This asset class is poised to rise 38% as a result of markets overestimate threat of worldwide recession, Goldman says

[ad_1]

Nonetheless reeling from Fed Chairman Jerome Powell’s higher-for-longer remarks last week, riskier asset like equities look set for an additional battering, on Monday.

“You can’t have the inventory market collapse over 5% on the phrases of 1 man,” grumbled FWDBONDS ‘ chief economist Chris Rupkey, who sees a serious credibility downside for the central financial institution. “Fed officers set the inflation hearth ablaze with an excessive amount of QE and now they are saying they know what to do now that inflation is uncontrolled. Nobody believes that.”

And as we head into the worst calendar month for Wall Avenue, economists expect extra hawkishness out of the Fed, and say a powerful jobs report on Friday will solely shore up rate-hiking resolve.

So the place are the havens? Dividend stocks, the entrance finish of credit score markets and Latin American currencies and bonds are simply a number of the options floating round.

Our name of the day from Goldman Sachs gives one other. They see a shopping for alternative by way of a latest gentle patch in commodities and scale back threat elsewhere. They see equities threatened by sticky inflation and a probably hawkish Fed shock.

Commodities are “the very best asset class to personal throughout a late-cycle part the place demand stays above provide. Bodily fundamentals sign a number of the tightest markets in many years,” stated a crew led by senior commodities strategist Sabine Schel in a brand new notice.

Goldman Sachs

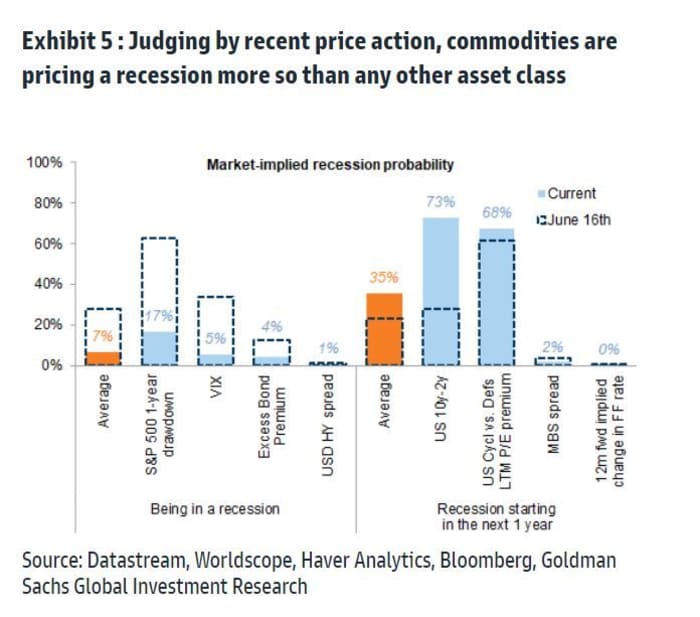

The latest pullback in agricultural and industrial commodities was resulting from a world recession being priced in by merchants. Recession fears have had extra of an influence on commodities than on some other asset class, Goldman stated. Nonetheless, the financial institution believes a recession will probably be largely confined to Europe, with the U.S. and China avoiding one.

Goldman Sachs

It’s a matter of simply not sufficient commodities to go round, they are saying.

“As additional stock falls set off depletion dangers, commodity returns for buyers are more likely to strengthen. Put in a different way, with the danger of stock exhaustion considerably better than the danger of an imminent international financial recession in our view, we imagine commodity index backwardation ought to steepen,” stated Schels.

Backwardation refers to futures costs tied to a given commodity buying and selling increased than the present spot value.

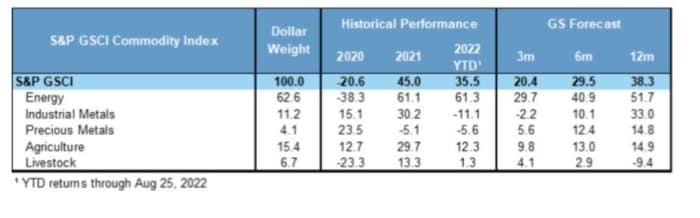

In step with this view, Goldman has raised its forecasts for the S&P GSCI commodity index on a 12-month foundation to 38.8%. The financial institution additionally sees 12-month returns of 51.7% for the power sector.

Goldman Sachs

Goldman says drivers for this commodity run will probably be “micro in nature as additional value spikes are required to carry demand again consistent with provide within the absence of inventories,” including that these spikes will create “excessive” bouts of backwardation.

