[ad_1]

“There are a long time the place nothing occurs; and there are weeks the place a long time occur.”

– Vladimir Ilyich Lenin

Lenin’s feedback definitely apply to the inconsistent, frenetic and manic market (down and up) motion of the final a number of months.

Whereas I believed that the transfer decrease out there in June supplied a very good entry level, based mostly upon our calculus of upside reward vs. draw back danger – the velocity and magnitude of the sturdy advance throughout the month of July shocked me.

Certainly, the swiftness and dimension of the rise in equities final month have not too long ago pushed the markets again to valuation ranges that concern me – lowering the overall attraction of equities and posing the danger of extra unfavorable outcomes for shares.

I now consider that danger property are in danger.

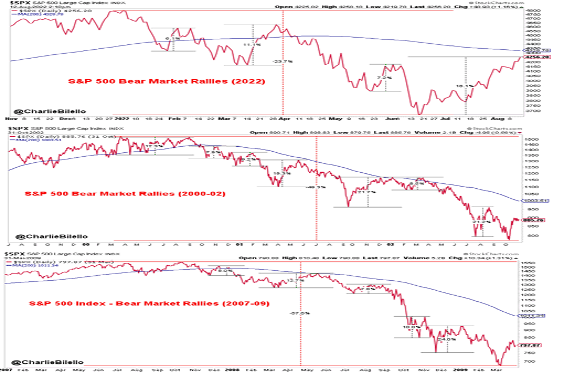

Here’s a comparability of the present rally versus the rallies within the 2000-02 and 2007-09 bear markets:

It needs to be clear that in observing the weird market volatility and frenetic weekly/month-to-month strikes that we aren’t in our father’s market – issues have modified as markets have grown more and more manic.

I’ll attempt to clarify how and why the market has modified and why a tactical/strategic flexibility and continued opportunistic buying and selling and investing applications are incumbent within the present market setting, as a way to ship engaging, risk-adjusted returns.

As I wrote in my Diary again in Could:

“Performing properly throughout this unsteady and uneven interval has required a versatile and opportunistic method, an understanding of the altering market construction, the implementation of danger controls and value self-discipline coupled with a premium on frequent sense, expertise and a way of funding historical past.

Surviving and even prospering in such a difficult market and quickly altering financial, social and political backdrops have positioned calls for on traders who’ve skilled a close to uninterrupted thirteen-year Bull Market since March 2009.

The times of shopping for thirty core investments and sitting again and watching their regular appreciation seems over – as the following a number of years would require far completely different ability units that succeeded within the final decade. With out the power and willingness to commerce and quick shares – one thing that many cash managers are restricted from or are usually not proficient in – could also be akin to investing with one hand behind one’s again. Whereas this may sound self-serving, a brand new regime of volatility, uncertainty and fewer regular (upwards) trending market circumstances are a perfect surroundings for supple and opportunistic hedge funds.”

Final Saturday I had I lunch with my outdated boss (I used to be briefly Omega’s Director of Analysis), iconic investor and longtime good friend and mentor, Omega Advisors’ Lee Cooperman. We’ve recognized one another for 4 a long time and I can testify that Lee is a considerate and optimistic individual and investor. As we speak he believes whereas U.S. shares could also be one of the best asset within the monetary asset neighborhood, he would not just like the neighborhood.

Listed here are among the ideas and pearls of knowledge that Lee communicated to me final week:

Lee is of the view that we face rising charges, that are too low given inflation, worse than anticipated inflation and better taxes.

Due to excessively stimulative fiscal and financial insurance policies inventory returns have borrowed from the longer term.

The absence of political cooperation holds coverage dangers.

Like me, Lee sees a risk from machine-driven adjustments in market construction.

Lee observes that whereas nominal income are presently doing properly, not a lot after adjusting for inflation. The underside line is that Lee sees S&P truthful worth at about 18x projected EPS of $230/share – which equates to about 4140. Nevertheless, if we get a recession subsequent 12 months, income can drop to $180/share, utilizing a 20x value earnings a number of yields 3600 on the S&P Index.

Looking additional in time – and that is vital – Lee sees the January S&P degree (of about 4800) not solely the excessive for the 12 months however he would not be shocked if it was a excessive for a number of years.

