Silver is at a 2-year low, but it surely’s not gold that may decide what occurs subsequent, this analyst says

[ad_1]

A tie can really feel like a loss in case you had been in line for a victory. Conversely the draw will be celebrated in case you had been going through defeat.

After plenty of periods when early beneficial properties evaporated, merchants can be relieved that Thursday noticed an preliminary sharp decline cancelled and the S&P 500

SPX,

finish mildly in constructive territory.

On such reversals are sustainable rallies doubtlessly made, although there’s nonetheless a protracted strategy to go together with the index down 17.3% for the 12 months.

Silver bugs are having a good harder time. The gray metallic

SI00,

this week dropped beneath $18 an oz. for the primary time since June 2020, having traded close to $27 as lately as March. The iShares Silver Belief

SLV,

has misplaced practically 23% for the 12 months and World X Silver Miners ETF

SIL,

for instance, has shed 38% thus far in 2022.

So, what ought to traders do now if they’re contemplating betting on the infamously risky sector.

“Don’t take note of gold, take note of copper

HG00,

”, Ole Hansen, head of commodity technique at Saxo Financial institution, informed MarketWatch in a cellphone interview.

The explanation for that is that not like its treasured metallic peer gold, silver has in depth industrial makes use of, with as much as 50% of provide utilized in areas like electronics and photo voltaic merchandise. Worry of a world financial slowdown is thus hurting silver along with pressures from greater borrowing prices and a surging greenback that historically batter bullion, Hansen notes.

So, whereas gold is off about 6% this 12 months, silver’s decline of 23% is just like the 21% drop for copper, extensively accepted as the economic metallic benchmark.

“Silver has not solely been challenged by the weak point talked about in gold but additionally, and extra importantly, by China [economic] weak point associated promoting throughout industrial metals, particularly copper.” Says Hansen.

Nonetheless, he spies indicators that the market could also be oversold. “The rout in silver and copper, in addition to zinc and aluminum, two metals that lately discovered assist from smelters decreasing capability as a result of excessive vitality prices, has by now reached the capitulation stage with silver having entered a earlier consolidation vary between $16.50 and 18.50.”

Ought to proof emerge that inflation considerations are fading, inflicting the greenback to tug again and decreasing fears that greater rates of interest will curb development, then the futures market might shortly discover itself wrongfooted.

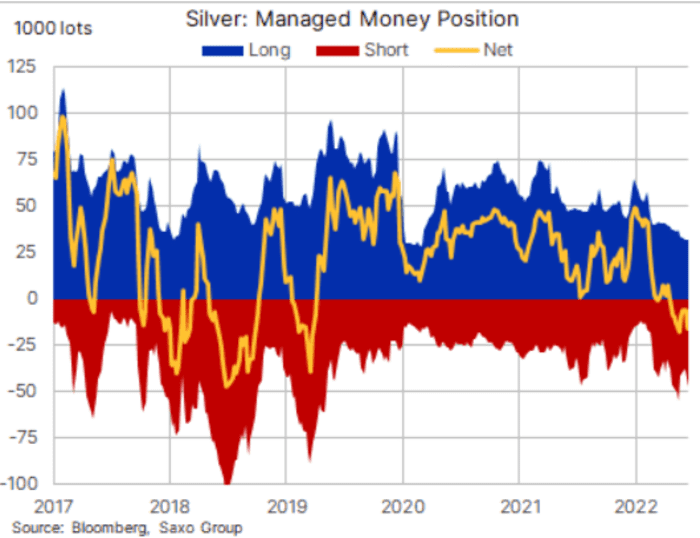

“Speculators, already maintain internet quick positions in each metals, and it could require a change within the technical and/or basic outlook to show these quick positions right into a tailwind by quick protecting,” says Hansen.

Supply: Saxo Group

Ought to such a pattern happen it could assist silver get better some poise relative to its bullion peer.

“The gold-silver ratio, final at 96 (ounces of silver per ounce of gold) has retraced greater than 50% of the 2020 to 2021 collapse from 127 to 62 with the following stage of resistance round 102.5, a possible additional 6% underperformance relative to gold, whereas a break again beneath 94 could be the primary sign of energy beginning to come again,” says Hansen.

Table of Contents

Markets

S&P 500 futures

ES00,

had been little modified at 3,968 forward of the roles knowledge. The benchmark 10-year Treasury yield

TMUBMUSD10Y,

was up lower than 1 foundation level at 3.266%. Bitcoin was up 0.2% at $20119. U.S. pure fuel futures

NG00,

fell 2% to $9.073 per million British thermal models as European fuel costs additionally weakened.

