Why is inflation nonetheless so excessive proper now, and when can we anticipate it to lastly cease?

[ad_1]

By the tip of 2022, inflation would be the yr’s greatest buzzword. Not solely within the U.S., however around the globe.

Do not miss

U.S. inflation has barely eased for the second month in a row, reaching 8.3% in August. That is the bottom determine in 4 months, preceded by a 40-year excessive of 9.1% earlier this yr

But Individuals are nonetheless seeing rising costs nearly in all places they appear, with some sectors are being hit more durable than others. The price of power and gasoline fell 5% month-over-month however meals costs noticed main upticks.

“The meals index elevated 11.4% during the last yr, the most important 12-month enhance because the interval ending Could 1979,” the Bureau of Labor Statistics says.

The Federal Reserve enacted its second consecutive 0.75 proportion level rate of interest enhance in late July in hopes of easing inflation. However what’s actually inflicting costs to rise to rise within the first place, and what is going to it take to make it cease?

Table of Contents

What are the causes of inflation?

There are 4 common causes of inflation. Essentially the most generally acknowledged causes are:

demand-pull inflation

cost-push inflation

built-in inflation

The fourth trigger is a rise within the cash provide, as a result of Federal Reserve printing extra.

Demand-pull inflation occurs when demand from shoppers pulls costs up. An instance of costs going up attributable to mixture demand is rising home costs, particularly in highly-coveted areas. For instance, Portland, Ore., which has been ranked as one of many hottest markets within the nation, noticed greater than 117percentt enhance in dwelling costs from a mean of $176,325 in 2002 to round $383,482 in 2020.

Value-push inflation occurs when the price of producing objects will increase, pushing the costs greater. An instance of cost-push inflation is what we noticed through the pandemic.

The onset of COVID-19 led to a sequence of provide chain disruptions, labour shortages and finally rising prices to provide objects and supply providers. World’s economies are nonetheless reeling from this impact, and this is without doubt one of the causes for this inflation.

Constructed-in inflation or wage-price spiral is when employees demand greater wages to maintain up with rising dwelling prices. This may induce companies to boost their very own costs too, resulting in a circle impact.

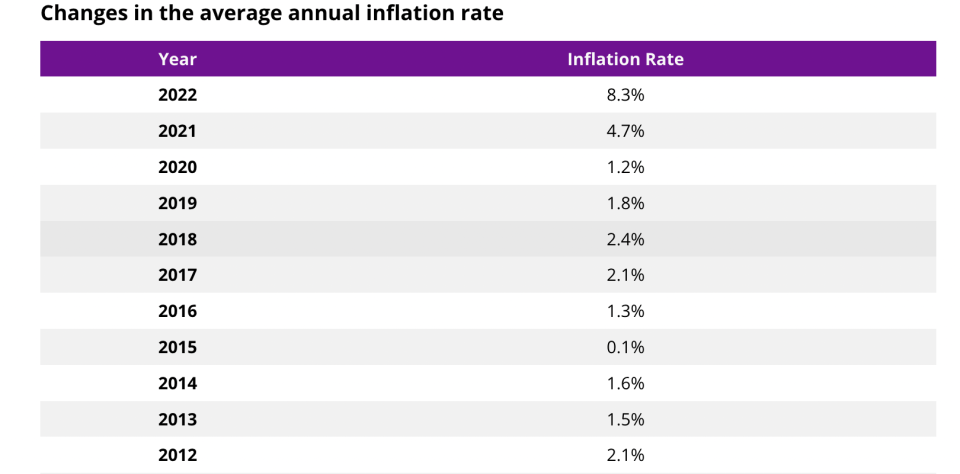

United States inflation historical past

Does an elevated cash provide induce inflation?

There’s debate on whether or not the Federal Reserve printing out more cash might or might not trigger inflation.

Powell nonetheless believes that inflation and the cash provide are unconnected however he has fierce critics who think otherwise.

Steve H. Hanke — a professor of utilized economics at Johns Hopkins College — acknowledged the cash provide is rising 13% yearly.

Till the pandemic, provide hadn’t grown that a lot because the late Seventies. Hanke additionally stated that even when the Fed acts swiftly to slash that enhance in half, annual inflation will high six % via 2024.

