‘The psychology has modified so rapidly’: Why stock-market lows could also be retested as S&P 500 enters its weakest stretch of 12 months

[ad_1]

With summer time winding down, the U.S. inventory market is ready up for a doubtlessly shaky fall.

“Recession fears are the most certainly set off of a retest of the June lows,” mentioned Ed Clissold, chief U.S. strategist at Ned Davis Analysis, in an Aug. 31 word. “From a seasonality perspective, a retest may come within the subsequent a number of weeks.”

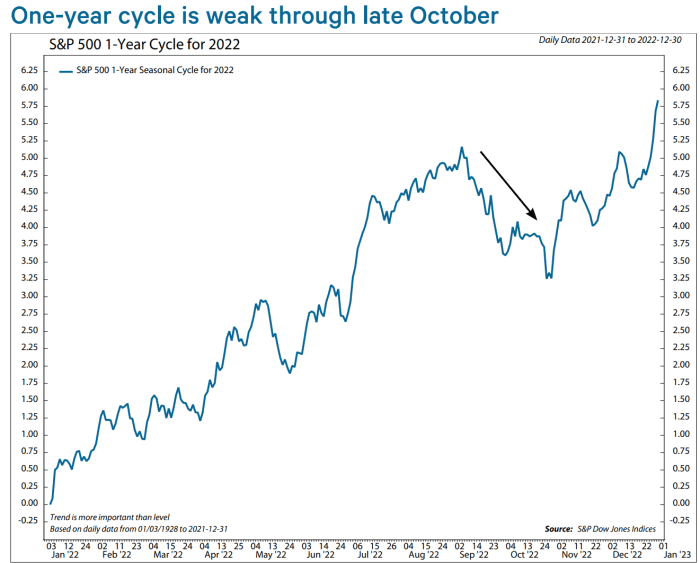

When U.S. traders return from the lengthy Labor-Day weekend, historical past signifies they’ll be going through the weakest time of the 12 months for the S&P 500 index: the stretch from Sept. 6 to Oct. 25, in accordance with the word.

NED DAVIS RESEARCH REPORT DATED AUG. 31, 2022

The inventory market is already wobbly.

U.S. shares closed sharply lower Friday, with all three main benchmarks struggling a 3rd straight week of losses. Nonetheless, the S&P 500

SPX,

ended 7% above its 52-week low of 3666.77 on June 16, in accordance with Dow Jones Market Information.

“I believe we’ve got to return and check that stage,” mentioned Bob Doll, chief funding officer of Crossmark World Investments, in a cellphone interview. “I don’t assume the bear market is essentially over,” he mentioned, although “what I don’t see is an enormous decline from right here.”

Learn: ‘Prepare for an epic finale’: Jeremy Grantham warns ‘tragedy’ looms as ‘superbubble’ may burst

In the meantime, ongoing rate of interest hikes by the Federal Reserve to fight hovering inflation in a slowing U.S. financial system improve odds of a recession together with the prospects of this 12 months’s stock-market lows being retested, in accordance with the Ned Davis word. The Fed this 12 months is “dedicated to eradicating liquidity from the monetary system,” making a retest extra seemingly, wrote Clissold.

Vanguard Group mentioned in a Sept. 1 report that it downgraded its forecast for U.S. financial development this 12 months after two straight quarters of contraction. The agency now expects financial development of 0.25%–0.75% for full-year 2022, down from its estimate final month of about 1.5%.

“We consider it seemingly that the US will wrestle to regain above-trend development within the quarters forward,” Vanguard mentioned. “We place the probability of a U.S. recession at about 25% within the subsequent 12 months and 65% within the subsequent 24 months.”

Whether or not any “retest” of the inventory market’s lows is transient might rely upon the power of the U.S. to keep away from a recession, in accordance with Ned Davis.

“The common non-recession bear lasts about seven months and has declined 25% (-18% over the previous half century), placing the January – June drop consistent with the standard case,” Clissold wrote within the Ned Davis word. “Conversely, the common recession bear has lasted a couple of 12 months (17 months over the previous 50 years) and declined a imply of 35%.”

