[ad_1]

UK banks are piling into purchase now, pay later regardless of rising dangers of default and growing regulatory scrutiny, in a defensive effort to win again younger customers extra snug with fintechs like Klarna than bank cards.

With nimbler rivals snapping up youthful prospects, NatWest, Virgin Cash, HSBC and Monzo have all launched BNPL merchandise — which permit customers to place off or cut up funds for purchases — within the UK over the previous yr.

“It’s no shock that banks need a piece of the purchase now, pay later market,” mentioned Amy Gavin, senior strategist at fintech consultancy 11:FS. “Suppliers that fail to supply it danger dropping entry to their prospects, significantly millennials and Gen Z.”

Fintechs akin to Sweden’s Klarna — previously Europe’s most respected non-public tech firm earlier than its valuation crashed throughout its newest funding spherical — have benefited vastly from the increase in on-line procuring and BNPL demand sparked by the pandemic.

Researchers on the universities of Chicago, Warwick and Nottingham estimated that the UK BNPL market grew to £5.7bn in 2021, greater than double the determine calculated by the Monetary Conduct Authority for 2020.

“Take up has been away forward of what we had been anticipating,” mentioned Monzo chief government TS Anil of Flex, the service it launched in September, which he mentioned was “the appropriate long-term play” for the neobank.

A number of bankers mentioned that they didn’t count on their merchandise to generate vital revenues within the short-term, however they would supply them to youthful prospects demanding the service.

One banker mentioned they didn’t count on to generate profits on BNPL, however had been involved concerning the menace posed by the fintechs in the event that they branched into providing different companies.

Lenders have sought to place their merchandise as accountable options to incumbents, who’re dealing with questions across the affordability of their loans.

Conventional BNPL transactions have primarily relied on gentle credit score checks, which try to gauge creditworthiness usually utilizing knowledge offered by customers. These usually are not seen to different lenders and depart no everlasting file, resulting in issues that customers can tackle debt from plenty of corporations. A rising variety of suppliers have begun reporting their transactions to credit score reference companies.

Against this, banks providing BNPL do a extra full search of a shopper’s monetary file, which might uncover circumstances of defaults or late funds. These more durable credit score checks are recorded on candidates’ credit score historical past and might influence credit score scores.

“We’re involved that customers’ credit score efficiency can endure from the usage of unregulated purchase now, pay later,” mentioned David Lindberg, chief government of retail banking at NatWest. “As extra of our youthful prospects use these companies, we wish to present another.”

NatWest’s BNPL possibility, which launched in June, is on the market to account holders over the age of 18 incomes no less than £10,000 a yr, in step with the standards for its primary bank cards.

In June, the federal government introduced plans to strengthen guidelines on the sector, together with requiring that companies checks that buyer can afford to make use of their merchandise. Nonetheless, regulation is due by 2023 on the earliest.

UK banks might additionally profit as incumbents face rising charges and a price of dwelling disaster which is squeezing debtors and which has hit valuations — Klarna had its valuation slashed from $46bn to lower than $7bn in July and US-based Affirm has suffered an 80 per cent drop in its share value since November.

Analysts additionally level to an a variety of benefits banks have over the incumbents.

“They’ve an current buyer base and huge ‘low-cost’ credit score strains already in place,” mentioned Rohit Mathur, a associate at enterprise capital agency Digital Horizon which invested in Klarna.

Gavin at 11: FS mentioned that banks’ scale might permit them to cost retailers decrease transaction charges, undercutting current suppliers who already function on razor-thin margins.

British fairness analysis home Redburn estimated in 2021 that incumbents made on common 0.3 level gross revenue earlier than working prices.

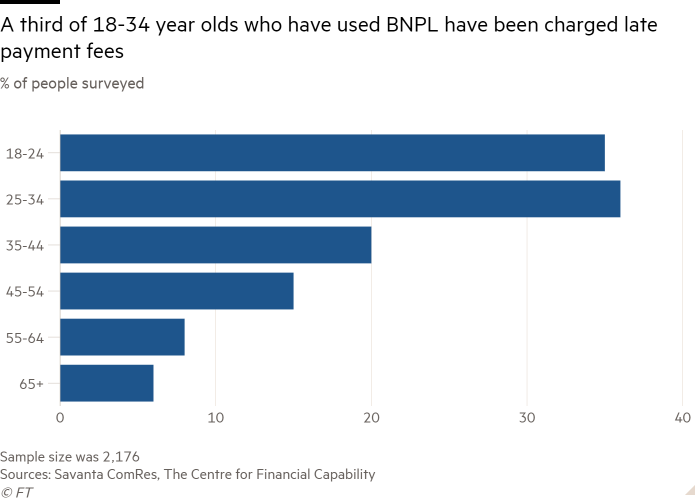

Banks will, nonetheless, additionally need to take care of late funds and defaults.

NatWest fees a £12 payment per thirty days if funds arrive greater than a day after they’re due, whereas Monzo mentioned it’ll try to take a smaller quantity by transferring to a longer-term instalment plan.

Against this, Virgin mentioned it will not be charging for late charges, an strategy already taken by some purchase now, pay later suppliers within the UK together with Klarna.

However whereas many lenders are charging in, others are holding hearth.

“It’s a dangerous time to start out [a buy now, pay later product] in a down credit score cycle. It’s a product for individuals who are likely to wrestle with credit score, in spite of everything,” mentioned one financial institution government. “Can we wish to open ourselves as much as the credit score and fame harm from that?”

Source link