Final week, in an interview within the enterprise media, Lee cited the pharaoh’s dream as recounted within the bible and interpreted by Joseph. The dream was the seven fats years he skilled could be adopted by seven lien years. We’ve been by some of the speculative intervals in our funding lifetime – aided by zero rates of interest and 0 commissions. SPACs, could be FANGS with outlandish valuations and 0 earnings, and many others. It’s onerous for Lee to think about that we’ll be again to a bull market very quickly.

Table of Contents

Market Construction and Positioning

Market construction adjustments have been vital determinants to the provision and demand for equities over the past a number of years. Structural adjustments have had explicit affect upon quick time period (weekly/month-to-month) funding returns.

A decade in the past, lively investing, on the a part of hedge funds and different institutional traders, dominated the funding scene. Passive investing performed a restricted affect on markets. Since then, passive methods and merchandise have gained reputation and now account for the lion’s share of mixture buying and selling exercise.

Passive investing – quant methods like danger parity and alternate traded funds – are machine, and algorithm, pushed. They’re impassive and function at breakneck velocity. Passive investing worships on the altar of value momentum – they know every thing about value and little about worth. This helps to clarify why these systematic applications “purchase excessive and promote low.”

The affect of passive merchandise and techniques can’t be understated as they’ve develop into the tail that wags the funding canine.

It’s estimated that 80% of market quantity is quantitative and passive buying and selling. The opposite 20% of market quantity is lively buying and selling – principally hedge funds. They’re the marginal purchaser.

When value momentum shifts to the upside, because it did in early July, the 80% passive (quant methods, Et al.) observe costs larger and purchase.

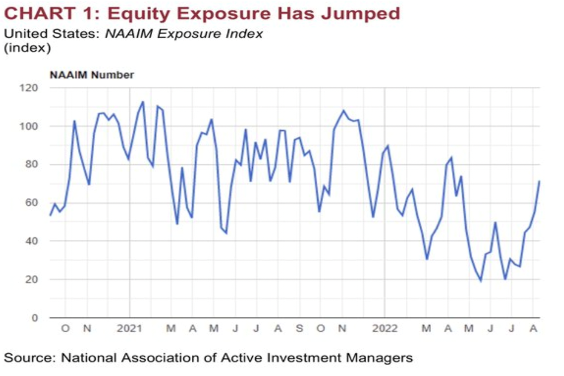

That different 20% of market quantity are hedge funds, asset managers and retail accounts. All three of those constituencies started July defensively positioned. Bear in mind the BOFA bull/bear indicator had fallen to ZERO 45 days in the past!

Positioning has additionally develop into an vital determinant to the path of inventory costs. And, as expressed, in our letter final month, positioning firstly of July was defensive and danger averse as many hedge funds degrossed and derisked.

As I’ve famous, nearly each good hedge hogger I do know was bearish on the finish of the primary half of 2022. Prior to now I’ve used Dan Loeb’s Third Level hedge fund as a proxy for the hedge fund neighborhood. Dan is one of the best of breed. In his investor letter he stated he was over 70% web lengthy at 2021-year finish, 40% web lengthy in April I consider, and in June a bit over 20% web lengthy.

Within the final two months we now have witnessed the twin affect of each passive and defensively positioned lively gamers shopping for. This has intensified over the past a number of weeks.

To summarize, whereas market construction and positioning normally would not have a long-term affect on equities, we realized over the past two months that it definitely can affect the short-term efficiency of shares.

Renewed Issues

July’s market power was the polar reverse of June’s weak spot. Markets skilled their strongest beneficial properties since November 2020.

Whereas I used to be rising extra optimistic, on a buying and selling foundation two months in the past, we didn’t anticipate the rally to be as swift and as violent to the upside.

To justify shopping for at at the moment’s costs signifies that one expects a brand new Bull Market leg – one thing I stay doubtful of.

