasury

TMUBMUSD10Y,

slipped to three.54%, and the greenback

DXY,

continued to march greater.

The excitement

Russian President Vladimir Putin ordered a partial mobilization of reservists, accused the West of nuclear blackmail and implicitly threatened to make use of nuclear weapons.

The Federal Open Market Committee rate resolution is at 2 p.m. Jap, with expectations settling that the speed hike will probably be 75 foundation factors. Economists at Deutsche Financial institution anticipate the dot plot, launched concurrently the FOMC assertion, to point out a 2022 median fed funds forecast of 4.1%, a 2023 forecast of 4.3% and a 2024 forecast of three.9%. The press convention with Fed Chair Jerome Powell begins at 2:30 p.m.

Forward of that, present dwelling gross sales are due at 10 a.m. Jap.

Dr. Doom — Nouriel Roubini — says stocks may drop 40%. (subscription required)

Basic Mills

GIS,

lifted its outlook after fiscal first-quarter outcomes, and after the shut, builder Lennar

LEN,

reviews third-quarter outcomes.

Microchip maker Micron Expertise

MU,

was downgraded to impartial at Mizuho and began at maintain by Stifel.

Better of the net

Newly launched FBI recordsdata present how Bernie Madoff reacted when the feds lastly caught on.

The early returns on a pilot four-day workweek find bosses, in addition to workers, liking it.

What a Quebec lithium mine says about the future of electric cars.

High tickers

Right here have been essentially the most energetic stock-market ticker symbols as of 6 a.m. Jap.

| Ticker | Safety title |

|

TSLA, | Tesla |

|

GME, | GameStop |

|

AMC, | AMC Leisure |

|

BBBY, | Mattress Bathtub & Past |

|

AAPL, | Apple |

|

NIO, | Nio |

|

AMZN, | Amazon.com |

|

NVDA, | Nvidia |

|

HKD, | AMTD Digital |

|

F, | Ford Motor Co. |

Random reads

Common Studios will provide non-fungible tokens at their theme parks.

A flub by a German lawmaker and a Simpsons episode has QAnon supporters worried about Sept. 24.

The actor Tom Hardy secretly entered, after which received, a Jiu-Jitsu competitors.

Have to Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your e mail field. The emailed model will probably be despatched out at about 7:30 a.m. Jap.

[ad_2]

Source link