[ad_1]

In its personal phrases, Front is a buyer communication hub that retains groups centered on what expertise can’t exchange: guaranteeing each dialog strengthens the shopper relationship. The corporate just lately raised $65 million at a $1.7 billion valuation, which is a hell of a funding spherical. Uniquely, the corporate has really revealed all of its previous funding decks publicly, which suggests this can be a uncommon alternative to comply with an organization’s journey from its first progress funding spherical all through to the current.

From spherical to spherical, the corporate’s CEO Mathilde Collin outlines the evolution of the corporate and the way it’s positioned available in the market. She writes one of many clearest breakdowns of how the aim of every spherical has developed:

- Seed: “We’re a very good group with a big market alternative.”

- Collection A: “We’ve got proof of product-market match ($1M ARR)” — see the company’s Series A pitch deck.

- Collection B: “We’ve got leverage (we all know the best way to spend cash to develop quicker)” — see the company’s Series B pitch deck.

- Collection C: “We perceive our market, which unlocks new levers of progress (outbound & upmarket)” — see the company’s Series C pitch deck.

- Collection D: “We perceive what’s distinctive about our place on this market, and why our mission issues greater than ever.”

So, let’s see how information of market place interprets right into a pitch story.

We’re in search of extra distinctive pitch decks to tear down, so if you wish to submit your individual, here’s how you can do that.

Table of Contents

Slides on this deck

Entrance’s pitch deck is an extremely tight, 11-slide deck that opens with a mic drop, and, effectively, these should be some butter-slathered microphones, as a result of it certain is slippery — the corporate simply retains dropping mics because the slides progress. On first skim, I’m getting nervous as I understand I’ve to search out stuff I want to enhance about these slides.

However! I’m feeling courageous, so let’s give it a whirl.

- Cowl slide

- “Entrance in key numbers” — traction-summary slide

- “Modern, rising, next-gen firms use Entrance to align groups, execute quicker & ship world-class service” — social proof slide

- “A buyer communication hub” — product slide

- “A large market alternative” — market description slide

- “Typical utilization throughout our core use instances” — answer slide

- “A greater product, at scale” — scaling slide

- “Robust fundamentals hold getting stronger” — metrics/traction slide

- “An bold imaginative and prescient few firms can ship” — imaginative and prescient slide

- “Constructed for the long term” — abstract slide

- “Thanks” — closing slide

The slide deck could be very near being as-pitched by the corporate’s founding group, with a few minor redactions. The corporate blanked out the income information on slide 2, it hid a few of its clients on slide 3 and whereas slide 8 saved the graphs, the corporate eliminated the numbers from the axes.

Three issues to like

Initially, this is without doubt one of the finest slide decks I’ve ever seen. It tells a good and compelling story with out utilizing too many phrases.

That’s the way you begin a pitch!

[Slide 2] Yassss. That is the way you do it. Picture Credit: Front (opens in a new window)

Whenever you’re elevating angel funds or your first institutional cash, you will get away with elevating with a imaginative and prescient, a dream and a sliver or two of hope. By the point you’re elevating a progress spherical — sometimes your Collection A and past — you want greater than a wing and a prayer. And if you happen to’re elevating at a $1.7 billion valuation? Overlook about it. Arduous information proving that you simply’ve discovered what your market dynamics is non-negotiable.

Despite the fact that slide 2 is considerably redacted, you get the image: The corporate comes onerous out of the gate and reveals that it is aware of why it’s sitting throughout the desk from a enterprise capital agency: Traction, child, and a plan for what occurs subsequent.

If I have been an investor on this area, slide 2 alone could be sufficient to get the corporate to a second assembly.

Whenever you make it to your Collection D, if you happen to haven’t bought traction, you’re useless within the water. Meaning except you’re elevating cash for one thing new and spectacular (say, a complete new product or a model new market growth), you open together with your traction.

So sure, Entrance bought that proper, however it additionally reveals that it is aware of which metrics matter. ARR, ARR progress and retention are key. The remainder of the figures are eye sweet, however, I imply, take a look at that eye sweet! If I have been an investor on this area, this slide alone could be sufficient to get the corporate to a second assembly.