Nonetheless, the Feds elevated the cash provide by over 120% in 2008/09, and the rise didn’t trigger inflation.

The impact of financial coverage

In the course of the pandemic, stimulus checks have been launched to assist preserve the economic system energized. With three rounds of stimulus checks, the U.S. authorities gave greater than 472 million funds or $803 billion in whole monetary reduction to these impacted by the pandemic.

To proceed spurring financial exercise, the Feds additionally lowered its charges.

Nonetheless, some critics claim that whereas the stimulus payments have been mandatory, they’ve contributed to the inflation we all know at this time.

And this additionally explains why some economists imagine that inflation is the results of a financial coverage.

“Inflation is at all times and in all places a monetary phenomenon, within the sense that it’s and will be produced solely by a extra speedy enhance within the amount of cash than in output,” the late economist and Nobel prize laureate Milton Friedman as soon as stated.

Why is inflation so excessive proper now?

The principle causes of the present inflation within the U.S. is the persistence of provide disruptions and shortages of meals merchandise, which began with the pandemic. Moreover, inflation can also be affected by the upper power costs. The U.S. isn’t the one nation experiencing this.

The U.Okay.’s inflation dipped from 10.1% in July to 9.9% in August after a drop in petrol costs. Nonetheless, it’s nonetheless excessive.

Canada’s inflation additionally slowed to 7.6% in July, however it’s nonetheless far above the Bank of Canada’s 2% target. Fuel costs are reducing however households are nonetheless feeling the impression of inflated meals costs.

Some international locations are in a far worse predicament with regards to inflation. In Argentina, inflation stands at 64% and is predicted to hit 95% by the tip of 2022. In Turkey, it is practically 80%. Inflation shouldn’t be solely a results of foreseeable financial adjustments, but additionally geopolitical occasions that trigger ripple results, reminiscent of COVID-19 and Russia’s invasion of Ukraine.

On account of the Russian invasion on Ukraine, and quite a few international locations imposing sanctions on gas-exporter Moscow, the world felt the commodity shock when power costs soared excessive and reached new information. This explains why power costs reached report highs in lots of elements of the world.

When will inflation go down?

General, the August outcomes present that costs have began to say no in key areas, reminiscent of gasoline or airfare, most likely indicating that inflation peaked. Nonetheless, the underlying points inflicting this inflation haven’t been solved but.

In its post-COVID-19 indicators, provide chain agency Flexport said that “general shopper preferences for items over providers will decline however nonetheless stay barely above summer time 2020 and pre-pandemic ranges.”

In August, Artwork Hogan, managing director and chief market strategist at B. Riley Monetary, instructed Forbes that he estimates that this era of inflation can finish by the center of 2023.

“We’re seeing costs come down and that can assist shorten the inflation cycle,” he says. “Each transport prices and occasions have come down significantly.”

Nonetheless, monetary providers firm Edward Jones speculates that inflation ought to begin to moderate by the tip of 2022.

As well as, perhaps there may be some silver lining for the provision chains in the US since U.S. executives are presently pondering of various methods to re-pivot and cope with these provide chain points.

In keeping with Dodge Development Community, the development of latest manufacturing services within the U.S. has soared 116% over the previous yr, dwarfing the ten% acquire on all constructing initiatives mixed. Nonetheless, it will get sophisticated with the labor scarcity and extra child boomers find yourself retiring

Tricks to fight inflation

There are 4 fundamental methods you may struggle inflation in your day by day life.

Reduce discretionary spending. It’s apparent that inflation requires reducing again on discretionary, or non-essential spending and tracking your income.

Carry in additional earnings. Those that are very cash-strapped or wish to save more cash might tackle an extra job.

Make the most of excessive rates of interest. Nonetheless, those that have some cash to spare can spend money on excessive curiosity financial savings accounts or time period deposits if potential.

Eradicate your money owed. Additionally, as soon as pursuits are up, it’s advisable to refinance any present variable-rate debt.

What to learn subsequent

This text supplies data solely and shouldn’t be construed as recommendation. It’s offered with out guarantee of any form.

Source link