Inflation ‘dragon’

Buyers have been anticipating one other massive rate of interest hike from the Fed at its Sept. 20-21 assembly, after chair Jerome Powell despatched a transparent message in his Jackson Gap speech on Aug. 26 that the central financial institution would hold battling excessive inflation till the job was completed – even when meaning some ache for households and companies.

Shares swooned on his remarks that day, with the Dow Jones Industrial Common

DJIA,

closing down 1,000 factors and losses have deepened since then.

The “vigorous” rally in shares seen earlier over the summer time had mirrored “an excessive amount of optimism given we’re nonetheless within the early levels of combating inflation,” mentioned Crossmark’s Doll. Though he thinks inflation has peaked, Doll predicts that its continued decline this 12 months will seemingly be irregular and end 2022 above the Fed’s 2% goal.

“It’s not going to finish up at a stage the place we are saying, ‘okay we acquired that dragon, what’s subsequent’?” he mentioned. If inflation, which ran as hot as 9.1% in June based mostly on the consumer-price index, comes all the way down to 4% or 5%, “that’s excellent news, nevertheless it’s not sufficient excellent news to say the Fed’s completed,” mentioned Doll.

Vanguard expects the Fed to extend its federal funds charge goal to a variety of three.25%–3.75% by year-end, from close to zero in the beginning of 2022, in accordance with its word. That compares with a current range of two.25% to 2.5%.

Forward of Powell’s Jackson Hole speech, the market narrative had switched away from the Fed combating inflation by aggressive charge hikes to, “when are they going to pivot?” mentioned Steve Sosnick, chief strategist at Interactive Brokers. However utilizing a comparatively brief speech, which had “no ambiguity,” Powell turned the main target again to financial tightening and the Fed’s unfinished combat with inflation, sending “a really highly effective message to the market,” mentioned Sosnick.

“We’ve been coping with that ever since,” he mentioned, pointing to inventory market losses.

“The truth that we’ve moved up to now so quick, and the psychology has modified so rapidly, makes me assume that we’re nowhere close to seeing the final of volatility, notably into the autumn,” mentioned Sosnick. “The September-October interval undoubtedly will get greater than its share of market weirdness.”

Inventory-market backside?

Fairness and quant strategists at Financial institution of America mentioned in a BofA World Analysis word dated Sept. 2 that valuations for the S&P 500 stay “wealthy.” Of their view, “a backside just isn’t in.”

“Initially, the rally off the June lows regarded extra like a younger cyclical bull than a bear market rally,” mentioned Clissold, within the Ned Davis word. “A number of breadth thrusts and increasing new highs advised a lot of the decline had run its course.”

However intermediate-term and long-term breadth wanted to observe to verify a bull market, he mentioned, and with out that affirmation, “a retest can’t be dominated out.”

“The S&P 500 stalled slightly below its falling 200-day shifting common and has given up about half of its June 16 – August 16 positive aspects,” Clissold wrote. Additionally, “the proportion of shares above their 50-day shifting averages simply missed its 90% threshold.”

U.S. shares ended Friday with weekly losses, with the S&P 500

SPX,

shedding 3.3% whereas the Dow Jones Industrial Common

DJIA,

fell 3% and the technology-heavy Nasdaq Composite

COMP,

dropped 4.2%.

The U.S. inventory market will take a break on Monday to celebrate Labor Day, resuming buying and selling on Tuesday. The financial calendar for the upcoming week contains information on U.S. providers, jobless claims and client credit score, in addition to the discharge of the Fed’s “beige book,” which features a assortment of enterprise anecdotes from across the nation.

The Fed’s continuation of aggressive charge hikes mixed with weak spot forward for firm earnings and the labor market “just isn’t a robust backdrop for the fairness market,” mentioned Liz Ann Sonders, chief funding strategist at Charles Schwab, by cellphone. Additionally, “we all know September, seasonally, tends to be a weak month” for shares.

Source link