There’s just one ‘excellent asset’ to struggle all of the dangerous information that may very well be coming, says this strategist

[ad_1]

Forward of that, inventory futures are falling after Ford warned on excessive provide prices, on the heels of FedEx’s

FDX,

revenue warning final week.

The greenback and money have been among the many hottest havens for buyers as they navigate recession dangers with larger charges and better inflation, alongside a brutal struggle in Europe.

However our name of the day from Warren Pies, co-founder and strategist at 3Fourteen Research, sees vitality as the hedge for any dangerous information within the pipeline. As he notes, after years of shifting in reverse instructions, equities and bonds have been falling collectively.

“I feel that you simply simply have much more potential outcomes sooner or later now the place shares and bonds are positively correlated. There’s only a few belongings that may hedge the dangers which are on the market. And I feel vitality is the right asset,” Pies mentioned in an interview that published last Friday with Actual Imaginative and prescient.

And whereas the Fed might attempt to hike till it brings down vitality costs — a serious cause for surging inflation — they might not succeed as they “can’t influence the principle prime driver of oil proper now” — geopolitics, mentioned Pies.

“If we transfer ahead absolutely sanctioning Russian oil and actually getting off this stalemate that’s occurring proper now and posturing, the world’s going to be quick loads of oil,” and that may create “one heck of a recession,” he mentioned. “Oil goes to do its personal factor…That’s why it is advisable to have oil publicity via vitality in your portfolio.”

As for the forms of oil firms, Pies advises conserving it easy. “You don’t must tackle any form of firm particular threat or beta proper right here. Purchase the bellwethers, the large vitality firms, liquid vitality firms.

“If you wish to be somewhat bit completely different or outdoors of the benchmark, we do nonetheless like the massive cap Canadian producers as a result of they’ve a decrease value of manufacturing and upkeep capex roughly,” he mentioned.

What he’s been suggesting to shoppers is a ten% to twenty% vitality place, given the sector represents 5% of the S&P 500

SPX,

after which whittle the remainder of the portfolio to high quality firms. “You’re simply making an attempt to sidestep the unprofitable tech stuff,” mentioned Pies.

The strategist sees an identical set as much as what occurred after the final tech bubble between 2000 and 2005, when markets entered into a brand new commodity secular bull market, and high quality plus vitality lagged the market, particularly the tech house. He sees that related setup enjoying out over the following yr.

Weighing on whether or not the inventory market is backside, Pies mentioned if the S&P 500 reaches the three,600 neighborhood he’d begin shopping for. “We did it final time. On June 16, we put a report out to our shoppers after being bearish all yr, saying put about 25% or 33% of your capital again into the market right here. And if we get there once more, then we might make the identical transfer.”

And within the worst case the S&P 500 drops to 3200? “We may very well be one other 10% decrease, however for those who can’t deal with a ten% drawdown on this enterprise, you’re within the improper enterprise,” mentioned Pies.

Learn: Stocks may be headed for more pain as second half of September is historically ‘very bearish’

Table of Contents

The markets

Inventory futures

ES00,

NQ00,

are moving lower, with bond yields

TMUBMUSD02Y,

TMUBMUSD10Y,

rising and oil costs

CL.1,

regular. The greenback

DXY,

is larger and bitcoin

BTCUSD,

is hovering simply above $19,000.

Hear from Ray Dalio on the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. The hedge-fund pioneer has robust views on the place the economic system is headed.

The excitement

Ford

F,

is dropping in premarket after it warned inflation has driven up supply costs by $1 billion, with elements shortages leaving extra vehicles unfinished, although the auto maker caught to its annual forecasts.

SPAC ‘King’ Chamath Palihapitiya is winding down two vehicles

IPOD,

IPOF,

after failing to seek out goal firms in time.

House fitness-bike maker Peloton

PTON,

is introducing a $3,195 rowing machine.

Apple

AAPL,

is raising the price of apps and in-app purchases throughout elements of Asia and any nation that makes use of the euro. Shares are slipping.

The Swedish krona

SEKUSD,

is falling even after the Riksbank hiked rates of interest a bigger-than-expected 1%. Aside from the two-day Fed assembly that begins Tuesday, the Financial institution of England, Swiss Nationwide Financial institution and Norges Financial institution may even meet this week.

Contemporary information confirmed housing begins were strong in August, however constructing permits fell.

Better of the net

New episode of ‘Serial’ podcast expected after Adnan Syed’s murder conviction is overturned

President Biden says pandemic is over, but 400 to 500 people a day are still dying

Brad Pitt and Nick Cave make their artistic debuts in Finland.

The chart

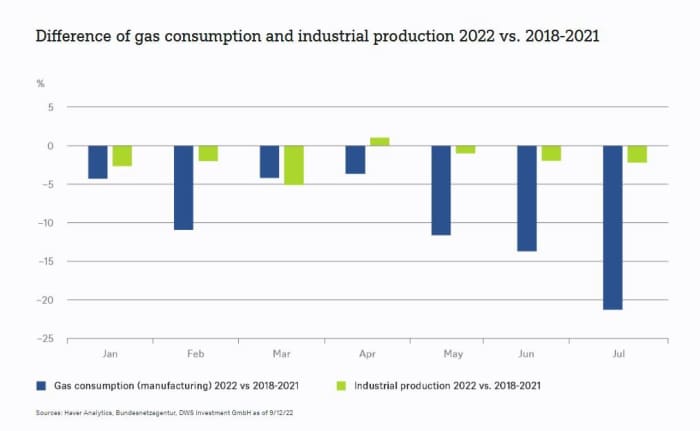

“What would have been a serious disaster some months in the past has turned out to be manageable to this point,” note strategists at DWS, in reference to excessive vitality costs in Europe, particularly Germany after Russia has all however stopped fuel exports.

They are saying that’s for 2 causes: Germany is growing fuel storage quicker than anticipated and consumption has dropped remarkably as their chart beneath reveals. Whereas a troublesome winter and even three might lay forward, “we are actually seeing how adaptable Western industries are when confronted with extraordinary stress,” says Martin Moryson, chief European economist.

DWS

Learn: Germany econ. minister says natural gas storage will be ’empty’ after winter

High tickers

These have been essentially the most energetic tickers on MarketWatch as of 6 a.m. Jap:

| Ticker | Safety title |

|

TSLA, | Tesla |

|

GME, | GameStop |

|

AMC, | AMC Leisure |

|

AAPL, | Apple |

|

NIO, | NIO |

|

BBBY, | Mattress Bathtub & Past |

|

APE, | AMC Leisure most popular shares |

|

NVDA, | NVIDIA |

|

AMZN, | Amazon.com |

|

AVCT, | American Digital Cloud Applied sciences |

Random reads

Past Meat’s

BYND,

COO accused of a road rage attack outdoors a soccer sport.

The #OneChipChallenge is allegedly putting kids in the hospital

One $100 wedding dress shared over a number of a long time by eight brides.

Must Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your e mail field. The emailed model shall be despatched out at about 7:30 a.m. Jap.

Source link