What’s one of the best ways to spend money on tech shares proper now? This technique is working nicely for one fund supervisor.

[ad_1]

Expertise shares have been rallying for weeks.

However there are many arguments that we’re within the midst of a bear-market rally and that extra volatility lies forward, particularly for the quickly rising, however not essentially worthwhile, know-how shares that carried out so nicely in the course of the earlier bull market by late 2021.

Robert Stimpson, chief funding officer for Oak Associates Funds, made the case {that a} “financials first method” to corporations with endurance is the perfect one for the present setting, with dangers that embrace rising rates of interest and a potential recession.

Throughout an interview, Stimpson, who has been with the agency for 21 years and co-manages the $544 million Crimson Oak Expertise Choose Fund

ROGSX,

described his crew’s method to deciding on large-cap tech shares for “enticing valuation, excessive revenue margins and a capability or willingness to help and acknowledge shareholder worth.”

That final half may embrace share buybacks, which improve earnings per share, dividend will increase or acquisitions anticipated to extend earnings per share.

The fund has a low-turnover method, at present holds 26 shares and has a four-star ranking, the second-highest, from Morningstar.

An organization doesn’t essentially should pay a dividend to be among the many fund’s holdings, Stimpson mentioned, however “it has to point out respect for traders,” which features a “non-hubristic method to acquisitions.”

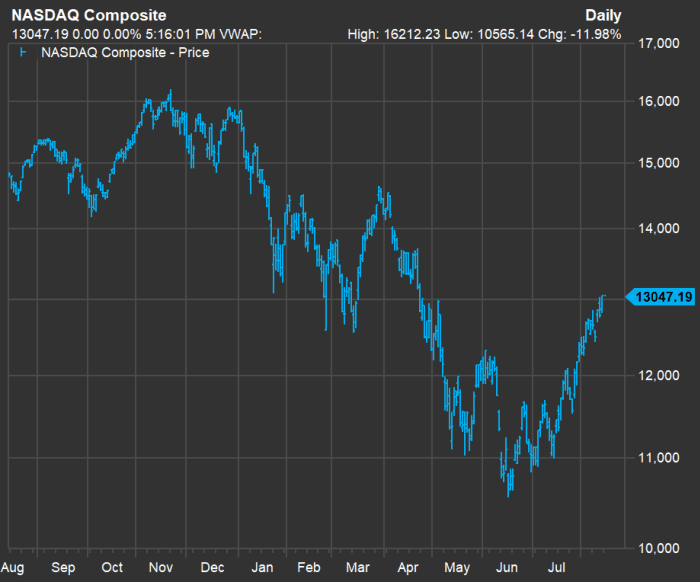

A better take a look at the tech-stock rally

Right here’s a one-year chart exhibiting the motion of the Nasdaq Composite Index

COMP,

:

FactSet

The Nasdaq has rallied 23% from its 2022 closing low on June 16 and it’s now down 17% for the yr. The Nasdaq-100 Index

NDX,

— which incorporates the 100 largest nonfinancial shares within the full Nasdaq — can be down 17% this yr. However even after its personal 22% rally since June 16, 23 of the Nasdaq-100 are nonetheless down between 30% and 59% for 2022.

To make certain, the Crimson Oak Expertise Choose Fund hasn’t escaped this yr’s broad decline — it has fallen 17% for 2022.

Regardless of the better-than-expected inflation numbers for July, the Federal Reserve is predicted to remain the course and proceed elevating rates of interest to chill the economic system. Rising rates of interest at all times put strain on inventory costs — much more so for tech shares. That’s as a result of their beneficial properties had been pushed by gross sales progress, and even by emotional reactions to their potential for “disruptive innovation,” reasonably than will increase in revenue, money circulate and deployment of capital in methods meant to profit shareholders.

“Once we had been in a zero-interest-rate setting, the acceptance of danger was a lot larger. Capital was low-cost and firms that weren’t anticipated to turn out to be worthwhile for some time had been acceptable,” Stimpson mentioned.

Trying forward, he recommends traders keep away from investing in corporations on the expectation that they’ll ultimately develop into present valuations that seem “lofty.”

