[ad_1]

© Reuters. Pre-Open Movers: Okta Sinks on Disappointing Outcomes, Nutanix Features on Stable Beat

Pre-Open Inventory Movers:

Okta, Inc. (NASDAQ:) 21% LOWER; Q2 EPS of ($0.10), $0.21 higher than the analyst estimate of ($0.31). Income for the quarter got here in at $452 million versus the consensus estimate of $430.64 million. Okta, Inc. sees FY2023 EPS of ($0.73)-$0.70. Okta, Inc. sees FY2023 income of $1.81-1.82 billion, versus the consensus of $1.82 billion.

Nutanix (NASDAQ:) 18% HIGHER; This autumn EPS of ($0.17), $0.21 higher than the analyst estimate of ($0.38). Income for the quarter got here in at $385.5 million versus the consensus estimate of $355.3 million. Nutanix sees Q1 2023 income of $410-415 million, versus the consensus of $372.63 million. Nutanix sees FY2023 income of $1.77-1.78 billion, versus the consensus of $1.66 billion.

C3 Ai (NYSE:) 16% LOWER; Q1 EPS of ($0.12), $0.12 higher than the analyst estimate of ($0.24). Income for the quarter got here in at $65.3 million versus the consensus estimate of $66.02 million. C3.ai sees Q2 2023 income of $60-62 million, versus the consensus of $71.7 million. C3.ai sees FY2023 income of $255-270 million, versus the consensus of $310.58 million.

AnaptysBio, Inc. (NASDAQ:) 15% LOWER; introduced top-line information from its HARP Part 2 trial for the remedy of moderate-to-severe hidradenitis suppurativa (HS). The trial indicated imsidolimab was secure and nicely tolerated, nevertheless, didn’t display efficacy over placebo within the trial’s main endpoint and key secondary endpoints. Medical growth of imsidolimab is being discontinued in hidradenitis suppurativa.

MongoDB (NASDAQ:) 15% LOWER; Q2 EPS of ($0.23), $0.05 higher than the analyst estimate of ($0.28). Income for the quarter got here in at $303.7 million versus the consensus estimate of $284.37 million. MongoDB sees Q3 2023 EPS of ($0.19)-($0.16), versus the consensus of ($0.14). MongoDB sees Q3 2023 income of $300-303 million, versus the consensus of $294.85 million. MongoDB sees FY2023 EPS of ($0.35)-($0.28), versus the consensus of ($0.21). MongoDB sees FY2023 income of $1.196-1.206 billion, versus the consensus of $1.19 billion.

Veeva Methods (NYSE:) 12% LOWER; Q2 EPS of $1.03, $0.02 higher than the analyst estimate of $1.01. Income for the quarter got here in at $534.2 million versus the consensus estimate of $530.71 million. Veeva Methods sees FY2023 EPS of $4.17. Veeva Methods sees FY2023 income of $2.14-2.145 billion, versus the consensus of $2.17 billion.

Pure Storage, Inc. (NYSE:) 8% HIGHER; Q2 EPS of $0.32, $0.10 higher than the analyst estimate of $0.22. Income for the quarter got here in at $646.8 million versus the consensus estimate of $636.04 million. Pure Storage, Inc. sees Q3 2023 income of $670 million, versus the consensus of $651.62 million. Pure Storage, Inc. sees FY2023 income of $2.75 billion, versus the consensus of $2.64 billion.

Semtech (NASDAQ:) 7% LOWER; Q2 EPS of $0.87, $0.02 higher than the analyst estimate of $0.85. Income for the quarter got here in at $209.3 million versus the consensus estimate of $208.29 million. Semtech sees Q3 2023 EPS of $0.60-$0.66, versus the consensus of $0.90. Semtech sees Q3 2023 income of $170-180 million, versus the consensus of $215.61 million.

Construct-A-Bear Workshop (NYSE:) 6% LOWER; Q2 EPS of $0.38, $0.07 worse than the analyst estimate of $0.45. Income for the quarter got here in at $100.7 million versus the consensus estimate of $96.67 million. Construct-A-Bear Workshop sees FY2022 income of $440-460 million, versus the consensus of $454.5 million.

