[ad_1]

The Japanese yen has tumbled by a fifth in opposition to the greenback this yr, however broad shifts within the nation’s financial system imply its influence on Japan Inc is way extra uneven than the final time the foreign money traded at such weak ranges 24 years in the past.

Japanese firms had lengthy struggled to match the fee competitiveness of rivals in China and South Korea when manufacturing merchandise of their dwelling market, having traditionally endured a robust foreign money in addition to excessive electrical energy payments and labour prices.

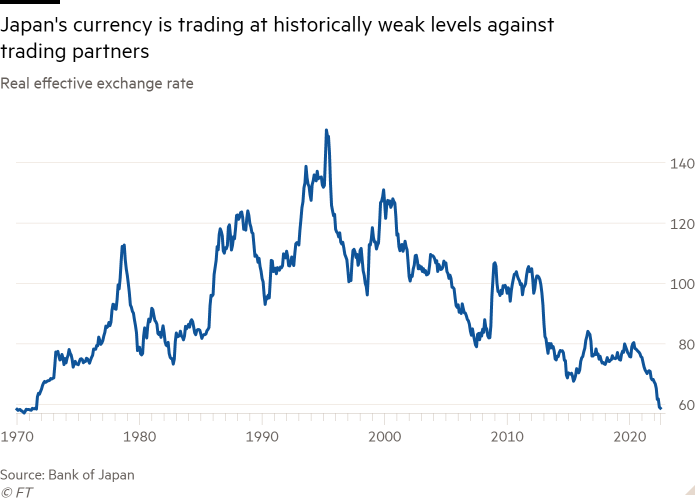

The panorama is now shifting because the yen has tumbled 20 per cent this yr in opposition to the US greenback, reaching a low of ¥145 on Thursday. The true efficient trade fee, a measure of the foreign money’s power in opposition to these of buying and selling companions adjusting for value ranges, has reached its lowest stage since 1970, in accordance with Bank of Japan information.

Japan final week sharpened its verbal intervention in opposition to the weakening yen. The Financial institution of Japan contacted banks to test on foreign money charges, which has previously been a precursor to a market intervention, which might be ordered by the nation’s finance ministry.

Whereas officers could also be rising extra nervous a few weak yen, its results are way more nuanced now than in years previous.

Traditionally, a weak yen has been a boon for Japan Inc. It offered a lift to the nation’s sprawling export sector by making Japanese items cheaper for international consumers. Nevertheless, company Japan has modified for the reason that final time the yen was this low cost in 1998. Virtually 1 / 4 of producing has shifted abroad and the previous relationships with an trade fee that after dominated supreme have now been damaged.

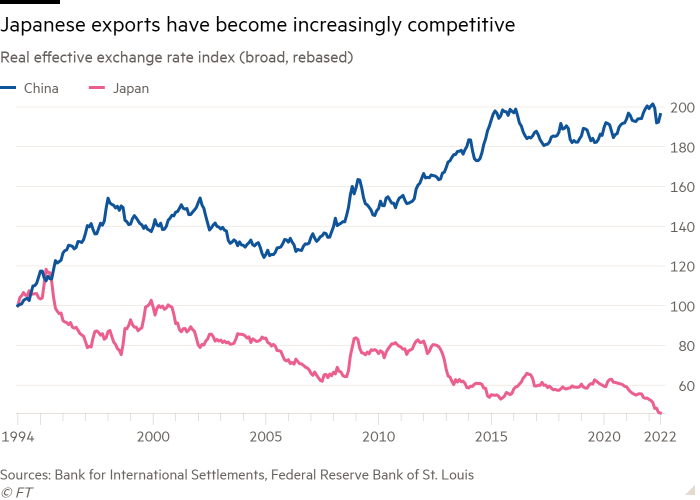

“Relative to Asian rivals, it has by no means on report been as cost-competitive as it’s now,” stated Nicholas Smith, Japan strategist at CLSA, who added that the Chinese language actual efficient trade fee has nearly doubled since 1994 as Japan’s has been in long-term decline. There has additionally by no means been a time when Japan has been as price-competitive because it at present is relative to South Korea.

Listed here are 5 case research exhibiting how the weak yen is now having a extra nuanced impact throughout Japan’s $5tn financial system.

Table of Contents

Sony: tech and leisure conglomerate

For Sony, with its numerous vary of companies, the weaker yen is a combined blessing. The Japanese electronics and gaming group started outsourcing the manufacturing of its PlayStation consoles and shopper electronics merchandise previously few many years. For these companies, a weaker yen is unfavourable because it will increase the dollar-denominated prices of producing in addition to the costs of uncooked supplies and parts bought in {dollars}. This prompted an unprecedented price rise for the PlayStation 5 final month.

However for picture sensors that Sony has continued to fabricate in Japan to promote to Apple and different cell phonemakers, the yen’s decline is a lift for its abroad exports. Total, the online foreign money influence is barely “barely optimistic” for the group’s three companies.

