[ad_1]

This has been a painful yr for inventory market buyers, as nothing appears to be working.

There’s an exception: Vitality. It’s the best-performing sector and may nonetheless be a cut price for many who might be affected person.

A snapshot of the 11 sectors of the S&P 500

SPX,

underlines what a cut price the power sector is for long-term buyers:

| Sector | Ahead P/E | Ahead FCF Yield | Dividend yield | Estimated headroom | Whole return – 2022 |

| Vitality | 8.5 | 11.94% | 3.77% | 8.17% | 46% |

| Financials | 11.5 | 8.59% | 2.18% | 6.42% | -14% |

| Supplies | 13.0 | 6.39% | 2.26% | 4.13% | -17% |

| Communication Companies | 14.9 | 6.52% | 1.02% | 5.49% | -33% |

| Well being Care | 15.9 | 6.35% | 1.71% | 4.64% | -9% |

| Industrials | 16.3 | 5.57% | 1.82% | 3.75% | -14% |

| Actual Property | 17.4 | 4.72% | 0.00% | 4.72% | -21% |

| Shopper Staples | 19.9 | 4.59% | 2.70% | 1.89% | -6% |

| Info Expertise | 19.9 | 4.93% | 1.08% | 3.85% | -25% |

| Utilities | 20.2 | -2.07% | 2.84% | -4.92% | 7% |

| Shopper Discretionary | 26.6 | 3.51% | 0.87% | 2.64% | -22% |

| S&P 500 | 16.5 | 5.22% | 1.70% | 3.52% | -17% |

| Supply: FactSet | |||||

The power sector shines regardless of which column is used to kind the desk. Right here it’s sorted by ahead price-to-earnings ratio, based mostly on weighted mixture earnings estimates amongst analysts polled by FactSet.

The second column exhibits estimated free money stream yields, based mostly on present share costs and free money stream estimates for the following 12 months.

The power sector has the best dividend yield of any S&P 500

SPX,

sector. It additionally has the best estimated FCF yield and probably the most anticipated FCF “headroom” — an indicator that there’ll proceed to be loads of free money that can be utilized to lift dividends or purchase again shares.

So there are the “4 causes” within the headline of this text: lowest ahead P/E, highest anticipated FCF yield, highest dividend yield and most anticipated FCF headroom.

Extra about power: There’s only one ‘perfect asset’ to fight all the bad news that could be coming, says this strategist

“Primarily based on the following a number of years of free money stream era, with the money plowed into repurchases, 20% of the market cap might be repurchased on common over the following two to 3 years” by built-in U.S. oil firms, based on Ben Cook dinner of Hennessy Funds.

Among the many built-in oil firms within the S&P 500 are Exxon Mobil Corp.

XOM,

and Chevron Corp.

CVX,

Share buybacks at these ranges imply drastic reductions in share counts, which might increase earnings per share considerably and add assist for greater inventory costs over time.

LNG has untapped potential

Throughout an interview, Cook dinner, who co-manages the Hennessy Vitality Transition Fund

HNRIX,

and the Hennessy Midstream Fund

HMSIX,

pointed to the potential for persevering with will increase in U.S. exports of liquid pure fuel (LNG). Europe is now competing with Asia for U.S. pure fuel as the provision from Russia has been disrupted.

Cook dinner mentioned that based mostly on tasks beneath growth and estimates by the Vitality Info Administration, U.S. every day LNG export capability may enhance to twenty billon cubic ft (Bcf) from the present 12 to 13 Bcf by the tip of 2025 or in 2026.

However he added that the present tasks “are underwritten based mostly on contracts to promote to customers in China, Korea and Japan.”

“Even with new capability coming on-line, it isn’t as if these models haven’t been spoken for,” he mentioned.

That, together with the uncertainty in Europe, underline what may very well be a generational alternative for the U.S. pure fuel business to develop approach past the enlargement in export capability that was beneath approach lengthy earlier than Russian President Vladimir Putin began build up a military on the Ukraine border in late 2021.