Proudly owning the market

[Slide 5] “That is what we do” seen by means of a market lens. Picture Credit: Front (opens in a new window)

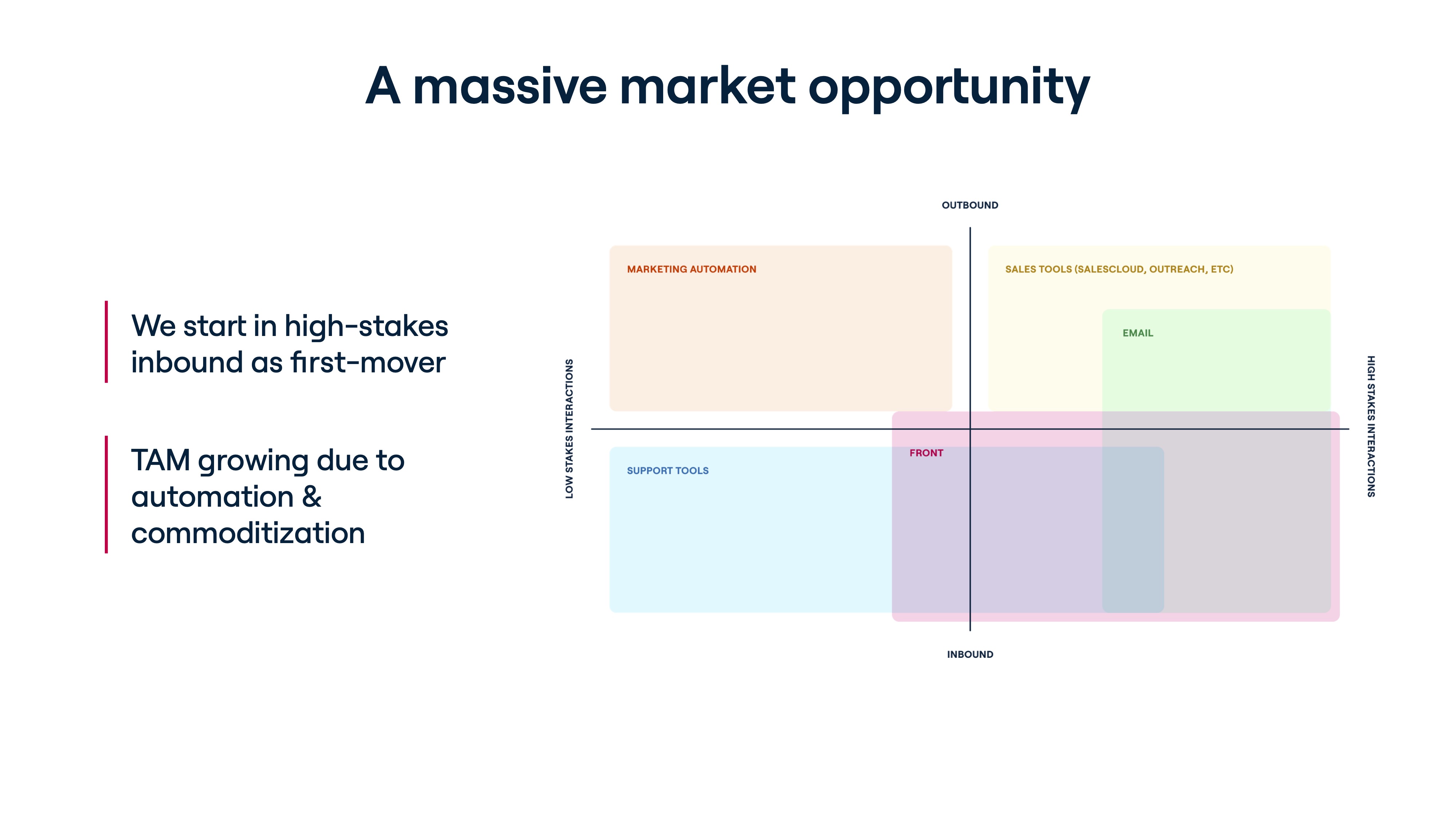

Name me ignorant, however till Entrance submitted its pitch deck for a teardown (you can do that, too!), I had by no means heard of the corporate. Slide 4 is actually elegant: It reveals a screenshot of the product with callouts exhibiting what its clients love about it. However Slide 5 nails the corporate’s product and its place available in the market fantastically. It additionally does a extremely refined factor, which I’ll get again to in only a second.

I really like a very good two-by-two graph in a pitch deck, because it actually helps present how an organization positions itself available in the market and the way it differs from its clients. Entrance’s fifth slide will be learn a couple of alternative ways, however after I take a look at it, I instantly observed this: “If it’s inbound and vital, use Entrance.” That signifies that the platform can be utilized for high-importance buyer assist interactions, inbound gross sales, inside gross sales and normal buyer communications.

