Recession is not priced into shares, says this $1.4 trillion fund supervisor that has simply turned extra cautious

[ad_1]

Will the FOMC put an finish to the FOMO in markets? Extra on that in a second.

However first we’ll talk about this bearish name from Invesco, the fund supervisor with $1.4 trillion in property below administration.

For the primary time since Feb. 2020, Invesco’s macro framework has entered what it calls a contraction regime, which suggests each that the financial system is rising beneath its long-term development and is predicted to decelerate. Its definition consists of, however doesn’t require, recession.

Invesco’s world main financial indicator has dropped beneath its long-term development for the primary time because the second quarter of 2020, when the world was first confronting the coronavirus pandemic, as each the U.S. and the developed ex-U.S. main indexes have dropped for 3 straight months. They have been dragged down by enterprise surveys, housing indicators, industrial orders, shopper sentiment and labor market situations in manufacturing — so principally all the pieces, besides possibly meme shares.

Invesco

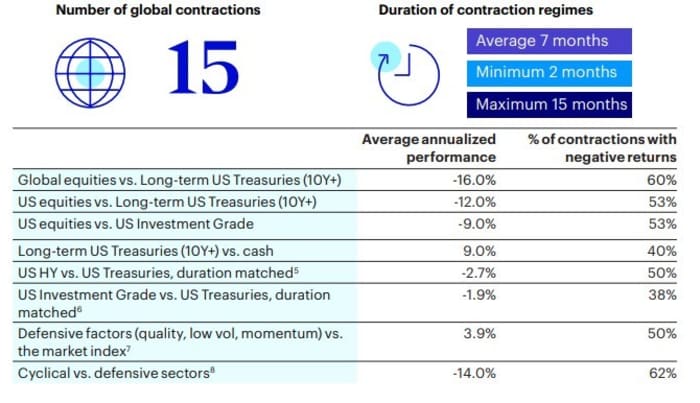

Contraction regimes, Invesco says, final a mean of seven months however have run as much as 15 months. Throughout these intervals, the common annual efficiency of U.S. shares vs. the 10-year Treasury is -12%, with world equities performing an excellent worse -16%. Defensive elements outperform the broader by a mean of 4%, Invesco says.

Markets, the agency provides, have largely not priced in a recession. The underperformance of shares this 12 months is nearly solely according to the underperformance in 30-year authorities bonds

TMUBMUSD30Y,

“Broadly talking, fairness and credit score markets haven’t discounted the extra underperformance resulting from decrease earnings progress to be anticipated in a recessionary state of affairs,” stated Alessio de Longis, senior portfolio supervisor and head of tactical asset allocation for Invesco Funding Options.

The agency sees parallels with the recent inflation of the Nineteen Seventies and Eighties, though in contrast to these intervals, inflation expectations are much less extreme and core inflation will not be as excessive. “Our gauge of U.S. inflation momentum gives some early indication of peaking inflationary pressures over the previous 3 months, however it’s too early to guage the persistence of this destructive momentum,” he added.

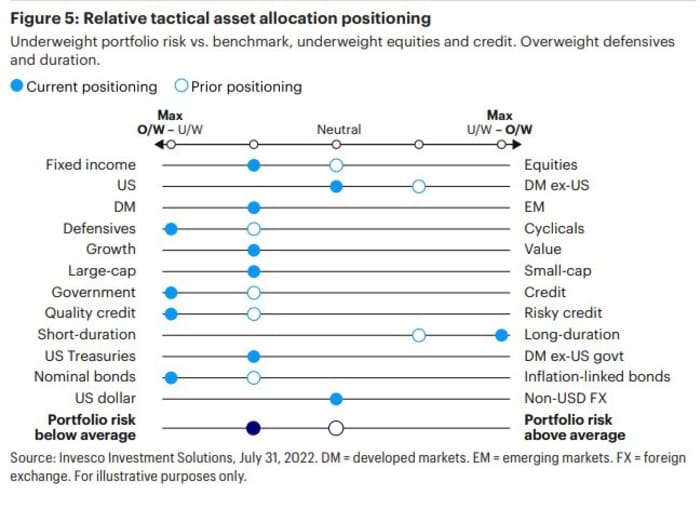

Its asset allocation suggestions mirror the elevated warning — extra towards bonds than shares, towards U.S. than developed rivals and towards defensives from cyclicals.

