[ad_1]

U.S. shares had been sliding on Monday amid fears the current rally was based mostly on a very optimistic view about how excessive the Federal Reserve would take rates of interest.

How are shares buying and selling

-

The S&P 500

SPX,

-1.79%

dipped 65 factors, or 1.6%, to 4,163 -

The Dow Jones Industrial Common

DJIA,

-1.50%

fell 441 factors, or 1.3%, to 33,265 -

The Nasdaq Composite

COMP,

-2.17%

shed 231 factors, or 1.8%, to 12,475

On Friday, the Dow Jones Industrial Common fell 292 factors, or 0.86%, to 33707, the S&P 500 declined 55 factors, or 1.29%, to 4228, and the Nasdaq Composite dropped 260 factors, or 2.01%, to 12705. The Nasdaq Composite is up 19.3% from its mid-June low however stays down 18.8% for the yr up to now.

What’s driving markets

Wall Avenue was on the right track for a consecutive day of chunky declines as buyers expressed wariness over a sequence of financial, technical and seasonal elements.

The benchmark S&P 500 had rallied sharply off its mid-June low, partly on hopes that indications of peak inflation would permit the Fed to gradual the tempo of rate of interest rises and even pivot to a dovish trajectory subsequent yr.

Nevertheless, that assumption has been challenged over the previous a number of days by a succession of Fed officers who, to the market’s thoughts at the least. appeared to be making a concerted effort to disabuse merchants of the much less hawkish narrative.

“Fed audio system continued to reiterate a ‘no matter it takes’ narrative to curb inflation,” famous Julian Emanuel, analyst at Evercore ISI, including that the Fed is more likely to keep its “resolutely hawkish tone” on the Jackson Gap Symposium that begins later this week.

Falling bond yields had helped equities of their current rally. However after dropping beneath 2.6% at the beginning of August, the 10-year yield

TMUBMUSD10Y,

is nearing 3% once more.

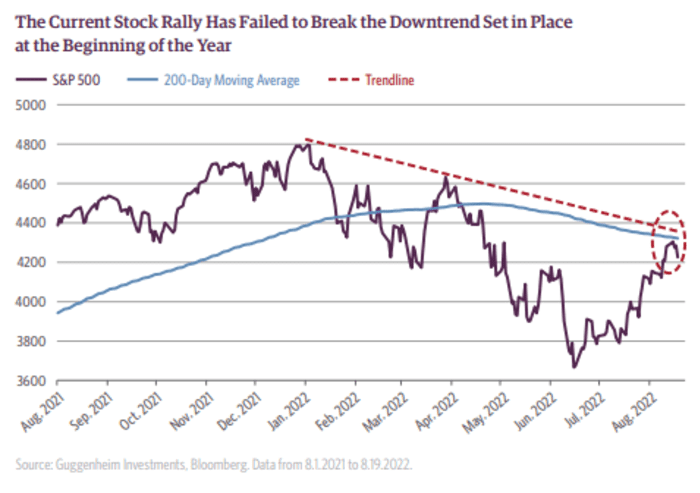

One other concern worrying the bulls is the S&P 500’s failure to interrupt by a key technical degree, elevating fears the market stays in a downtrend.

Supply: Guggenheim

“Shares have seen a powerful rally because the Federal Open Market Committee assembly in mid-June, however the S&P 500 has struggled to shut above its 200-day transferring common prior to now week,” mentioned analysts at Guggenheim in a be aware.

“Based mostly on the historical past of earlier bear markets, this degree (at present 4,320) is a crucial one to observe. A failure to interrupt the 200-day transferring common may portend a lot deeper losses for equities within the months forward.”

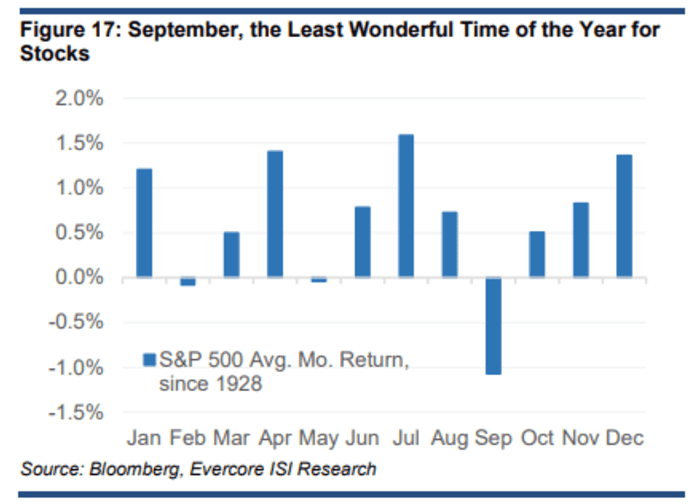

As well as, merchants are conscious that the market is getting into a interval of conventional weak point, with September typically a damaging month for shares, notes Evercore’s Emanuel.

Supply: Evercore ISI

Lastly, the greenback index

DXY,

is again to 20-year highs as worries in regards to the European economic system amid surging vitality costs pull the euro

EURUSD,

to parity with the buck. A robust greenback is related to weaker shares, because it erodes international earnings of American multinationals by making them price much less in U.S. greenback phrases.

Nonetheless, Lori Calvasina, fairness analyst at RBC Capital Markets, famous that some buyers thought “the summer season rally within the S&P 500 has left shares wanting costly once more” however she was extra sanguine in regards to the market’s prospects.

“S&P 500 P/E’s have moved barely above common on bottom-up consensus EPS forecasts, and look much more elevated on our personal EPS forecasts of $214 (2022) and $212 (2023),” she accepted.

“However even after we substitute in our personal EPS views to the P/E calculation, it’s price noting that multiples are nonetheless decently beneath the previous few main peaks. In our minds, whereas that is worrisome, it’s not adequate to name an imminent finish to the summer season rebound.”

How are different belongings faring

-

The ten-year Treasury yield

TMUBMUSD10Y,

2.997%

rose to 2.987%, whereas the yield on the 2-year Treasury

TMUBMUSD02Y,

3.271%

rose to three.289%. -

The general risk-off tone available in the market is impacting most asset lessons. Oil futures

CL.1,

-4.00%

had been decrease with U.S. crude down 2% to $89.01 a barrel. -

Gold futures

GCZ22,

-0.71%

GC00,

-0.71%

for December supply had been off $17.50, or 1%, to $1,744 per ounce on Comex, because the rising greenback and better Treasury yields continued to weigh on treasured metals. -

The ICE U.S. Greenback Index

DXY,

+0.51% ,

a gauge of the greenback’s energy towards a basket of rivals, was up 0.2% at 108.38, nearing a multi-decade excessive reached final month. -

Bitcoin

BTCUSD,

-1.24%

fell 1% to $21,296. -

In Europe, the Stoxx 600 fairness index

SXXP,

-1.01%

fell 1.2%, whereas the UK stock-market benchmark FTSE 100

Z00,

-0.15%

was down 0.4%. In Asia most bourses had been additionally decrease, although China’s Shanghai Composite

SHCOMP,

+0.61%

bucked the pattern with a 0.6% achieve after the central financial institution trimmed mortgage charges to assist the struggling property sector.

Source link