[ad_1]

In a letter addressed to Disney chief government Bob Chapek in mid-August, activist hedge fund supervisor Dan Loeb mentioned a “robust case could be made” for the ESPN sports activities community to be spun off from the corporate.

Loeb, identified for waging bruising battles towards the likes of Sony and Sotheby’s, outlined his argument together with a bunch of different suggestions to enhance efficiency at Disney, together with a board “refresh”, taking full management of the Hulu streaming community and cost-cutting measures.

Lower than a month later, nonetheless, the aggressive supervisor of hedge fund Third Level reversed his position on spinning off Disney’s sports activities community after Chapek informed the Monetary Instances that he had a plan to “restore ESPN to its progress trajectory”. In a tweet, Loeb mentioned he had come to a “higher understanding of ESPN’s potential as a standalone enterprise”.

Loeb’s message got here as a aid to Disney and ESPN workers, however the episode has shone a lightweight on the deeper issues dealing with the sports activities community — and left traders questioning in regards to the particulars of Chapek’s plan to repair them.

“[Chapek] has received to elucidate to Wall Avenue how ESPN generally is a good enterprise,” mentioned Wealthy Greenfield, an analyst at LightShed Companions. “Cable networks are only a challenged enterprise. The issue is much less and fewer individuals are subscribing to [traditional] TV, and the sports activities prices maintain arising.”

Neither Disney nor Third Level would touch upon the matter, however each emphasised there was cordial dialogue between Loeb and Chapek.

As soon as Disney’s revenue engine because of its commanding share of cable subscribers, a gentle stream of affiliate charges and promoting income, ESPN has suffered within the streaming age.

Its subscriber base has fallen from a peak of 99.4mn in 2011 to a projected 73.6mn by the tip of this 12 months — a drop of greater than 25 per cent — in line with estimates by S&P World Market Intelligence.

Worse, its well-known cash-spinning capability is anticipated to shrink dramatically over the following three years, mentioned Scott Robson, senior analysis analyst at S&P World. He estimates money circulate will drop from about $2.5bn in 2021 to $1bn in 2025.

“All people is aware of that the . . . cable bundle is deteriorating over time,” Chapek informed a Goldman Sachs convention this week. “It’s nonetheless a big enterprise, very appreciative from a money circulate standpoint for us. However sooner or later, we see the writing on the wall the place that is going, and we’re getting ready for that.”

In addition to cord-cutting, ESPN is dealing with escalating prices of rights to broadcast sports activities — pushed partially by streaming services run by deep-pocketed Apple and Amazon. Disney expects to pay $10.3bn in contractual commitments for sports activities programming this 12 months, and an extra $60bn in future commitments.

“These sports activities rights are getting increasingly more costly,” Robson mentioned. “It’s actually going to start out negatively impacting the underside line at ESPN.”

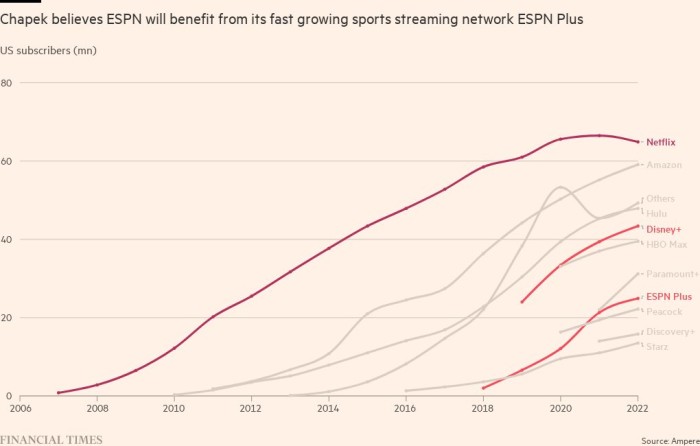

However Chapek informed the FT he believes ESPN can return to its progress. Essential to this will probably be extra aggressive advertising of ESPN Plus, its sports activities streaming community, as a part of a bundle with its different streaming platforms, Disney Plus and Hulu. ESPN Plus has about 22.8mn subscribers, or almost 10 per cent of Disney’s 221mn streaming subscribers.

Chapek famous the enduring energy of sports activities to draw massive audiences, even in an age of viewers fragmentation. He additionally believes ESPN can turn out to be a power within the quickly increasing US sports-betting trade — a step that earlier generations of Disney leaders would have thought too racy for the family-friendly firm.

Disney acquired a 5 per cent stake in DraftKings, a fantasy sports activities and betting group, in 2019 when it purchased twenty first Century Fox. It additionally has a cope with Caesars Leisure that provides it the unique proper to supply sports activities betting odds to ESPN. Chapek has even floated the concept of launching an ESPN-branded sports activities betting app, although the corporate has not began work on this, insiders say.

In his letter, Loeb mentioned it will be simpler for ESPN to pursue sports activities betting outdoors of Disney. He additionally mentioned a spin-off would assist cut back Disney’s debt, which stood at $46bn on the finish of the newest quarter.

However Loeb’s proposal to spin off ESPN divided Wall Avenue analysts. Greenfield at LightShed Companions helps the concept, however analysts at MoffettNathanson wrote final month that it will be “financially harmful to divest ESPN”. Not solely are Disney’s revenues reliant on ESPN’s money, they wrote, however traders aren’t eager on a leveraged asset whose main enterprise is cable tv within the period of twine reducing.

Furthermore, latest sports activities rights offers present the ever-appreciating worth of stay occasions. Disney rival Paramount final month greater than doubled the worth it can pay Uefa for US rights to broadcast the Champions League, now worth $1.5bn over six years.

Apple has reached multibillion-dollar agreements to air Main League Soccer and Main League Baseball, whereas Amazon final 12 months joined the most expensive package of stay sports activities rights ever offered: the Nationwide Soccer League’s $110bn broadcast phrases over 11 years.

Inside ESPN, executives argue that the community is healthier served with the advertising may of the remainder of the Disney firm, which incorporates the ABC broadcast community. They level to the seven-year deal ESPN signed final 12 months with the Nationwide Hockey League permitting it to point out video games on the ESPN cable community, ESPN Plus, the Hulu streaming service and ABC. The same 12-year plan was signed not too long ago for the rights to the Wimbledon tennis championships.

Even with the headwinds dealing with its core cable tv enterprise, Chapek mentioned Disney had been “deluged” with curiosity from corporations in search of to purchase ESPN or take part a spin-off after experiences that the corporate was weighing a sale earlier this 12 months. “If everybody needs to come back in and purchase it . . . I believe that claims one thing about its potential,” Chapek mentioned.

He added: “When the remainder of the world is aware of what our plans are, they are going to be as assured about that proposition as we’re.”

Loeb seems glad to attend for Chapek’s plan — no less than for now.

Source link