[ad_1]

Eire’s three remaining excessive avenue banks are dealing with a “as soon as in a technology” likelihood to increase as two of their rivals put together to exit the market, leaving €30bn in mortgage books and 1mn prospects behind.

Rising rates of interest and the chance to develop at a fast tempo are offering optimism for the nation’s banking system, which has been rehabilitated after a disaster greater than a decade in the past that crashed all the Irish economy.

“For the primary time in various years, we’re seeing the inexperienced shoots of recent web lending in Eire — one thing that has threatened to reach and by no means has fairly arrived,” Mark Spain, chief monetary officer on the Financial institution of Eire, the nation’s greatest lender, instructed the Monetary Occasions.

However whereas bankers rejoice, others are more and more involved that the market has consolidated too rapidly, because the exit of Ulster Financial institution and KBC will doubtlessly create an unhealthy discount within the variety of choices for purchasers.

In response to a authorities evaluate of the business, the Central Financial institution of Eire mentioned the nation was in a “place the place consolidation has led to rising issues relating to market focus and competitors”.

Brian Lucey, professor of worldwide finance at Trinity Faculty’s enterprise faculty, mentioned Eire was in impact “shifting into an virtually oligopolistic market” in retail banking. He mentioned that though this could increase income to the advantage of shareholders, it was “most likely not” optimistic for customers or the broader Irish financial system.

Like many banks in Europe, the three remaining lenders in Eire have benefited from rising rates of interest and sounded optimistic of their half-year outcomes over the previous few weeks.

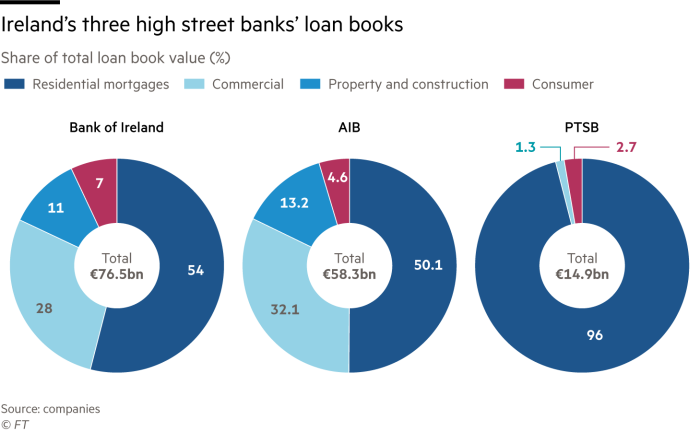

State-backed AIB reported a 74 per cent leap in income on the again of upper revenue. BoI mentioned it anticipated the state to withdraw as a shareholder this summer season. Everlasting TSB, which can also be government-backed, reported a rise in lending and expects to return to revenue this 12 months.

However Irish banks might have a bonus over their European rivals. Brian Hayes, chief government of the Banking and Funds Federation of Eire, the principle voice of the business, mentioned 80 per cent of their revenue was generated from rate of interest strikes, whereas 20 per cent comes from charges. This compares with a 60-40 break up within the EU, he mentioned.

As inflation continues to soar, extra fee rises are on the playing cards. The European Central Financial institution raised charges in July by half a proportion level to zero, the primary improve in 11 years, following within the footsteps of the US Federal Reserve and the Financial institution of England.

The BoI mentioned it anticipated €435mn in further web curiosity revenue if charges rise by 1 proportion level, whereas AIB has pointed to a €369mn uplift, primarily based on their forecasting fashions.

“As you look into 2023, there’s clearly a really materials and important upside to curiosity revenue,” mentioned Diarmaid Sheridan, banking analyst at stockbrokers Davy.

“There are some inflationary impacts on prices, however a lot lower than you’re seeing on the income aspect,” he mentioned. “It’s a vastly optimistic story. We have now some higher upside [than EU banks] and we’re most likely higher insulated from a number of the draw back.”

Retail banks’ steadiness sheets have additionally been cleaned up for the reason that disaster. A mortgage lending spree throughout Eire’s “Celtic Tiger” increase — what Hayes calls the “insanity years” — introduced the banks to the brink of insolvency and compelled Dublin to simply accept a €67.5bn bailout from the EU and IMF.

Because of their recklessness prior to now, Irish banks now have to use stringent checks to mortgage lending. The typical loan-to-deposit ratio is all the way down to 78 per cent in 2020 from 102 per cent in 2016, according to the Central Bank of Ireland. That is considerably decrease than the EU financial institution common of 107 per cent.

Because the market contracts, PTSB particularly is poised to profit from the business’s dramatic restructuring.

PTSB is shopping for €7bn of mortgages from Ulster Financial institution, 25 of its branches and about €600,000 in belongings from its small enterprise and asset finance divisions. The deal will increase PTSB’s mortgage enterprise by 40 per cent, its small enterprise e book by 200 per cent and its department community by practically a 3rd.

“The transformation of the Ulster Financial institution deal for us is far more substantial than, say, AIB or Financial institution [of Ireland],” PTSB’s chief government Eamonn Crowley instructed the FT. “It’s extra incremental for them. For us, it’s a considerable change in each our steadiness sheet and in our profitability and certainly our potential to compete.”

BoI is shopping for €9bn of residential mortgages from KBC and greater than €4bn of deposits, which it mentioned would additionally increase its mortgage lending by 40 per cent. AIB is buying €5.7bn of Ulster Financial institution mortgages and €3.7bn of economic loans.

Regardless of the expansion alternatives, political threat stays a headwind. Sinn Féin, the nationalist get together in pole place to win the subsequent elections due in 2025, has steered that it doesn’t need to see the state exit the banking sector totally. This has fuelled nervousness in components of the monetary sector about public coverage if the populist get together takes energy.

Pearse Doherty, Sinn Féin’s finance spokesperson, criticised an aborted AIB decision to withdraw money companies at 70 of its branches, saying that if the state allowed a full privatisation “there can be no affect that we will have . . . over different choices that they might have sooner or later”.

Because the banks emerge from state possession, they’re additionally searching for to take away restrictions on pay — one of many final remnants of the monetary disaster.

BoI is getting ready to push again in opposition to government pay caps and a ban on bonuses because the state sells down its remaining holding, which has fallen to lower than 3 per cent.

Critics of the pay coverage argue that it has led to churn at senior government ranges of Irish banks, whereas lenders in different nations, such because the US, are capable of supply extra aggressive remuneration packages. BoI’s chief government Francesca McDonagh would be the newest in a string of senior banker departures from Eire when she stands down subsequent month.

After greater than a decade of Irish banks paying their dues and as prospects for larger income enhance, the BoI’s Spain mentioned now was the time to drop limits on pay, at the least when his financial institution returns absolutely to personal fingers.

“The restrictions needs to be eliminated for BoI,” he mentioned. “I believe we needs to be rewarded.”

Source link