That’s a hell of a slice of the market. It additionally reveals that Entrance doesn’t compete with the big variety of lower-impact buyer assist instruments on the market. Whether or not that’s a good suggestion will be left as an train to the reader, however it’s elegant, clear and it reveals that the corporate has nice self-discipline.

The opposite cool factor — the refined a part of this slide I simply talked about — is expounded to market growth. One vital consideration that pops into my thoughts after I see this slide is how the corporate might increase its market. There are two logical choices: Both all the pieces inbound (additionally tackle the lower-value inbound communications at the moment coated by extra generic assist instruments) or all the pieces precious (shift to additionally enabling outbound gross sales and advertising communications and tackle Salesforce at its core enterprise as effectively).

Both method, this can be a clear slide that does quite a lot of heavy lifting, and I can see this inflicting a vigorous debate at a pitch assembly.

Flexing your buyer use instances

[Slide 6] Buyer use instances. Picture Credit: Front (opens in a new window)

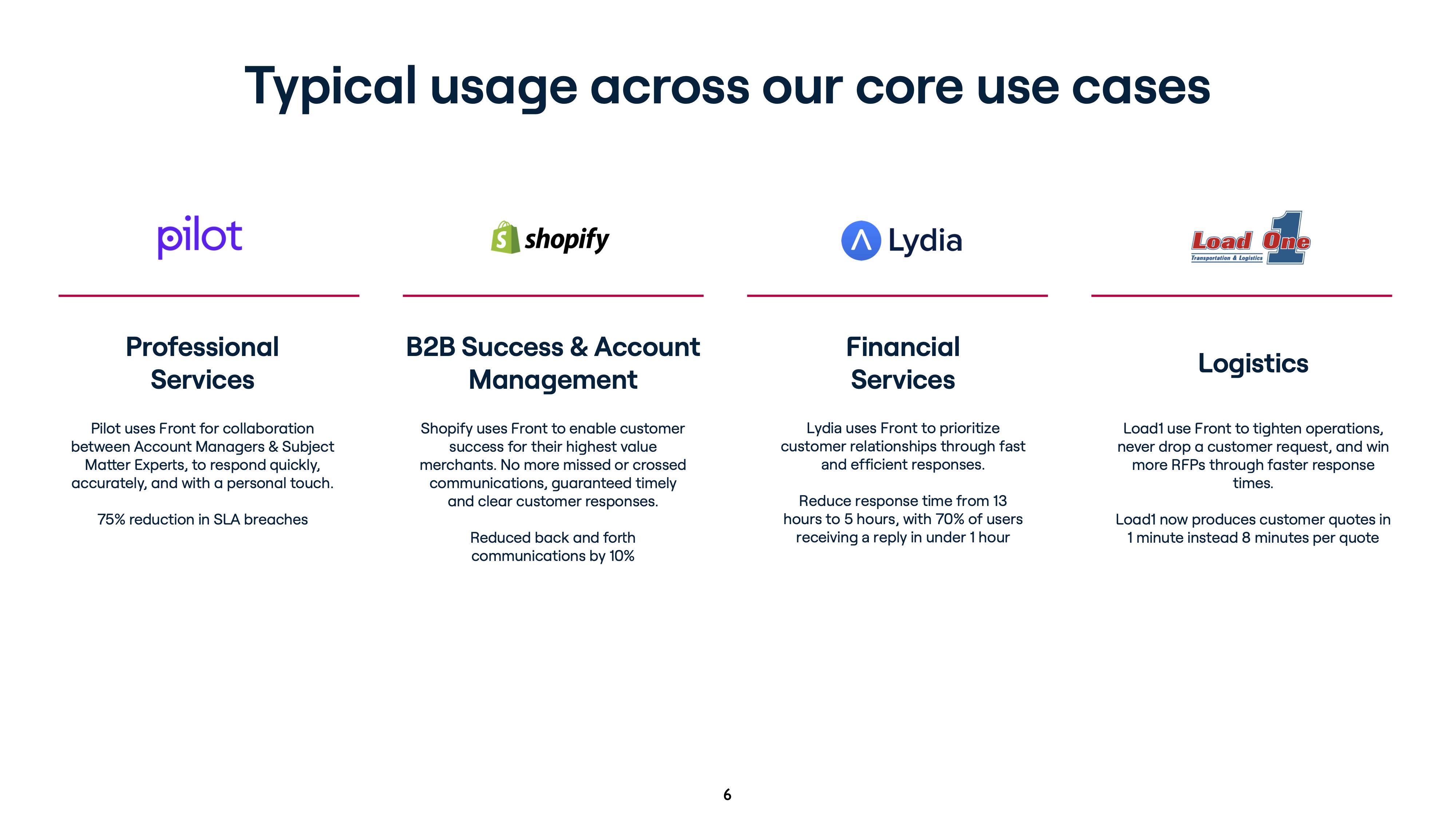

Slide 6 had me shaking my head and muttering “yesss” underneath my breath. Other than the truth that it has extra textual content than I’d like, the corporate does a couple of issues extraordinarily proper right here.

