[ad_1]

Wait till the VIX will get lots decrease earlier than placing any sideline money again to work within the inventory market.

That’s the implication of a 2019 educational research within the Journal of Monetary Economics. Entitled “Volatility-Managed Portfolios,” it was performed by finance professors Alan Moreira of the College of Rochester and Tyler Muir of UCLA.

This research’s findings are stunning as a result of they run counter to what traders for years have been taught about how we should always react to volatility. We’ve been instructed that our feelings are our worst enemies on the subject of making portfolio choices. That in flip implies that, although our guts inform us to run for canopy when inventory market volatility spikes, we should always as a substitute be sustaining and even growing our fairness publicity.

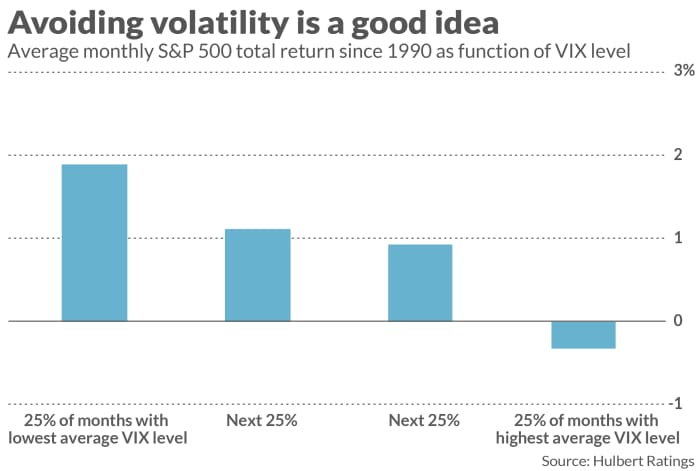

It seems that our guts had been proper. The inventory market traditionally has turned in above-average efficiency when the CBOE’s Volatility Index

VIX,

has been low, not excessive. That is illustrated within the accompanying chart, which plots the S&P 500’s

SPX,

month-to-month common complete return as a perform of the VIX’s month-to-month common. Discover that the best common return was produced within the 25% of months with the bottom VIX ranges, and that this common declines steadily as VIX ranges rise.

I wrote about this technique two years ago for Retirement Weekly. I’m revisiting it now as a result of its efficiency throughout this yr’s bear market is an efficient illustration of its advantages. Whereas it known as for being shut to totally invested on the finish of final yr, it rapidly lowered its beneficial fairness publicity as market volatility spiked upward earlier this yr. To date this yr its common fairness publicity has been greater than 30 p.c decrease than the market’s.

Utilizing VIX as a market timing instrument

Moreira and Muir don’t suggest utilizing the VIX as an all-or-nothing sign to set off shifting from 100% out there to 100% in money. As an alternative, they counsel utilizing it to progressively improve or lower your fairness publicity. In varied emails during the last couple of years, they’ve offered me with just a few easy guidelines for a way this would possibly work in observe:

- Choose a goal or default fairness allocation. For instance, if you happen to’re in any other case totally invested in shares, your goal or default fairness allocation can be 100%.

- Decide a middle-of-the-road VIX stage that can correspond together with your goal allocation. This baseline stage is what you can be utilizing to find out your fairness publicity. If the VIX is increased than your baseline, your fairness publicity might be under your default stage—and vice versa.

- To find out your exact fairness publicity stage for every month, multiply your goal allocation by the ratio of your VIX baseline to the closing VIX stage of the instantly previous month.

For instance, let’s assume your goal fairness allocation is 100%, and the middle-of-the-road VIX stage that corresponds to that concentrate on is the historic median—which at present is 17.71. On condition that the VIX on the finish of July was 21.33, your fairness allocation in August can be 83.0%. And assuming the VIX closes August at the place it stood as this column goes to press, your allocation for September can be barely decrease at 81.3%.

Whereas this method usually doesn’t name for large publicity modifications from month to month, it does result in huge swings in fairness publicity over time. Within the case of my hypothetical illustration, the fairness publicity stage since 1990 assorted from a low of 28.3% to a excessive of 174.9% (on margin, in different phrases).

I backtested this method to 1990, which is how far again information for the VIX can be found. I credited the 90-day T-bill charge to the noncash portion of my hypothetical portfolios, whereas debiting margin curiosity price when the mannequin known as for being greater than 100% invested.

| Technique | Annualized return since 1990 | Customary deviation of month-to-month returns | Sharpe ratio |

| Volatility-based market-timing mannequin | 10.2% | 3.67 | 0.83 |

| S&P 500 complete return | 10.4% | 4.25 | 0.75 |

You would possibly marvel what’s so spectacular a couple of technique that didn’t earn more money than the S&P 500. The reply lies within the technique’s decrease danger—14% decrease, as measured by the usual deviation of month-to-month returns. Consequently, the technique’s Sharpe ratio (a measure of risk-adjusted efficiency) is markedly increased than that of the S&P 500.

Primarily equaling the market’s return with decrease danger is an enormous deal, as a result of that decrease danger will increase the probability that traders will truly keep on with their monetary plan via thick and skinny. The S&P 500’s appreciable volatility in bear markets is among the massive explanation why traders quit on their plans throughout bear markets—virtually all the time to their long-term detriment.

The desk doesn’t present how the technique has achieved to this point this yr. But it surely has misplaced considerably lower than the market, dropping 7.8% via Aug. 25, when this column goes to press. Although a loss is rarely welcome, it’s lots smaller and extra tolerable than the losses incurred by the general market.

Because the saying goes on Wall Road, he who wins throughout a bear market is he who loses the least.

Learn to shake up your monetary routine on the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. Be a part of Carrie Schwab, president of the Charles Schwab Basis.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Rankings tracks funding newsletters that pay a flat payment to be audited. He might be reached at [email protected].

Source link