[ad_1]

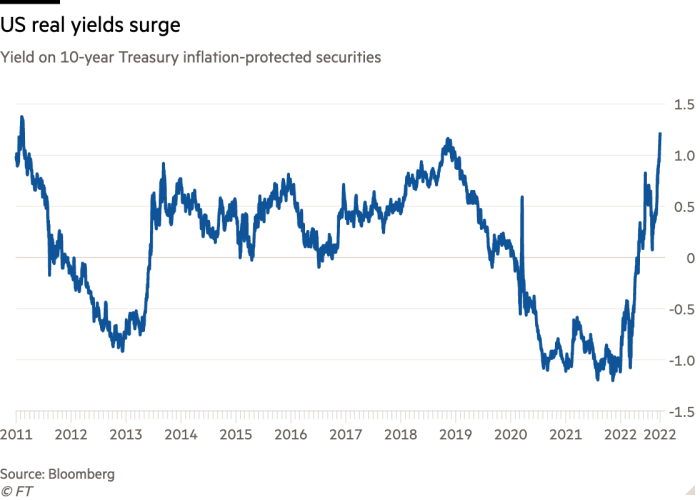

US actual yields, the returns buyers can count on to earn from long-term authorities bonds after accounting for inflation, have soared to the best stage since 2011, additional eroding the attraction of shares on Wall Road.

The yield on 10-year Treasury inflation-protected securities (Ideas) hit 1.2 per cent on Tuesday, up from roughly minus 1 per cent in the beginning of the 12 months, as merchants guess the Federal Reserve will aggressively increase rates of interest and maintain them elevated for years to return because it makes an attempt to chill inflation.

The sharply larger returns safe-haven authorities debt now provide have weighed closely on the $42tn US stock market, given buyers can discover attractive funding alternatives with far much less threat. Strategists with Goldman Sachs on Tuesday stated that “after a protracted stretch”, buyers shopping for Treasuries or holding money would quickly earn returns which were “unattainable” to return by for the previous 15 years.

Actual yields are intently adopted on Wall Road and by policymakers on the Fed, providing a gauge of borrowing prices for corporations and households in addition to a scale to evaluate the relative worth of any variety of investments.

These actual yields fell deeply into adverse territory on the peak of the coronavirus pandemic because the Fed reduce rates of interest to stimulate the financial system, sending buyers racing into shares and different dangerous property looking for returns. That has reversed because the US central financial institution has quickly tightened coverage.

“What you see within the larger actual charges is the clear expectation that the Fed goes to empty an incredible amount of money and liquidity out of the market,” stated Steven Abrahams, head of funding technique at Amherst Pierpont.

The Fed has already lifted its predominant rate of interest from close to zero in the beginning of the 12 months to a variety of two.25 to 2.5 per cent. It’s anticipated to spice up it by one other 0.75 proportion factors in a while Wednesday, with additional will increase bringing the federal funds charge to round 4.5 per cent by early 2023.

The Fed’s quantitative tightening programme, through which it’s decreasing its $9tn stability sheet, is placing further upward stress on yields.

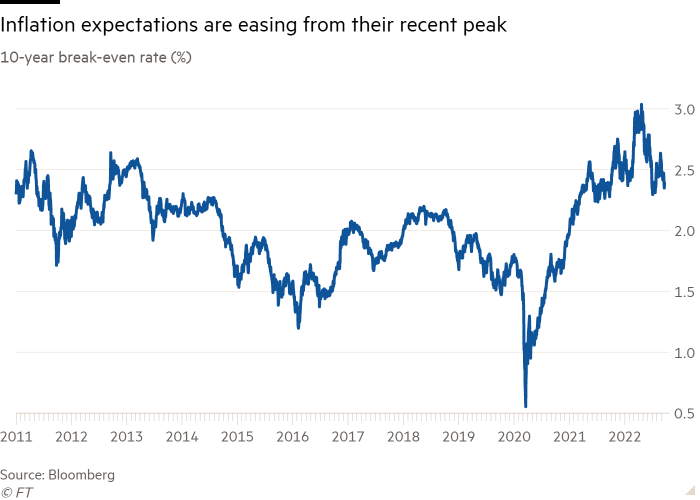

The leap in so-called actual yields has been pushed partially by expectations that the Fed will be capable of deliver inflation nearer to its long-term goal of two per cent within the years to return.

A measure of inflation expectations often called the 10-year break-even charge, which is predicated on the distinction in yield on conventional Treasuries and Ideas, has eased from a excessive of three per cent in April to 2.4 per cent this week. That might mark a dramatic decline from the August inflation charge of 8.3 per cent.

“What’s vital for development equities will not be whether or not the height has occurred in rates of interest, however the truth that the discounting charge will stay larger for an extended time,” stated Gargi Chaudhuri, head of iShares funding technique for the Americas at BlackRock. “For the following 18 to 24 months, all of those corporations’ valuations will proceed to get discounted at that larger stage.”

Quick-growing corporations that led the rally on Wall Road from the depths of the coronavirus disaster in 2020 are under the most pressure from rising actual yields. That’s as a result of larger actual yields scale back — or “low cost” — the worth of the incomes these corporations are anticipated to generate years from now in fashions buyers use to gauge how costly shares look.

Because the begin of the 12 months, the tech-heavy Nasdaq Composite has tumbled 27 per cent. A restoration within the latter half of the summer season has been all however obliterated as expectations of additional aggressive Fed motion have been cemented. The autumn in unprofitable tech shares, which had posted spectacular positive aspects as buyers chased excessive yields, has been significantly notable — with a Goldman Sachs index monitoring such corporations dropping half its worth in 2022.

“Very costly and really unprofitable expertise corporations have been accustomed to discounting their money flows at a adverse charge and now should readjust to constructive charges,” Chaudhuri stated. “As a result of your discounting charge is larger, the valuations of these corporations will look much less enticing, as a result of they’re discounting at the next stage.”

Rising actual yields might also put better stress on corporations that took out leveraged loans, that are made to debtors that have already got important debt masses. Rates of interest on these loans are normally floating, which means they regulate in keeping with the broader market versus being mounted at a specific stage.

“That is significantly dangerous information for leveraged debtors,” stated Abrahams.

Ian Lyngen, head of US charges technique at BMO Capital Markets, added that “sentiment throughout the financial system, by way of threat asset efficiency and the notion of the impression on shoppers, is nearer to actual yields than it has been to nominal yields”.

He stated: “The logic there being that when adjusted for inflation, actual yields represents the clear impression of efficient borrowing prices on finish customers.”

Source link