[ad_1]

On the golden sands of the French Riviera, simply alongside the seashore from a night sport of volleyball, dark-suited non-public fairness executives crowded right into a marquee for a drinks reception and did their greatest to disregard the disaster hitting their business.

Cocooned at a convention this week in one among Europe’s most unique locations, prime dealmakers exuded confidence even because the situations that fuelled a decade-long non-public fairness growth went into reverse.

For years, virtually all the pieces has gone proper for the buyout business’s billionaire bosses. Now, as charges rise and their mannequin faces its greatest check since at the very least the 2008 crash, non-public fairness is seeking to what dealmakers hope can be their subsequent revolution: an unprecedented wave of cash from retail buyers.

“When the markets stabilise it is going to be an amazing time for personal fairness” and an inflow of retail cash is “a matter of when”, not if, Verdun Perry, world head of Blackstone Strategic Companions, mentioned on the convention’s primary stage this week.

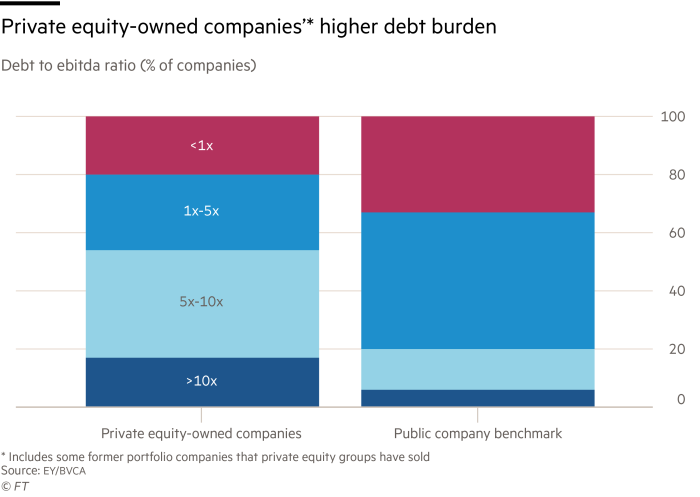

Buyout teams have spent the previous few years hanging record numbers of deals at typically eye-watering valuations, utilizing rising quantities of debt. Now, they’re holding companies whose borrowing prices are rising simply as their earnings fall.

Buyers specialising in distressed debt might barely comprise their glee on the prospect of those firms falling into bother.

“For the primary time for the reason that world monetary disaster and for very completely different causes, we’re starting to see cracks in an actual method throughout the board,” mentioned Matt Wilson, a managing director at Oaktree, throughout a panel dialogue on the occasion.

“The confluence of decrease earnings, decrease money stream and better borrowing prices goes to be a really difficult scenario,” he mentioned. “We’re very enthusiastic about what we see in entrance of us proper now . . . it’s onerous to see a path to a delicate touchdown.”

And as some argue that the highest of the market has been reached, others have gotten involved concerning the business’s practices.

Mikkel Svenstrup, chief funding officer at Denmark’s largest pension fund ATP, used his platform on the convention to compare private equity to a pyramid scheme.

He complained concerning the business’s use of “continuation funds”, a fast-growing mannequin by which a personal fairness group sells a company to itself by shifting it between two of its personal funds. And he mentioned he was “trying very fastidiously” at “all these tips they do to type of manipulate” returns figures.

Talking privately on the sidelines of the occasion, nonetheless, a prime government at a European buyouts group mentioned he was assured that “the golden age of personal fairness is simply starting”.

One of many primary causes for optimism is the hunt for money from people — in distinction to the pension funds, endowments and sovereign wealth funds which have thus far propelled the business’s development — what senior figures describe because the “democratisation” of personal fairness.

A few of that cash will come from the very rich. Morgan Stanley and Oliver Wyman mentioned in a report final yr that individuals with between $1mn and $50mn to speculate would in complete commit an additional $1.5tn to non-public markets by 2025.

However the business can be concentrating on folks a lot additional down the revenue ladder.

“We’re speaking actual democratisation,” Virginie Morgon, chief government of the buyouts group Eurazeo, mentioned on the convention. The business would increase cash from “not, like, excessive web price people” who can make investments €1mn or extra, however folks with €5,000 or €10,000, she mentioned.

Ariane de Rothschild, who chairs the Franco-Swiss non-public financial institution and asset supervisor Edmond de Rothschild, warned of the necessity for “a robust governance framework in an effort to keep away from misunderstandings and potential reputational harm” when odd buyers are being introduced in.