“In 2000 or [2007-2008], for example, the depletion of inventories shifted oil markets right into a extremely unstable pricing regime the place excessive value spikes generated substantial backwardation. Even within the absence of serious value appreciation, this could produce exceptionally excessive returns for buyers,” stated Goldman.

And whereas backwardation has been mostly seen in power, the Goldman crew sees it spreading to base metals, notably copper, corn and soy the place volatility is more likely to improve.

Particularly, regardless of robust year-to-date returns, they see power and agriculture main. “With oil the commodity of final resort in an period of extreme power shortages, we imagine the pullback in your entire oil advanced gives a horny entry level for long-only investments.”

A McKinsey report recently highlighted a worsening scenario for international meals provide in 2023, owing to struggle in one of many world’s breadbasket — Ukraine — and local weather change. The USDA’s latest corn report downgraded subsequent 12 months’s yield.

Learn: There’s a new supercycle emerging for the economy, and these are the stocks that would benefit

Table of Contents

The markets

Inventory futures

ES00,

NQ00,

are underwater, the 2-year Treasury yield

TY00,

TMUBMUSD02Y,

is at a stage not seen since 2007, the greenback

DXY,

is climbing and gold

GC00,

is down. Oil

CL.1,

is barely increased, whereas natural-gas costs

NG00,

are surging. Asian and Europe shares are following Wall Avenue’s lead and bitcoin

BTCUSD,

has dropped under $20,000.

The excitement

After Powell’s market-shattering remarks, anticipate plenty of deal with information. Monday is quiet, however the remainder of the week will carry client confidence, the newest Institute for Provide Administration index, and most necessary payrolls information on Friday. New York Fed President John Williams is amongst a handful of Fed audio system anticipated this week.

Tesla

TSLA,

CEO Elon Musk stated he’s aiming to have self-driving technology prepared by year-end, with large launch within the U.S. and Europe relying on regulators.

Pinduoduo

PDD,

is hovering after the China primarily based agricultural firm that connects shoppers to producers reported surging revenue and profit.

Better of the net

‘Climate catastrophe’ in Pakistan as floods kill more than 1,000, wipe out crops

UN nuclear watchdog monitors are finally on the way to the Zaporizhzhia plant

The chart

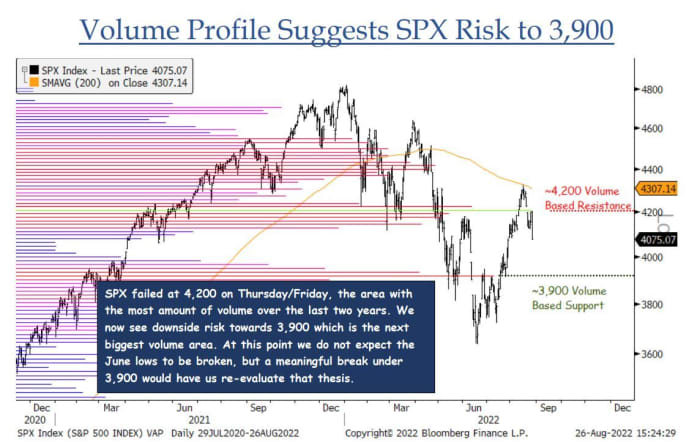

After the S&P 500 failed late final week at 4,200, which has seen essentially the most quantity within the final two years, all eyes are on 3,900, Jonathan Krinksy, chief market strategist at BTIG, tells shoppers.

“Whereas we stay cautious near-term, we predict the June lows will maintain as weak spot beneath 4,000 ought to see sentiment and positioning get bearish sufficient to create a good entry level heading into the fourth quarter,” he stated. But when that breaks, they are going to be tearing up the playbook a bit, he says.

BTIG

The tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m. Japanese Time:

| Ticker | Safety title |

|

TSLA, | Tesla |

|

BBBY, | Mattress Tub & Past |

|

AMC, | AMC Leisure |

|

GME, | GameStop |

|

APE, | AMC Leisure most well-liked shares |

|

AAPL, | Apple |

|

NIO, | NIO |

|

NVDA, | Nvidia |

|

AMZN, | Amazon |

|

BABA, | Alibaba |

Random reads

Activists mourn ‘man within the gap,’ the last of his Brazilian Amazonian tribe

NASA’s new moon rocket could not see liftoff on Monday

Must Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your electronic mail field. The emailed model will probably be despatched out at about 7:30 a.m. Japanese.

Source link