[ad_1]

U.S. shares have clawed again a lot of their losses from the primary half of the yr, however the three main indexes tumbed this week beneath reviving fears about rate of interest rises by the Federal Reserve, and there are indicators that the majority of the bear-market rally is already behind us, mentioned Citigroup’s analysts.

In accordance with strategists at Citi Analysis, the present bear market rally is sort of consistent with the size of a mean bear-market bounce, and sentiment has already improved as a lot because it usually does throughout common bear market rallies, which might counsel a attainable finish to the rally comparatively quickly.

“Bear market rallies are sometimes sentiment pushed, because the market simply turns into too bearish,” wrote Citi Analysis strategists led by Dirk Willer, the managing director and head of rising market technique, in a be aware on Thursday. “Extra basically, many bear market rallies are pushed by hopes that the Fed involves the rescue. The present one is not any completely different, because the Fed pivot narrative has been an essential catalyst.”

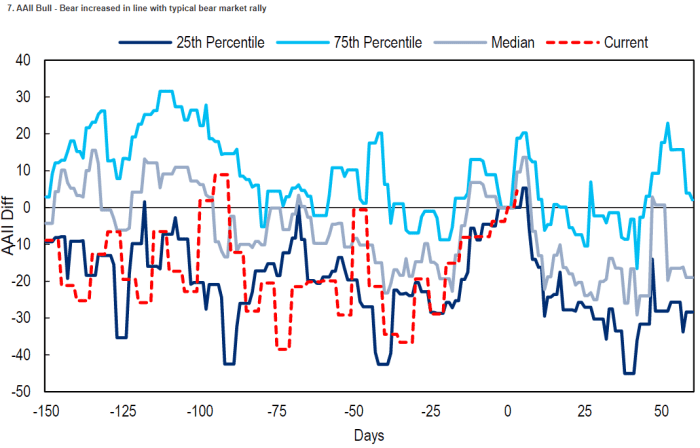

Specifically, the chart beneath reveals that the AAII bull-bear indicator, one of the closely-watched investor sentiment surveys, is sort of again to ranges the place bear market rallies peak out, with expectations that inventory costs will rise over the subsequent six months, growing 1.2 share factors to 33.3% within the week of August 15, whereas the bearish sentiment elevated 0.5 share factors to 37.2%.

SOURCE: CITI RESEARCH, BLOOMBERG

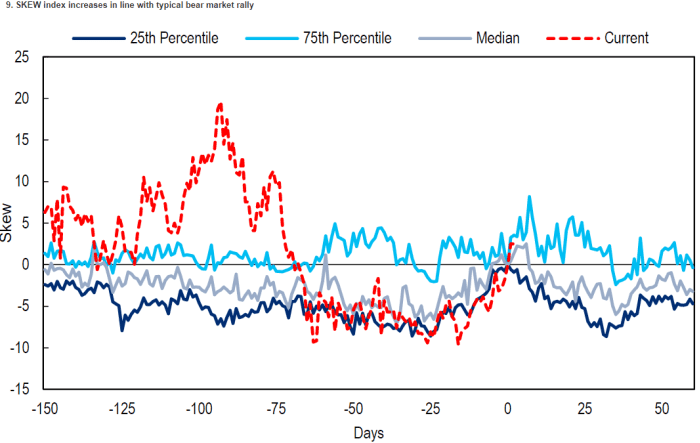

In the meantime, the SKEW index for the S&P 500, which measures the distinction between the price of derivatives that defend in opposition to market drops and the fitting to profit from a rally, normalized nearly as a lot because it does within the median bear market rally (see chart beneath), mentioned Citi Analysis. The index could be a proxy for investor sentiment and volatility.

SOURCE: CITI RESEARCH, BLOOMBERG

Federal Reserve officers in July agreed that it was necessary to move their benchmark interest rate high enough to gradual the financial system to fight excessive inflation, whereas elevating issues that they could tighten the stance of financial coverage by greater than obligatory, in response to minutes of the Federal Open Market Committee’s July 26-27 assembly launched Wednesday.

See: Powell to tell Jackson Hole that recession won’t stop Fed’s fight against high inflation

After the discharge of minutes of the assembly, the Federal Reserve Financial institution of St. Louis President James Bullard said he is leaning toward another large rate rise of 75 basis points on the central financial institution’s September assembly. In the meantime, Richmond Fed President Tom Barkin mentioned the Fed “will do what it takes” to drive inflation again towards its 2% goal, in response to a Bloomberg report, whereas Reuters reported that Barkin saying the Fed’s efforts needn’t be “calamitous.”

See: Stop misreading the Fed: It’s not getting cold feet about wrestling inflation to the ground

In accordance with Citi Analysis, the bear market rally refers to a bounce equal to or bigger than 10% that takes place between the height and the trough. “If a brand new low is made after a ten% rally, the subsequent rally of greater than 10% is a separate bear market rally (or a bull market, if no new lows are made subsequently),” wrote strategists.

The S&P 500

SPX,

was up 15.4% from its 52-week low of 3666.77 on June 16, whereas the Dow Jones Industrial Common

DJIA,

rallied 12.9%, and the NASDAQ Composite

COMP,

jumped 19.4% since their mid-June lows, in response to Dow Jones Market Information. In complete, Citigroup famous three indexes have skilled a 17% rally prior to now 42 buying and selling days since June 16.

U.S. stocks traded lower on Friday. The Dow Jones Industrial Common

DJIA,

fell 339.47 factors, or 1.0%, to 33,695.57. The S&P 500

SPX,

dropped 60.36 factors, or 1.4%, to 4,223.38. The Nasdaq Composite

COMP,

decreased 272.42 factors, or 2.1%, to 12,692.92.

Source link