To me, moreover low valuations, the proximate reason behind the July advance was the market’s interpretation that the Federal Reserve is on the trail of a “smooth pivot.” We’re of the view that market individuals have misinterpreted Fed Chairman Powell’s intentions:

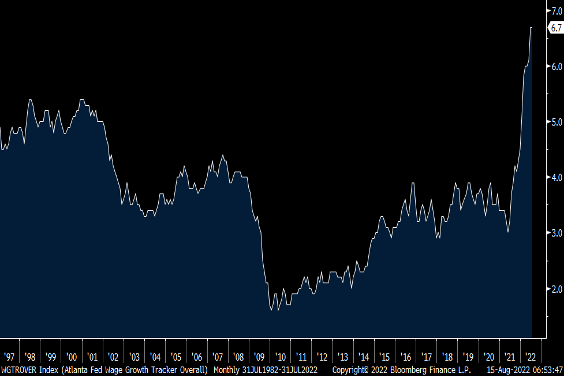

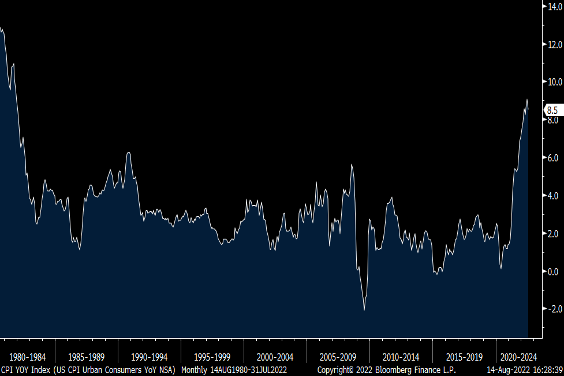

* Whereas I’ve been within the “Peak Inflation” camp, I believe inflationary pressures might be extra cussed than the consensus expects – in my base case of a “delicate and transient” financial assumption. Structural headwinds to decrease inflation stay – wages, rents and the worth of sturdy items.

Not too long ago, Peter Boockvar put a bit of math behind the argument that inflation is not going again to a sustainable 2% tempo or much less for some time.

To place this all into perspective, here’s a 25-year chart on Atlanta Wage Development:

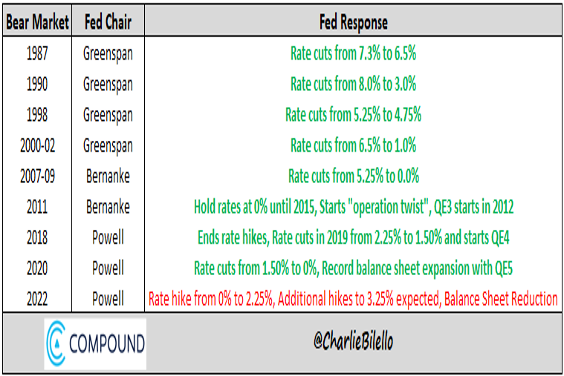

* The current easing of economic circumstances has run counter to the Fed’s possible path and, as seen over the past week, a number of Federal Reserve members have pushed again on the notion of a smooth pivot.

* I anticipate a continued hawkish Federal Reserve and, with equities elevated, there’s renewed market vulnerability. A serious distinction between at the moment and prior bear markets continues to be Fed coverage. In the course of the earlier eight bear markets the Fed responded with straightforward cash each time, with fee cuts and quantitative easing, and many others. This 12 months the Fed is doing the other – mountaineering charges and beginning to shrink their stability sheet. The final time we noticed a hawkish Fed was throughout the bear market of the early Eighties when Paul Volcker led the Federal Reserve:

In contrast to earlier cycles, if the economic system disappoints better than anticipated, the Fed doesn’t have the financial instruments to revive it. Nor do authorities have the fiscal instruments and suppleness.

* Non-U.S. financial prospects – particularly in China and EU – haven’t improved. The truth is, since we turned a bit extra constructive on the markets six to eight weeks in the past, the non-U.S. financial outlook has measurably deteriorated. Based mostly upon our analysis, China, particularly, possible faces the specter of decrease than anticipated Industrial Manufacturing, retail gross sales and stuck asset funding. Until China abandons its aggressive Zero Covid coverage, anticipated rate of interest and reserve requirement cuts are unlikely to reverse the area’s southerly financial vacation spot.

I’m skeptical that the U.S. could be an oasis of prosperity in an interconnected and flat financial world.