First off, it reveals off a few of its extraordinarily well-known clients. Pilot, Shopify, Lead1 and Lydia are well-established manufacturers, and seeing them on this slide is a reminder of how far Entrance has are available in its market penetration. The outline of how every firm makes use of the platform is genius, as a result of all 4 use instances are fairly distinct, and it reveals each the worth and the flexibleness of the instrument.

The precise stroke of genius, although, is the ultimate sentence on every of those use instances. Entrance averted the temptation to speak about options and even use instances. As a substitute, it talks in regards to the worth proposition it presents every of those buyer teams. Excellent, and precisely what you need to be doing on a slide like this. A 75% discount in SLA breaches? A ten% discount in back-and-forth comms? Lowering response occasions from 13 to 5 hours? Anybody who manages inbound buyer requests realizes how monumental these outcomes are and the super worth Entrance’s instruments convey.

It’s superbly executed, and I’ve bookmarked this slide away in my “That is the way you do it” folder. You wouldn’t consider what number of firms get this painfully flawed.

In the remainder of this teardown, we’ll check out three issues Entrance might have improved or executed otherwise, together with its full pitch deck!

Three issues that may very well be improved

Elevating at a $1.7 billion valuation and the quantity of effusive reward I’ve already poured on this slide deck is value celebrating. However, as ever, there’s a element or two I really feel compelled to poke enjoyable at.

That’s not the way you do a contest slide

As a lot as I beloved the market positioning slide (slide 5), I bristled on the lack of listed opponents. Sure, it’s doable that Entrance dominates its market. However that doesn’t imply there aren’t different instruments on the market that cowl points of what Entrance does, and it appears just a little smug to not embrace them as a part of the narrative.

I don’t care how massive you get, I need to know which opponents you’re maintaining a tally of. And (probably within the appendix) I need to see a SWOT evaluation of those that pose an lively menace or might accomplish that sooner or later.

So, er, what are you gonna do with the cash?

Entrance raised $65 million. That’s quite a lot of spondoolahs for any enterprise, and my quick query is: “What are you going to do with the money?” I’d have anticipated an operating plan in this deck, however it’s doable they’ve the lengthy and near-term financials in spreadsheets as an alternative. I don’t love that, however superb, I get it.

The one excuse I can think about for not together with near-future plans is that if the fundraise is earmarked for an IPO, and the cash will principally go towards getting ready the corporate for a list.

What I don’t get, although, is that the deck is sort of fully backward-facing. I get that traction is essential and spectacular, however you increase cash since you want the money to vary one thing about what the future of your organization seems like. There’s nothing in any respect on this deck about this. Is the corporate about to increase its market? Will it rent extra workers? Is it pivoting merchandise? Is there going to be a advertising push?

The one excuse I can think about for not together with near-future plans is that if the fundraise is earmarked for an IPO, and the cash will principally go towards getting ready the corporate for a list. If that’s the case, you need to play your playing cards near your chest till it occurs and never together with it within the pitch deck would possibly make sense.

On condition that’s the one motive I can consider to not embrace future plans, I’m 70% certain the corporate will file an S-1 and run an IPO course of subsequent 12 months. Entrance, if that’s the case, you don’t need to admit it; simply ship me a postcard or one thing with a smiley face on it as soon as your S-1 drops. I referred to as it ;-).

You are able to do higher in the marketplace facet of issues

As a lot as I really like the market define slide, it doesn’t say something about measurement of the native or world market. That’s unforgivable, as a result of for a corporation seeing aggressive progress, I’d need to learn the way way more it will probably develop earlier than it’s taken on its whole serviceable obtainable market (SOM) and the way it’s going to increase its addressable market (SAM).

There’s no method Entrance hasn’t spent quite a lot of time fascinated by this, and there’s zero probability that it wouldn’t have been challenged on this level within the fundraising and due diligence course of. Chances are you’ll as effectively seize that specific bovine by its horns, get forward of the dialog and stick it entrance and heart on a slide.

The complete pitch deck

In order for you your individual pitch deck teardown featured on TC+, here’s more information. Additionally, take a look at all our Pitch Deck Teardowns and other pitching advice.

Source link