Table of Contents

The market

U.S. inventory futures

ES00,

NQ00,

have been weaker after the S&P 500

SPX,

completed at highest degree on Tuesday since April 22. The yield on the 10-year Treasury

TMUBMUSD10Y,

rose to 2.88%, and the actual motion was within the U.Okay., where gilt yields surged after an inflation surprise.

The thrill

The minutes of the final Federal Open Market Committee assembly are due at 2 p.m. Jap. There’s already a spot between what Fed policymakers say they are going to be doing and what the market believes, so the query is whether or not the minutes widen this sizeable expectations hole or not.

Retail sales for July were flat, although outdoors of gasoline and autos it rose a strong 0.7%. There’s additionally a $15 billion public sale of 20-year Treasury securities.

Lowe’s

LOW,

the number-two house enchancment retailer, beat on earnings however missed income expectations. Goal

TGT,

recorded a far worse than forecast second-quarter revenue, however didn’t change its gross sales forecast for the 12 months.

Elon Musk tweeted he was going to purchase Manchester United

MANU,

the struggling English soccer big, then said he was joking.

Better of the online

Bill Gates kept talking to Sen. Joe Manchin earlier than the important thing negotiations breakthrough on the local weather and drug invoice — and steered {that a} nuclear energy vegetation may very well be in-built West Virginia.

The MIT professor cleared of spying costs said he’s found what could be the best semiconductor material.

The influence the reversal of Roe v Wade has had on male partners.

A Saudi girl was given a 34-year prison sentence for using Twitter.

The chart

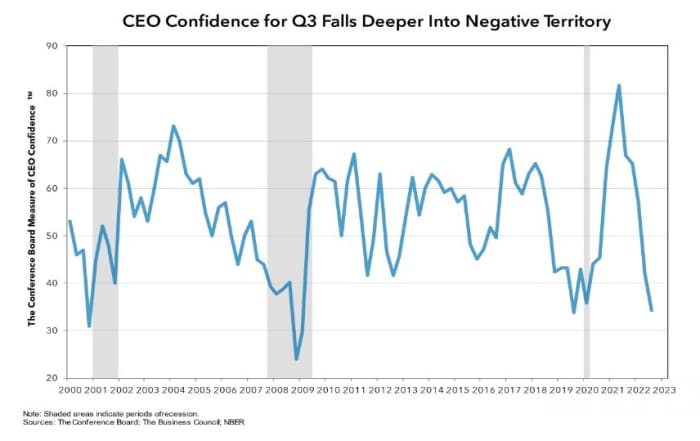

CEOs haven’t been this pessimistic because the begin of the pandemic, in response to a quarterly survey from The Convention Board in collaboration with The Enterprise Council. Some 81% stated they have been making ready for a quick and shallow U.S. recession, with 12% anticipating a deep recession and seven% not anticipating any recession in any respect.

High tickers

Right here have been essentially the most energetic stock-market tickers as of 6 a.m. Jap.

| Ticker | Safety title |

|

BBBY, | Mattress Bathtub & Past |

|

GME, | GameStop |

|

AMC, | AMC Leisure |

|

TSLA, | Tesla |

|

BBIG, | Vinco Ventures |

|

AAPL, | Apple |

|

NIO, | Nio |

|

BBY, | Greatest Purchase |

|

AMZN, | Amazon.com |

|

MANU, | Manchester United |

Random reads

Mariah Carey is finding opposition to her try and trademark the time period, “Queen of Christmas.”

Scientists are attempting to revive the Tasmanian tiger from extinction.

There are snake-safety courses — for dogs.

Have to Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your e-mail field. The emailed model might be despatched out at about 7:30 a.m. Jap.

Source link