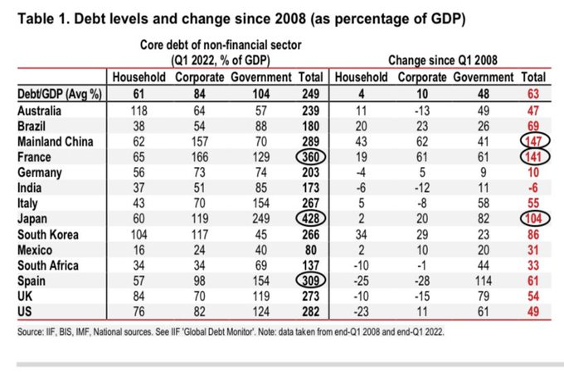

* As famous by Lee Cooperman, above, I stay involved in regards to the buildup of personal and public debt hundreds which act as a governor to progress:

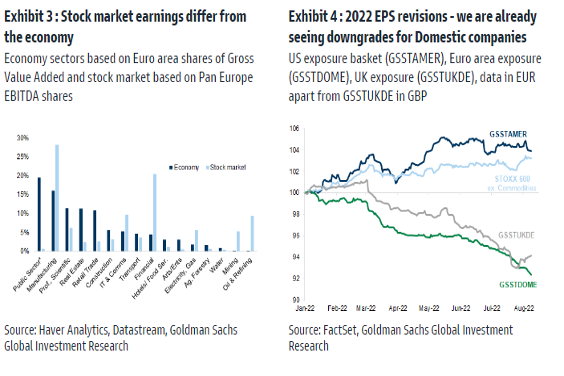

* The earnings season, although higher than many feared, has nonetheless not been good as ahead steering has disenchanted and has raised extra questions on potential developments in profitability:

Q2 2022 S&P income excluding the contribution of the strong beneficial properties within the vitality area, declined by 3.7%.

Consensus company revenue expectations are too elevated. Certainly, the tempo of the rise in enter prices will possible result in an earnings recession over the following few quarters. The PPI (Producer Worth Index) has now eclipsed the CPI (Client Worth Index) for 29 straight months. For example, final week’s PPI rose by +9.8% in comparison with “solely” +8.5% within the CPI. Enter prices are outpacing the power for firms to go on larger prices to the buyer:

PPI

CPI

Supply: Peter Boockvar

* Investor expectations and sentiment, so dour six weeks in the past, is now elevated. An oversold market in June has develop into overbought on each measure we have a look at as market power is being purchased. Brief positions are being aggressively coated and concern of the return of capital has rapidly morphed into the concern of lacking out (“FOMO”):

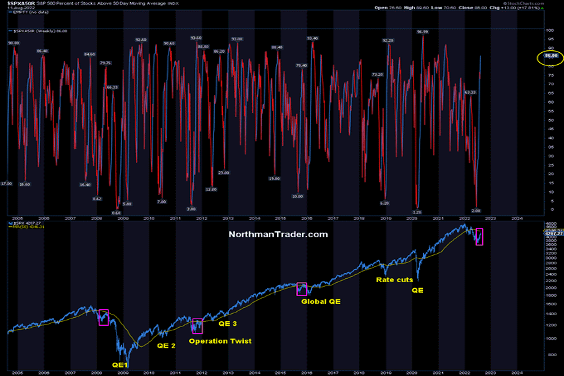

* Valuations have reset larger, rapidly reversing the earlier decrease valuation alternatives. In June solely 2% of the S&P Index parts traded above their every day 50 day transferring averages. We at the moment are again to 86% of the S&P Index above their transferring averages!

S&P Elements Buying and selling Above Their 50 Day Shifting Common

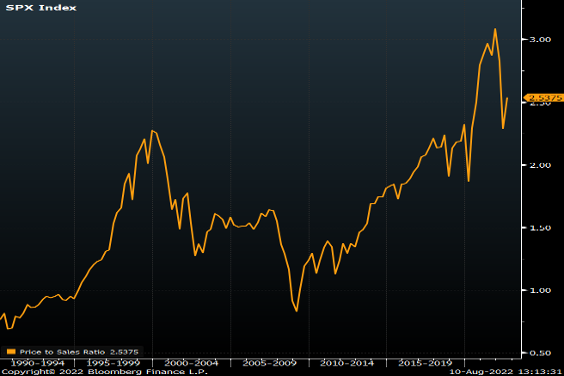

Right here is an up to date value to gross sales ratio of the S&P 500:

Supply: Peter Boockvar

Daring to Be Totally different

* I see myself as a contrarian with a calculator in hand.