Ollie’s Discount Outlet (NASDAQ:) 6% LOWER; Q2 EPS of $0.22, $0.11 worse than the analyst estimate of $0.33. Income for the quarter got here in at $452.5 million versus the consensus estimate of $456.38 million. Ollie’s Discount Outlet sees Q3 2022 EPS of $0.39-$0.43. Ollie’s Discount Outlet sees Q3 2022 income of $426-434 million, versus the consensus of $430.03 million. Ollie’s Discount Outlet sees FY2022 EPS of $1.74-$1.79. Ollie’s Discount Outlet sees FY2022 income of $1.843-1.861 million, versus the consensus of $1.88 million.

5 Under (NASDAQ:) 5% HIGHER; Q2 EPS of $0.74, $0.05 worse than the analyst estimate of $0.79. Income for the quarter got here in at $668.9 million versus the consensus estimate of $682.26 million. 5 Under sees Q3 2022 EPS of $0.08-$0.19, versus the consensus of $0.29. 5 Under sees Q3 2022 income of $600-619 million, versus the consensus of $636.5 million. 5 Under sees FY2022 EPS of $4.26-$4.56, versus the consensus of $4.83. 5 Under sees FY2022 income of $2.97-3.02 billion, versus the consensus of $3.07 billion.

Hormel Meals (NYSE:) 5% LOWER; Q3 EPS of $0.40, $0.01 worse than the analyst estimate of $0.41. Income for the quarter got here in at $3 billion versus the consensus estimate of $2.99 billion. Hormel Meals sees FY2022 EPS of $1.78-$1.85, versus the prior of $1.87-$1.97 and the consensus of $1.88. Hormel Meals sees FY2022 income of $12.2-12.8 billion, versus the prior of $11.7-12.5 billion and consensus of $12.45 billion.

NVIDIA (NASDAQ:) 5% LOWER; considerations about new U.S restrictions on chip exports to China

Culp, Inc. (NYSE:) 4% LOWER; Q2 EPS of ($0.47), $0.42 worse than the analyst estimate of ($0.05). Income for the quarter got here in at $62.6 million versus the consensus estimate of $69.64 million.

Greif, Inc. (NYSE:) 3% HIGHER; Q3 EPS of $2.35, $0.35 higher than the analyst estimate of $2.00. Income for the quarter got here in at $1.62 billion versus the consensus estimate of $1.6 billion. Greif Inc sees FY2022 EPS of $7.90-$8.10.

SentinelOne, Inc. (NYSE:) 2% LOWER; Q2 EPS of ($0.20), $0.05 higher than the analyst estimate of ($0.25). Income for the quarter got here in at $102.5 million versus the consensus estimate of $95.67 million. SentinelOne , Inc. sees Q3 2023 income of $111 million, versus the consensus of $108.2 million. SentinelOne, Inc. sees FY2023 income of $415-417 million, versus the consensus of $406.23 million.

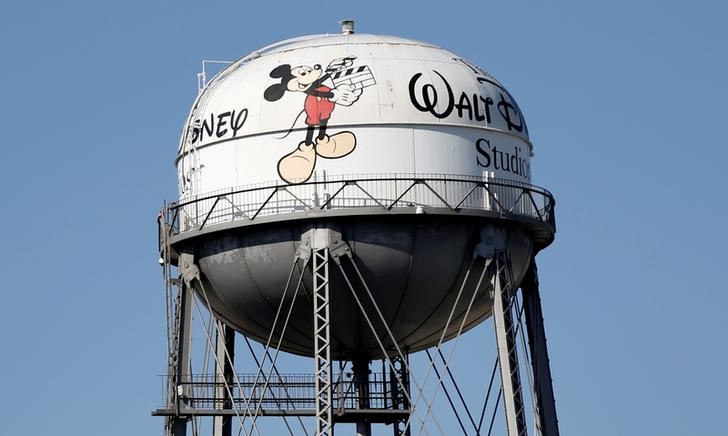

Walt Disney (NYSE:) 2% HIGHER; Explores Amazon (NASDAQ:) Prime-Like Membership Program to Supply Reductions and Perks — WSJ

Baidu (NASDAQ:) 1% HIGHER; JPMorgan (NYSE:) upgraded from Impartial to Obese with a worth goal of $200.00 (from $160.00).

Netflix (NASDAQ:) 1% HIGHER; trying to cost advertisers premium costs, goals for Nov. 1 launch of ad-supported tier – WSJ

Source link