“The weaker yen influence remains to be there, however clearly it isn’t what it was,” stated long-term Sony analyst Pelham Smithers.

Hoya: world chief in lenses

Optical glass specialist Hoya manufactures nearly all of its merchandise outdoors Japan. With the corporate producing about 75 per cent of its gross sales outdoors its dwelling market, it advantages from the weaker yen when income made abroad are repatriated and transformed into yen. In reality, the achieve was vital sufficient that Hoya introduced a ¥60bn share buyback programme after reporting a 17 per cent year-on-year enhance in internet revenue for the April-to-June quarter.

“Lots of our money is held in international foreign money, so when there was a rise in yen foundation, we determined we must be paying again to our shareholders once we can,” its chief monetary officer Ryo Hirooka stated when requested concerning the share buyback.

The massive query, stated Macquarie analyst Damian Thong, was whether or not firms would proceed the repatriation. “If Japanese firms resolve to not spend money on Japan by bringing the cash again to reap the benefits of Japan’s rising financial competitiveness, and resolve to make use of it for [mergers and acquisitions] or to construct factories overseas, then the yen might stay beneath strain with no profit to the Japanese financial system,” he stated.

The ratio of abroad manufacturing for Japan manufacturing firms has risen from common 3.8 per cent in 1990 to 17 per cent within the post-global monetary disaster interval of 2008-2012 to greater than 22 per cent lately. These choices have been made by producers which, traditionally, benefited most strongly when a weakening yen improved the competitiveness of their merchandise.

Honda: Japan’s offshoring pioneer

Amongst carmakers, Honda has been one of the vital aggressive firms pursuing offshoring within the Japanese automobile trade, with the ratio of its abroad manufacturing rising from 68 per cent in 2008 to 85 per cent final yr. Because of this, a depreciation of ¥1 within the yen in opposition to the US greenback will increase its working income by ¥10bn ($70mn), in contrast with an almost ¥20bn enhance it acquired 15 years in the past.

These offshoring choices weren’t, typically, made to chase cheaper labour however to extra successfully cater to the calls for of shoppers in international markets. As such, the offshoring is more likely to proceed as Japan’s home markets proceed to shrink. “[Exchange rates] can’t be a giant issue to decide on manufacturing location. A minimum of 1mn car manufacturing is required for a market to maintain manufacturing expertise,” stated Koichi Sugimoto, analyst at Mitsubishi UFJ Morgan Stanley Securities.

Even with a smaller profit from the weaker yen, Honda upgraded its annual steerage final month because the foreign money tailwind helped to offset an increase in uncooked materials prices. Corporations are nonetheless grappling with provide chain disruptions and a slowdown within the international financial system, however analysts say Honda’s case suggests there may be extra room for upgrades within the coming quarters for company Japan.

Quick Retailing: Asia’s largest clothes model

Earlier this yr in April, Tadashi Yanai, the chief govt of Uniqlo proprietor Quick Retailing, warned that the weak yen had “no benefit in any respect”. That will have been true 15 years in the past when its Uniqlo enterprise was primarily home. However with its Uniqlo shops at present producing almost half of their annual income outdoors of Japan, a depreciation of ¥1 in opposition to the US greenback will increase its income by ¥1.2bn when repatriated. The prices of imported supplies are nonetheless greater with a depreciation of ¥1 in opposition to the US greenback, wiping ¥4bn in Uniqlo income.

Since Asia’s largest clothes retailer has used hedging instruments referred to as international trade forwards, the weakening yen will solely critically begin to chunk in 2024. Thus, for the fiscal yr that led to August, the group is forecasting report income. Going ahead, Uniqlo has already introduced value hikes for a few of its merchandise and its abroad gross sales are anticipated to develop additional. “It’s a incorrect to imagine that every one retailers will do badly because of the weaker yen,” stated Credit score Suisse analyst Takahiro Kazahaya.

Nitori: Minimize-price furnishings for a deflationary technology

The low cost furnishing group generates most of its gross sales in Japan so the weaker yen influence is unfavourable as a result of rising price of imported supplies. Till the tip of this month, the corporate has international trade ahead contracts locking the dollar-yen fee at ¥115. However for the remainder of the fiscal yr till the tip of February, Nitori will probably be shopping for supplies at market costs because it had assumed that the yen would strengthen by the year-end on account of a recession within the US. A depreciation of ¥1 in opposition to the US greenback decreases its income by ¥2bn. Like Uniqlo, it might additionally increase costs to offset rising import payments.

“A value improve poses two points: there may be the query of whether or not the merchandise will promote if Nitori transferred the prices to shoppers, and there may be additionally a time lag till it may possibly switch the prices,” stated Kazahaya. The lag is particularly lengthy for Nitori because it might want to promote all of its previous merchandise earlier than it may possibly increase the worth of its new furnishings. Both approach, the corporate may have no selection however to switch a number of the prices to shoppers.

Source link