[ad_1]

Getty Photos

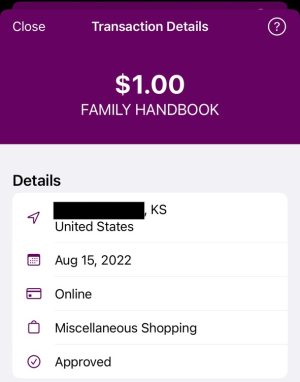

Ben Langhofer, a monetary planner and single father of three in Wichita, Kansas, determined to begin a aspect enterprise. He had made a handbook for his household, laying out core values, a mission assertion, and a structure. He needed to assist different households put their beliefs into an actual ebook, one they might maintain and show.

So Langhofer employed internet builders about two years in the past and arrange an internet site, buyer relationship administration system, and fee processing. On Father’s Day, he launched MyFamilyHandbook.com. He is had some modest success and has spoken with bigger teams about bulk orders, however enterprise has been principally quiet to this point.

That is how Langhofer knew one thing was unsuitable on Friday, August 11, when a girl from California known as a couple of fraudulent cost. He checked his service provider account and noticed practically 800 transactions.

“My coronary heart, it sunk,” Langhofer instructed Ars on Thursday. He instantly contacted his fee vendor Stripe, who he stated instructed him about card testing—a scheme during which on-line card thieves use tiny prices from an account to check for legitimate playing cards. Stripe stated it might concern a bulk refund, Langhofer stated. Figuring out his fee processor was conscious of the difficulty, he went about his weekend.

Langhofer awoke early Monday morning to a flurry of missed calls.

He stated his website had tried practically 11,000 extra transactions, every for $1, most of them initiated by e-mail addresses minutely completely different from each other. Lots of them concerned Ally Financial institution playing cards, Langhofer stated. He’d solely ever had two cellphone calls to the forwarded quantity listed in his on-line retailer, however now his cellphone would not cease ringing.

“My dad all the time taught me to have a superb identify, so this hurts,” he stated. “I haven’t got a giant employees, however I’ve an excellent identify in Wichita, on this state. Now my enterprise is tied up on this, and I do not know what’s subsequent.” In textual content messages earlier than an Ars Technica interview, Langhofer stated the ordeal “consumed my whole week and brought on extra panic than I recall having in a very long time.”

On the market: debit playing cards, barely used

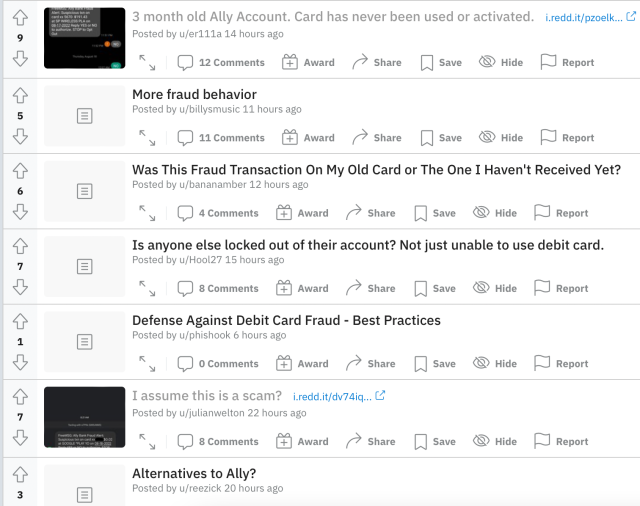

Langhofer’s enterprise seems to be a sufferer in a series of fraud that has affected 1000’s of debit card prospects over the previous week. Most outstanding amongst them are Ally Financial institution prospects, who’ve been tweeting and posting within the r/AllyBank subreddit about prices on playing cards, some they’ve by no means activated or used. They’ve reported (and Ars Technica has seen) cellphone help wait instances of as much as an hour or extra.

There’s an awesome sentiment that one thing is occurring, however the main events have but to verify something.

Ars Technica has reached out to Ally Financial institution quite a few instances, by cellphone and e-mail, for touch upon this story. We have additionally contacted Shopify. We are going to replace this submit if we hear again.

Two of these questioning what’s occurring are Stephen Fuchs and Curt Grimes, a Chicago-area couple who spoke with Ars Technica and shared their documentation. They opened their joint Ally checking account in March 2022. Each had debit playing cards tied to it, every with completely different numbers. Fuchs by no means activated his card. Up till final week, Grimes had solely used his card as soon as, to ship about $5 to somebody by way of Apple Money.

On August 10, a cost for $15 from a unusual software program website appeared on one in every of their playing cards, but it surely went unnoticed. On Friday, August 12, Grimes acquired an SMS fraud alert from Ally, alerting him to prices from two completely different Shopify shops for practically $200. Grimes flagged the costs as fraudulent, and Ally (and Apply Pay) reported that the cardboard was suspended. After spending nearly an hour ready on the cellphone for Ally on Saturday, August 13, Grimes disputed the sooner $15 cost and noticed in his Ally app {that a} new card, with a brand new quantity, was on its method.

[ad_2]

Source link