[ad_1]

Kevin Dietsch/Getty Photos Information

Rivian Automotive (NASDAQ:RIVN) has been below stress since late final 12 months, as the electrical automobile startup struggles to ramp up manufacturing within the face of mounting losses and murky market situations. As a part of this, the agency’s newest quarterly replace included a warning about near-term revenue stress.

Nevertheless, whereas shares have misplaced greater than half their worth since final 12 months’s IPO, RIVN has climbed greater than 90% from its 52-week low. On the similar time, the EV maker has drummed up curiosity from a few of Wall Avenue’s most distinguished hedge fund traders.

With names like Ray Dalio and David Einhorn growing their bets on RIVN, does it turn out to be a purchase for the typical investor?

Quarterly Earnings Report

In its Q2 earnings report, delivered final week, Rivian Automotive (RIVN) missed expectation on its GAAP EPS. Nevertheless, the agency surpassed estimates on income.

Particularly, the EV maker posted Q2 GAAP lack of $1.89 per share. This missed analysts’ consensus by $0.13 per share. On the similar time, the corporate reported income of $364M, which beat expectations by $26.02M.

In the meantime, RIVN detailed that it nonetheless sees 2022 manufacturing of 25K vehicles, sustaining its earlier goal. RIVN additionally anticipates capex spending of $2.0B this 12 months.

Because it delivered earnings, Rivian Automotive has dipped about 4%, leaving the inventory decrease by practically 65% for 2022 as an entire. In the meantime, at a present value simply above $37, shares sit at lower than half their IPO value of $78.

RIVN got here public with vital fanfare final November and rapidly skyrocketed to a put up IPO excessive of $179.47. The inventory has misplaced floor since then, weighed down by a basic market shift away from riskier belongings amid an increase in rates of interest. Provide considerations and worries in regards to the firm’s manufacturing ramp-up additionally scared traders away from the title.

In consequence, RIVN dropped to a put up IPO low of $19.27 within the first half of Might. Since then, nonetheless, the inventory has seen a gentle restoration, climbing greater than 90% from that time.

The 2022 buying and selling in RIVN has typically tracked general weak point within the EV area. Even so, the inventory has typically underperformed its friends.

For instance, Lucid (LCID) and XPeng (XPEV) have each dropped greater than 50%, whereas Fisker (FSR) has posted a retreat of larger than 40%. Nikola (NKLA) has fallen greater than 30%.

Trade heavyweight Tesla (TSLA) has outperformed most of its less-established names, though it has posted a 23% retreat in 2022. In the meantime, Li Auto (LI) has separated itself from the pack these days, exhibiting a drop of simply 5% for the 12 months to this point.

Is RIVN a Purchase?

Even with the volatility that has marked the inventory since its public debut, a few of Wall Avenue’s most distinguished hedge funds proceed to wager on Rivian (RIVN).

In accordance with the newest 13F filings, Ray Dalio’s Bridgewater Associates took new stakes within the electric-vehicle startup by buying 62.8K shares. On the similar time, Greenlight Capital, led by David Einhorn, added 74K shares.

In the meantime, different well-known traders have trimmed their positions these days. George Soros’s fund disclosed in its 13F submitting that it lowered its positions in Rivian Automotive to 17.8M shares from 19.8M shares.

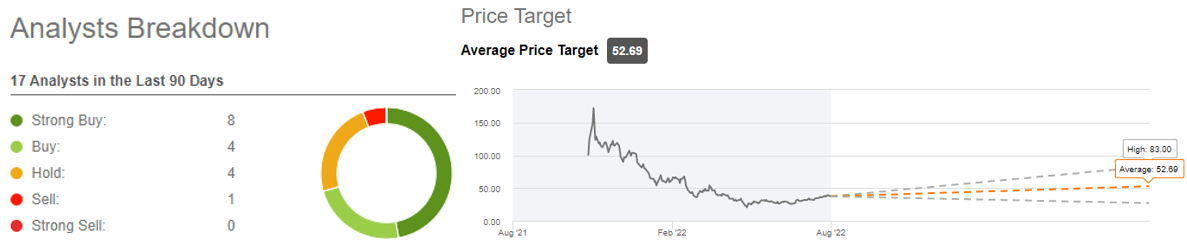

Wall Avenue’s analyst group, the overall consensus factors to a bullish outlook. Of the 17 analysts surveyed by Seeking Alpha, 12 have delivered an upbeat evaluation of the inventory. This consists of eight Robust Purchase opinions and 4 Purchase scores.

That leaves 4 analysts who’ve given the inventory a Maintain score. One market professional has issued a Promote suggestion.

Wall Avenue analysts have set a mean value goal of $52.69. The outlier value goal has the inventory going as excessive as $83 a share, which might put RIVN again above its IPO value.

See a breakdown under:

Whereas Wall Avenue appears optimistic about RIVN, In search of Alpha analysts seem a little bit extra reserved, with a mean score sitting within the Maintain vary. Contributor Invoice Maurer is amongst these attaching a Maintain opinion, stating: “The corporate has been working to scale manufacturing as quick as attainable, however its low volumes currently have resulted in large losses.”

The Asian Investor, one other In search of Alpha contributor, additionally tagged Rivian Automotive as a Maintain, highlighting the truth that Rivian’s revenues and manufacturing are ramping up. Nevertheless, the EV firm now expects a steep widening of EBITDA losses.

Source link