The bear market in shares has an extended strategy to go, this cash supervisor warns. Listed below are the two strategic strikes he is making.

[ad_1]

As if everybody isn’t tense sufficient, bubble professional Jeremy Grantham is warning that we’re within the final throes of a superbubble that’s about to burst. (In equity, he’s been crash calling for roughly a decade.)

Nonetheless, if the massive one is on the market, it helps to be ready. Our name of the day comes from Actual Funding Recommendation portfolio supervisor Michael Lebowitz, who thinks we nonetheless could also be early in that bear market. He presents up a easy bear market wealth technique, as purchase and maintain received’t work in a sticky inflation setting.

He explains in a blog post how RIA repositioned purchasers’ portfolios to brace for a bear market at first of this 12 months.

“Sensing the Fed was about to drag the liquidity rug from the markets, we began lowering our threat beginning on the primary buying and selling day of 2022. Not solely did we promote shares to scale back our gross fairness publicity, however we rotated from higher-beta development shares to lower-beta worth shares,” stated Lebowitz.

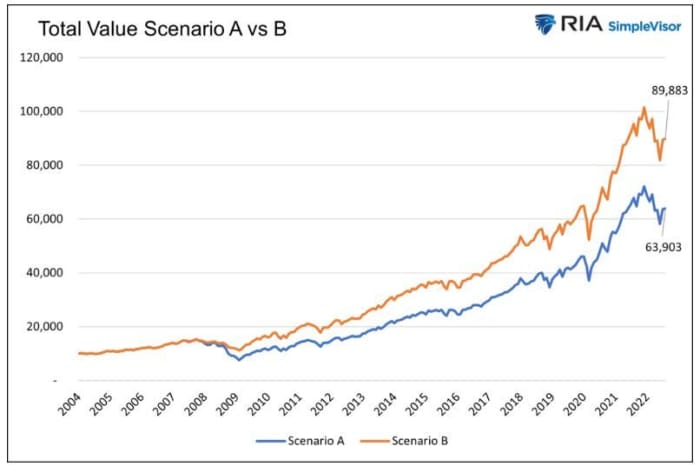

It lower the proportion allotted to shares and the sorts of shares held, which he stated has helped RIA portfolios outperform their benchmarks and all major inventory indexes thus far in 2022. He offers a chart exhibiting this technique’s advantages through the Nice Monetary Disaster.

As he explains, $10,000 was invested in two situations in 2004. The buy-and-hold Situation A was absolutely invested always, whereas B is identical besides through the 2008 bear market — when it went to 50% within the S&P 500, the remaining in money incomes 0%. Dividends had been reinvested for each.

RIA

Situation B got here out stronger as a result of fairness publicity was lower in half for 2 years, stated the adviser. This technique helped his portfolio got here out 41% stronger in that interval, whereas related motion in 2020 and 2022 would have meant even higher returns, he stated.

In follow-up feedback to MarketWatch, Lebowitz stated RIA lower publicity when it comes to allocation and shifted towards lower-beta (much less risky) worth shares at first of 2022. “We are going to seemingly keep a smaller-than-normal fairness allocation till it seems the Fed is really going to pivot,” he stated.

“We gravitated away from tech towards utilities and healthcare, for example. We additionally stored our inflation hedge/publicity up with power and a few supplies corporations,” he stated. A few of his holdings embrace NextEra Power

NEE,

Duke Power

DUK,

AbbVie

ABBV,

Abbott Labs

ABT,

CVS Well being

CVS,

Albemarle

ALB,

Exxon Mobil

XOM,

and Devon Power

DVN,

“Decrease beta and fewer publicity has been a giant winner up to now,” he stated, noting his portfolio was beating its benchmark by 5% by the point the market peaked two weeks in the past. He additionally outpoints worth outperforming development, noting a 9% drop within the iShares S&P 500 Worth ETF

IVE,

versus a 22% drop within the iShares S&P 500 Development ETF

IVW,

to date this 12 months.

Lebowitz believes markets are going through liquidity headwinds because the Fed shrinks its balance sheet and focuses extra on sticky inflation than the financial system.

“This Fed is tasked with a far totally different process than the Fed we’re used to,” stated Lebowitz, who worries buyers haven’t grasped that. “What considerations me is that this time it’s totally different.”