I make investments by doing what we view as right and never essentially by doing what’s widespread or consensus.

Most traders discover it onerous to enterprise out within the herd.

My market view is rarely based mostly on value momentum – it’s all the time based mostly on our evaluation and within the calculus of upside reward vs. draw back danger.

Again in June I wrote in my Diary that “when the time comes to purchase, most traders will not need to.”

As we speak I write “when the time involves promote, most traders will not need to.”

One other good friend (and somebody, like Lee Cooperman who has importantly influenced me as a cash supervisor) Oaktree Administration’s Howard Marks, not too long ago wrote about how non consensus cash administration can result in superior funding returns, in his commentary, “I Beg To Differ”:

“In fact, it is not straightforward and clear-cut, however I believe it is the overall state of affairs. In case your habits and that of your managers is standard, you are prone to get standard outcomes — both good or dangerous. Provided that the habits is unconventional is your efficiency prone to be unconventional … and provided that the judgments are superior is your efficiency prone to be above common…. The consensus opinion of market individuals is baked into market costs. Thus, if traders lack perception that’s superior to the common of the individuals who make up the consensus, they need to anticipate common risk-adjusted efficiency.”

I purchased the June weak spot (when concern was pervasive and there gave the impression to be no backside for the market) and diminished our publicity into the heady transfer in July (when greed unexpectedly appeared and there gave the impression to be no high for the market).

Right here is an expanded discussion of non-consensus investing from Howard Marks.

Backside Line: Worth Is What You Pay, Worth Is What You Get

* Market construction and positioning have had quite a bit to do with the current market advance

* I now consider danger property are in danger

* In late July I light the emotional burst of shopping for and diminished our lengthy publicity

* Consensus revenue estimates stay inflated and inflation will possible be sticky

As mentioned in our current Bloomberg interview – on the 20 minutes, 50 seconds mark – the markets have benefited dramatically from defensively positioned institutional and retail communities’ bearish positioning since early June.

As shares have rallied, market construction has kicked in and passive merchandise and techniques which worship on the altar of value have purchased into the rally – arguably exaggerating the upside transfer. In the meantime, defensively positioned traders who had derisked and degrossed, who at the moment are afraid of lacking out (FOMO) have been compelled into the markets.

This has occurred although the Fed has pushed again from the notion of a smooth pivot and as Peak Inflation, which we had anticipated, was confirmed out by the CPI and PPI prints.

Recognizing that lengthy positions have traditionally generated wealth (and quick positions defend wealth!) I would like to purchase and maintain. However, as talked about on this month-to-month commentary, based mostly on the factitious, exaggerated and non-fundamental affect of market construction and positioning, market circumstances have swiftly moved to changing into much less engaging.

For my part, the accessible alternative set of six weeks in the past has possible come and gone and a heightened regime of volatility and market vulnerability could, once more, lie forward.

On a extra basic foundation we proceed to stay involved – as we did firstly of 2022 – in regards to the possible path of (hawkish) Fed coverage, rising valuations, weakening international financial progress and the rising vulnerability of U.S. company income (and margins).

On the later rating I’d word solely 57% of the businesses which have reported 2Q2022 outcomes have overwhelmed EPS and gross sales estimates (it was over 70% within the earlier quarter). Furthermore, one out of each 5 corporations have lowered steering.

To conclude, at the moment’s column is a actuality examine.

I’ve dramatically diminished my lengthy publicity and have reestablished a way more conservative portfolio building.

For the primary time shortly, I’m discovering interesting quick alternatives to enrich my lengthy holdings.

(This commentary initially appeared on Actual Cash Professional on August 16. Click here to find out about this dynamic market data service for lively merchants and to obtain Doug Kass’s Daily Diary and columns from Paul Price, Bret Jensen and others.)

Get an e mail alert every time I write an article for Actual Cash. Click on the “+Comply with” subsequent to my byline to this text.

[ad_2]Source link