Economist predicts a ‘whopper’ of recession in 2023 — and that’s not essentially attributable to increased rates of interest

[ad_1]

Monetary markets buyers fear the U.S. is getting ready to an financial downturn as central bankers in Jackson Gap reaffirmed their willpower to boost rates of interest to carry inflation below management.

Steve Hanke, a professor of utilized economics at Johns Hopkins College, stated that he believes the U.S. is heading for a “whopper” of a recession subsequent 12 months, nevertheless it’s not essentially due to increased benchmark rates of interest.

“We can have a recession as a result of we’ve had 5 months of zero M2 development–cash provide development, and the Fed isn’t even taking a look at it,” Hanke stated in an interview with CNBC on Monday. “We’re going to have one whopper of a recession in 2023.”

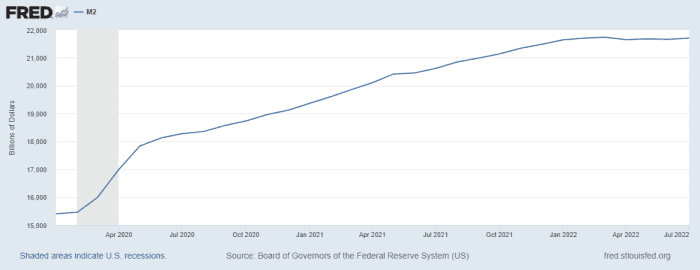

M2 is a measure of the cash provide that features money, checking and saving deposits, and shares in retail cash mutual funds. Broadly used as an indicator of the quantity of forex in circulation, the M2 measure has stagnated since February 2022, following “an unprecedented development of cash provide” beginning with the COVID-19 pandemic in February 2020. (See chart under)

“There had by no means been sustained inflation in world historical past – that’s inflation above 4% for about two years – that had not been the results of unprecedented development of cash provide, which we had beginning with COVID in February of 2020,” Hanke stated. “That’s the reason we’re having inflation now, and that’s why, by the best way, we are going to proceed to have inflation by 2023 going into in all probability 2024.”

SOURCE: BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM

U.S. inflation eased in July with the Shopper Worth Index growing 8.5% from a 12 months earlier, down from a 41-year excessive of 9.1% in June, elevating hopes {that a} surge in value degree could have peaked.

However based on Hanke, he predicted final 12 months that U.S. inflation can be someplace between 6% and 9% in 2022. “We hit the bullseye with that mannequin. Now the mannequin is working at between 6% and eight% on the finish of this 12 months on a year-over-year foundation, and 5% on the finish of 2023 going into 2024,” he instructed CNBC.

See: Fed likely needs to push interest rates above 3.5%, and hold them there until 2024, Williams says

Nevertheless, Chair Powell reaffirmed in his Jackson Hole speech final Friday that the central financial institution nonetheless plans to proceed elevating rates of interest to return inflation to their 2% goal, even when it ends in “some ache” for U.S. households and companies.

“The issue now we have is that the Chairman doesn’t perceive, even at this level, what the causes of inflation are and had been,” Hanke stated. “He’s nonetheless occurring about supply-side glitches. He has failed to inform us that inflation is all the time brought on by extra development within the cash provide, turning the printing presses on.”

Hanke is just not the one one predicting a a lot deeper financial downturn that might final into 2024. Stephen Roach, former chairman of Morgan Stanley Asia and former Federal Reserve economist, warns the U.S. wants a “miracle” to keep away from a recession.

“We’ll positively have a recession because the lagged impacts of this main financial tightening begin to kick in,” Roach told CNBC on Monday. “They haven’t kicked in in any respect proper now.”

Roach stated Chairman Powell has no selection however to take a Paul Volcker method to tightening. Volcker served because the twelfth chair of the Federal Reserve from 1979 to 1987. Throughout his tenure, Volcker aggressively hiked rates of interest and efficiently wrung inflation out of the economic system, however at an ideal value – tipping the economic system into two consecutive recessions with inventory market crashes and excessive unemployment.

“Return to the kind of ache Paul Volcker needed to impose on the U.S. economic system to ring out inflation. He needed to take the unemployment fee above 10%,” stated Roach.

See: Job openings climb to 11.2 million and show U.S. labor market still going strong

The unemployment rate was back to its pre-pandemic level in July and tied for the bottom since 1969. Nonfarm payrolls rose 528,000 in July, and the unemployment fee stood at 3.5%.

Nevertheless, markets await the August U.S. jobs report which is scheduled for launch on Friday. Wall Road estimates the nonfarm payroll will present the economic system including 318,000 jobs in August. The unemployment fee is projected to remain flat at 3.5%, whereas the typical hourly earnings are estimated to rise 0.4% following a 0.5% rise the earlier month.

See: Financial conditions show ‘cracks’ as stocks swoon and recession looms, warns Wells Fargo

U.S. stocks traded lower on Tuesday, extending a run of losses to a 3rd straight session. Dow Jones Industrial Common

DJIA,

slumped 230 factors, or 0.7%, to 31,860. The S&P 500

SPX,

misplaced 37 factors, or 0.9%, to three,993. The Nasdaq Composite

COMP,

declined 121 factors, or 1%, to 11,896. Three main indexes are on tempo to shut under their 50-day shifting common for the primary time since July 18, 2022, based on Dow Jones Market Knowledge.

Source link