Learn: Bursts of bullish exuberance are common during bear markets. Getting sucked in is easy

Table of Contents

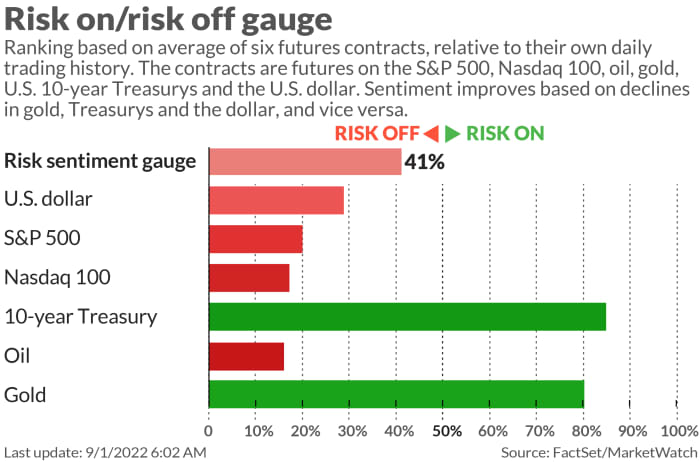

The markets

MarketWatch

Chip makers are dragging shares

DJIA,

SPX,

south , with Nasdaq

COMP,

losses out in entrance. Bonds

TMUBMUSD02Y,

TMUBMUSD10Y,

are once more promoting off, oil

CL.1,

and gold

GC00,

are down and the greenback

DXY,

is climbing. Bitcoin

BTCUSD,

is slightly below $20,000.

And: Crypto.com sues woman after accidentally depositing $10.5 million into her bank account

The excitement

Tesla

TSLA,

is down on shaky demand for China EV makers like Li Auto

LI,

In the meantime,, a COVID-19 lockdown is hitting 21 million residents of China tech and auto hub Chengdu.

Novo Nordisk

NOVO.B,

is shopping for Forma Therapeutics

FMTX,

in money deal valued at $1.1 billion.

Chip maker Nvidia

NVDA,

is down on information the U.S. is pushing it to curb its China data-center business. Broadcom

AVGO,

will report after the shut.

Elsewhere, MongoDB

MDB,

is tumbling on a gloomy forecast and Okta

OKTA,

is down on post-acquistion troubles and employee churn.

Weekly jobless claims dropped to the bottom since late June. Second-quarter labor productiveness was revised to a damaging 4.1% from an preliminary estimate of a 4.6% drop. Nonetheless to come back is the Institute for Provide Administration manufacturing index and building spending at 10 a.m.. Atlanta Fed President Raphael Bostic will give remarks later.

Learn: ‘Worst semiconductor downturn in a decade,’ warns Citi analyst

Ravil Maganov, the chairman of Russian oil large Lukoil — a Ukraine-war critic, has reportedly died after falling from a hospital window.

A West coast warmth wave has California officers declaring a grid emergency and fires shut down a major highway in the south.

Better of the net

This tiny $3 component is holding up new-home construction in the U.S.

Kid’s lives at risk this winter in the U.K. due to high energy prices, say experts

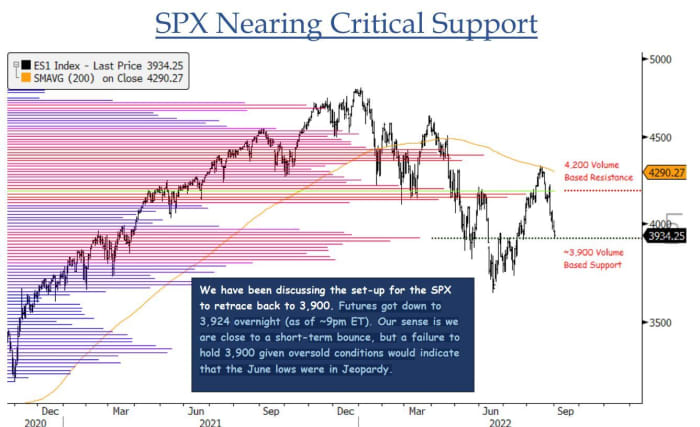

The chart

We’re circling again to an S&P 500 chart earlier this week from BTIG’s chief market strategist Jonathan Krinksy, whose had had his eye on the three,900 line in the sand.

“Futures received down to three,924 in a single day (as of ~9 p.m. ET). Our sense is we

are near a brief -term bounce, however a failure to carry 3,900 given oversold situations would point out that the June lows had been in jeopardy,” he stated late Wednesday.

BTIG

Bonus chart from blogger The Market Ear, which notes the S&P 500 has been hovering under its 200-day transferring common for some time, and the final time that occurred.

The Market Ear

The tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m. Jap:

| Ticker | Safety identify |

|

BBBY, | Mattress Bathtub & Past |

|

TSLA, | Tesla |

|

GME, | GameStop |

|

AMC, | AMC Leisure |

|

NVDA, | NVIDIA |

|

APE, | AMC Leisure most popular shares |

|

AAPL, | Apple |

|

NIO, | NIO |

|

ATXG, | Addentax |

|

AMZN, | Amazon.com |

Random reads

Single girls, no children are getting richer.

Adios skinny pants for men

This lady’s tribute to a good Samaritan captivated the web.

Must Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your e mail field. The emailed model might be despatched out at about 7:30 a.m. Jap.

[ad_2]

Source link