There was even discuss of retail buyers shopping for into continuation fund-related merchandise, that are so specialised that many individuals within the finance business have little understanding of how they work.

“In some ways I feel that product virtually makes extra sense for retail buyers” than shopping for into non-public fairness funds, mentioned Gabriel Mollerberg, a Goldman Sachs managing director who additionally specialises within the offers. The automobiles are much less unstable and extra diversified, he mentioned.

Amid the events and panels, executives warned that the business was caught in limbo as non-public valuations — of the businesses buyout teams personal and of unlisted non-public fairness corporations themselves — haven’t fallen in keeping with public markets.

“It’s been a really powerful yr for lots of [stock market] buyers,” mentioned Svenstrup, from ATP. “It’s type of attention-grabbing, proper, as a result of non-public markets appear to nonetheless hold their valuations . . . Finally they are going to converge. Whether or not that’s to the upside or the draw back, time will present.”

In the course of the convention, Goldman Sachs’ Petershill Companions, a London-listed group that owns minority stakes in non-public fairness corporations, reported an accounting loss because it marked down the worth of its investments.

The transfer highlighted how rising rates of interest have made buyout corporations, which obtain a gradual stream of money from the administration charges they cost buyers, much less worthwhile. Shares in Blackstone, Apollo World Administration, KKR, Carlyle Group, EQT and Bridgepoint have all fallen this yr by greater than the S&P 500.

The valuations of privately held buyout teams haven’t essentially adopted.

“One factor we’ve been requested about lots lately is, has our valuation, our strategy modified with what’s occurring within the public markets?” mentioned Tiffany Johnston, a managing director at Blue Owl, which buys minority stakes in non-public fairness corporations. “And it actually hasn’t . . . we’ve discovered we’ve simply been capable of be very constant.”

As even insiders query the business’s mannequin — amid hopes to lure in retail buyers — non-public fairness is formulating its defence.

George Osborne, the UK’s former chancellor who was on the convention as a associate at his brother’s enterprise capital agency, 9Yards Capital, mentioned the business needed to make investments “for the long term”, trying by means of the vitality disaster, inflation and the “tragic downside” of the struggle in Ukraine.

Orlando Bravo, co-founder of buyouts group Thoma Bravo, which ploughed tens of billions of {dollars} into software program offers on the peak of the market up to now few years, was among the many most bullish on the occasion.

“The way in which our business makes cash isn’t by timing the market,” he mentioned, including that non-public fairness had made some profitable offers at excessive valuations and unsuccessful ones cheaply. “You purchase an incredible enterprise when you possibly can . . . our business’s not about shopping for excessive and promoting larger, it’s by no means been about that.”

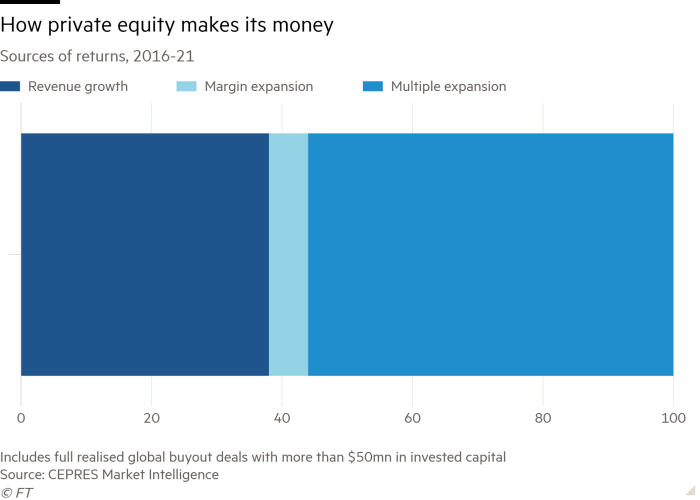

Figures from Bain & Co inform a special story. So-called “a number of enlargement”, or promoting an organization at the next a number of of its earnings than it was bought for, has been “the most important driver of buyout returns over the previous decade”, a report from the consultancy mentioned this yr.

Bravo, nonetheless, dismissed Svenstrup’s comparability of personal fairness to a pyramid scheme, saying: “Oh my gosh, the other. It’s the easiest way of possession on the planet!”

Further reporting by Chris Flood

Source link