The stage has been set for greater oil costs

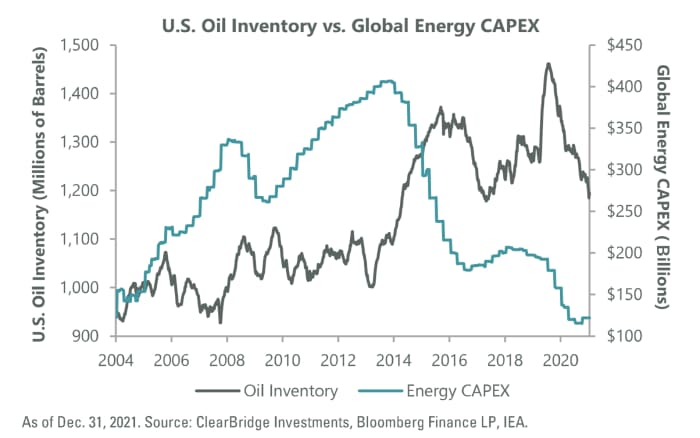

A mixture of declining U.S. oil stock and a drop in business funding in oil exploration and manufacturing had laid the groundwork for greater oil costs by the tip of 2021:

The chart was offered by Sam Peters, a portfolio supervisor at ClearBridge Investments, and most lately included in this article on Might 11 that included power inventory picks by Peters and different cash managers.

The left facet of the chart exhibits that oil business capital expenditures had elevated throughout earlier intervals of low provide. The proper facet of the chart exhibits that capital spending fell very low final yr as inventories have been declining.

U.S. oil and pure fuel producers have discovered from earlier cycles, when their give attention to constructing provide led to cost declines extreme sufficient to place some out of enterprise and create monetary stress for all. In the course of the present cycle, quite a few business executives have famous the significance of giving their shareholders what they need — a mixture of prudent funding, greater dividends and share buybacks.

Investing within the power sector

The power sector of the S&P 500 is made up of 21 shares and is tracked by the Vitality Choose Sector SPDR Fund

XLE,

The weighting of the index by market capitalization implies that Exxon and Chevron collectively make up 44% of the change traded fund’s portfolio, based on FactSet.

The iShares World Vitality ETF

IXC,

takes a broader strategy, holding all of the shares held by XLE however including publicity to non-U.S. producers, akin to Shell PLC

SHEL,

SHEL,

TotalEnergies SE

TTE,

TTE,

and BP PLC

BP,

BP,

for a portfolio of 48 shares. Additionally it is concentrated, with the highest 5 holdings making up 47% of the portfolio.

For the non-U.S. firms listed above, the primary ticker is for its native firm itemizing, whereas the second is for its American depositary receipt.

The Hennessy Vitality Transition Fund

HNRIX,

held 28 shares or power restricted partnership models as of June 30. The fund invests throughout the power manufacturing, transportation and distribution spectrum. It pays out dividend and capital features distributions yearly, in December. Its prime 5 holdings — Plains All American Pipeline L.P.

PAA,

EOG Assets Inc.

EOG,

Exxon Mobil, Solaris Oilfield Infrastructure Inc.

SOI,

and Cheniere Vitality Inc.

LNG,

— made up about 25% of the fund’s portfolio as of June 30.

The primary goal of the Hennessy Vitality Transition Fund is long-term development, with “transition” being the power business’s give attention to cleaner applied sciences, together with pure fuel.

The Hennessy Midstream Fund

HMSIX,

is principally centered on distributing earnings from its investments in firms and partnerships that retailer and transport power commodities. Its institutional shares have a distribution yield of 10.75%, based mostly on the closing value of $9.60 on Sept. 19 and the quarterly distribution of 25.8 cents a share that the fund has maintained since June 2015, based on Cook dinner.

The Midstream Fund’s prime holding is Vitality Switch LP

ET,

which made up 14% of the portfolio as of June 30. This partnership has raised its distribution twice in 2022.

“They’ve quite a lot of tasks in growth,” Cook dinner mentioned.

He pointed to a proposed LNG export facility in Lake Charles, La., which he expects might be beneath contract by the tip of this yr.

Whereas the Midstream Fund holds restricted partnerships, its personal distributions are reported on a 1099 — this implies buyers don’t must face the complication of Ok-1 reporting by restricted partnerships.

Don’t miss: It’s a great time to scoop up bargain stocks. Here are 21 examples that could make you a lot of money.

Hear from Ray Dalio at MarketWatch’s Best New Ideas in Money Festival on Sept. 21 and 22 in New York. The hedge-fund pioneer has robust views on the place the financial system is headed.

Source link