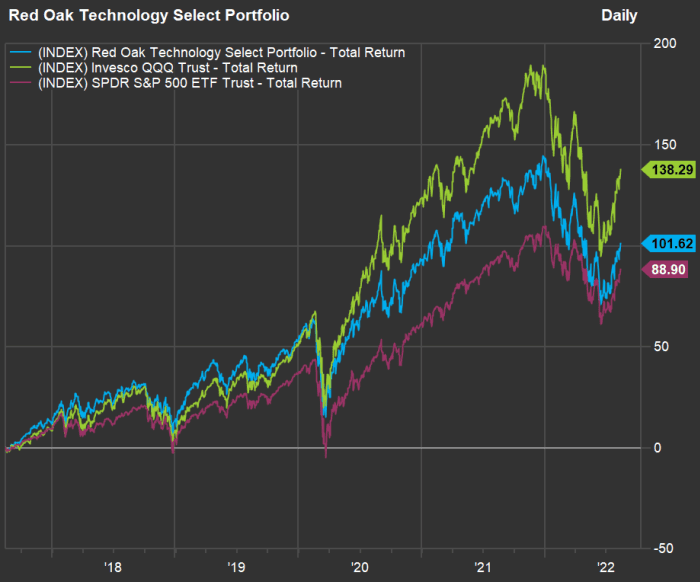

Fund efficiency

Stimpson was fast to agree that the Crimson Oak Expertise Choose Fund’s “high-quality blue-chip method” to tech shares underperformed over the past bull market.

“Do I want we owned Nvidia for the previous 20 years? Completely — it has been a monster,” he mentioned.

However Nvidia Corp.

NVDA,

Tesla Inc.

TSLA,

and Netflix Inc.

NFLX,

which he all termed nice corporations, featured “returns on equities shared with shareholders” that didn’t meet the fund’s requirements. He named Amazon.com Inc.

AMZN,

and Apple Inc.

AMZN,

as examples of corporations that do.

Right here’s a comparability of the fund’s complete return to these of the Invesco QQQ Belief

QQQ,

(which tracks the Nasdaq-100) and the SPDR S&P 500 Belief

SPY,

over the previous 5 years:

FactSet

It’s hardly stunning that the Crimson Oak Expertise Choose Fund trailed QQQ, when central-bank and monetary insurance policies did a lot to help even the riskiest tech shares. However the fund has crushed the S&P 500’s

SPX,

five-year efficiency, and relying on how you are feeling in regards to the route of rates of interest and the economic system, the conservative method to know-how often is the proper one for you.

Stimpson mentioned that over the previous yr, the fund has been decreasing holdings tied to shopper electronics, as a result of the administration crew believed “demand had been puled ahead in the course of the pandemic for gaming, properties, and many others.” He additionally mentioned they’d “lightened up on semiconductors,” and elevated holdings in enterprise-class software program corporations.

Prime holdings

Listed here are the ten largest holdings of the Crimson Oak Expertise Choose Fund as of June 30:

| Firm | Ticker | Share of fund | First bought |

| Alphabet Inc. Class C |

GOOG, | 7.9% | March 2014 |

| Apple Inc. |

AAPL, | 7.2% | March 2006 |

| Amazon.com Inc. |

AMZN, | 6.9% | March 2016 |

| Microsoft Corp. |

MSFT, | 6.0% | March 2013 |

| Cisco Programs Inc. |

CSCO, | 5.5% | April 1999 |

| Meta Platforms Inc. Class A |

META, | 4.9% | March 2016 |

| KLA Corp. |

KLAC, | 4.7% | June 2006 |

| Oracle Corp. |

ORCL, | 4.7% | September 2013 |

| Synopsys Inc. |

SNPS, | 4.5% | March 2010 |

| Intel Corp. |

INTC, | 4.4% | June 2010 |

| Supply: Morningstar | |||

The share of Alphabet Inc. shares on the checklist above is for the fund’s mixed holdings of the corporate’s Class C

GOOG,

and Class A

GOOGL,

shares.

Don’t miss: Oil prices are down, but energy companies’ earnings estimates keep rising — these stocks are cheap

Hear from Ray Dalio at MarketWatch’s Best New Ideas in Money Festival on Sept. 21 and 22 in New York. The hedge-fund pioneer has robust views on the place the economic system is headed.

Source link