The thrill

It’s jobs Friday once more and it definitely seems like Wall Street would rather see a soft nonfarm payrolls report than a powerful one. That method the Fed might determine to be a bit extra mild in elevating borrowing prices, is the reasoning. Economists forecast a internet 318,000 positions had been added in August, down from July’s 528,000, and that common hourly earnings rose 0.4% in comparison with the earlier month’s 0.5%.

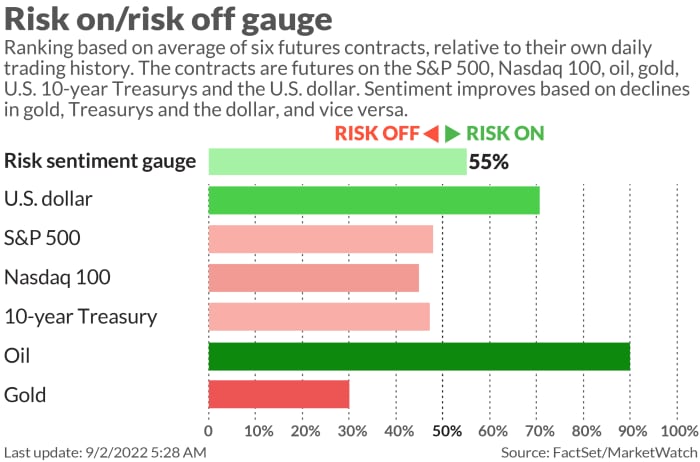

Merchants are additionally protecting a cautious eye on the greenback

DXY,

which has surged to a 20-year excessive because the Fed grew to become extra hawkish and fears construct about prospects for the European economic system amid the areas’ vitality disaster. The euro

EURUSD,

is beneath buck parity and it takes greater than 140 Japanese yen

USDJPY,

to purchase one dollar.

Russia mentioned it could cease promoting oil to nations in search of to impose a worth cap on crude. Brent

BRN00,

the worldwide benchmark, which on Thursday fell to a six month low close to $93 a barrel, is up 2.2% to $88.50.

Standard fund supervisor Cathie Wood has bought more Nvidia

NVDA,

benefiting from the chipmaker’s newest slide to a recent 52-week trough. She had trimmed her holding final month forward of Nvidia’s outcomes.

Lululemon shares

LULU,

jumped practically 10% after the clothes retailer delivered well-received results and gave upbeat forecasts.

Shares in Starbucks

SBUX,

had been holding a lot of the earlier session’s beneficial properties as traders absorbed information that former Reckitt Benckiser CEO Laxman Narasimhan would lead the coffee shop chain.

Bond markets have entered their first bear market in at least 30 years.

Better of the online

How Dan White turned the UFC into a $4 billion titan

Tech companies are slowly shifting production from China

Dan Niles is bearish and ready to dump Apple

Michael Burry of ‘The Big Short’ fame sees ‘mother of all crashes’.

The chart

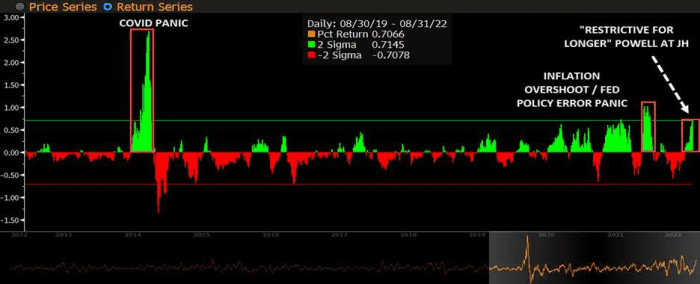

Through the nice monetary disaster and the COVID-19 meltdown the Fed was eager to be seen supporting markets as a result of it believes within the wealth impact. Merely put, that is the concept when households really feel richer due to rising asset values — similar to inventory or home costs — they are going to spend extra and assist the economic system.

The issue is this implies with a view to gradual the economic system and curb inflation the Fed believes it should cease and even reverse the wealth impact. The chart beneath from Nomura exhibits how U.S. monetary situations have certainly skilled some “impulse tightening” once more as each shares and bonds have fallen. Sadly for bulls, the Fed will wish to see this sustained for a while.

Supply: Nomura

Prime tickers

Right here had been essentially the most energetic stock-market tickers on MarketWatch as of 6 a.m. Jap.

| Ticker | Safety identify |

|

TSLA, | Tesla |

|

GME, | Gamestop |

|

BBBY, | Mattress Bathtub & Past |

|

AMC, | AMC Leisure |

|

APE, | AMC Leisure most popular |

|

NVDA, | Nvidia |

|

AAPL, | Apple |

|

NIO, | NIO |

|

AVCT, | American Digital Cloud Applied sciences |

|

BIAF, | bioAffinity Applied sciences |

Random reads

Passenger blimps making a comeback

Have to Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your electronic mail field. The emailed model can be despatched out at about 7:30 a.m. Jap.

Source link