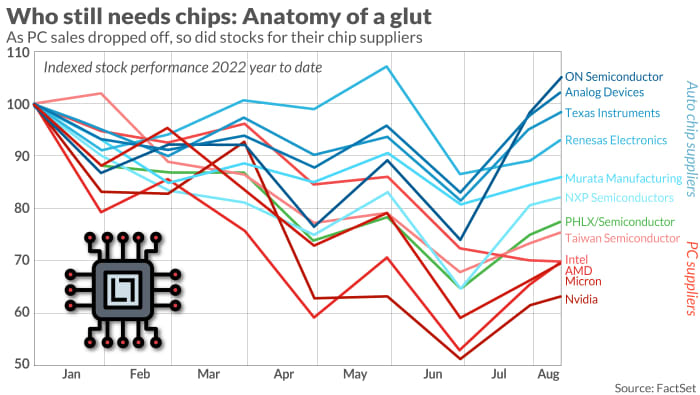

Chip shares tanked as pandemic demand for electronics slumped, however there are nonetheless some winners

[ad_1]

After two years of unprecedented chip gross sales and demand associated to the COVID-19 pandemic, a long-feared reversal has struck the semiconductor business, however some markets are nonetheless performing strongly — for now.

Wall Street analysts have been expecting a turnaround in the chip sector for months. And as pandemic-era shortages eased and clients notice they ordered too many semiconductors within the frantic rush of the chip crunch, shares cratered. To date, although, the downturn proven in earnings stories has been targeted on chips meant for client electronics, reminiscent of private computer systems and smartphones, which have seen an identical sharp downturn in demand because the pandemic stretches by means of its third 12 months.

Bernstein analyst Stacy Rasgon instructed MarketWatch in an interview that “the patron aspect of issues appears to sort of type of be in a recession.”

“Intel’s PC stuff imploded. Nvidia, adverse preview the opposite day, their GPUs have imploded. Reminiscence has been horrendous. Something that’s consumer-focused has been dangerous: PCs, smartphones, GPUs, TVs,” Rasgon instructed MarketWatch, including that it’ll not be a short-term drawback — “Issues are getting weaker they usually don’t normally get weaker for one quarter.”

“There was quite a lot of accelerated demand, and now, greatest case, it’s normalizing, type of like reversion to the imply,” he stated.

Learn additionally: What’s the best way to invest in tech stocks right now? This strategy is working well for one fund manager

Demand just isn’t falling off — but — in a few scorching sectors, nevertheless. The auto and industrial companies notably seem to nonetheless have power, and it exhibits up within the respective inventory efficiency of chip corporations targeted on these sectors.

MarketWatch/FactSet

Texas Devices Inc.

TXN,

which has a giant presence in auto chip gross sales, reported an outlook that topped Wall Street estimates at the time. Different U.S. suppliers to the auto business embody Analog Units Inc.

ADI,

and ON Semiconductor Corp.

ON,

, whereas exterior the U.S., large names embody Netherlands-based NXP Semiconductors NV

NXPI,

Japan’s Renesas Electronics Corp.

6723,

and Murata Manufacturing Co.

6981,

and Germany’s Infineon Applied sciences AG

IFX,

“The demand for auto chips is robust with a backlog that can maintain for at the very least the subsequent 12 months, making chip shares a safer port within the coming financial storm,” Maribel Lopez, principal analyst at Lopez Analysis, instructed MarketWatch.

“There will likely be a coming hunch, however there’s at the moment pent-up auto demand,” Lopez stated. “What I anticipate to see occur is sellers gained’t have the ability to cost above [the suggested retail price] as demand wanes.”

Whereas these chips are nonetheless promoting strongly, essentially the most worrisome improvement this earnings season might be a softening in data-center progress, a giant purpose for the thrill about Nvidia and Superior Micro Units Inc.

AMD,

in recent times. Living proof: Whereas Intel fell in need of Wall Road expectations for data-center gross sales by about $1.5 billion, AMD picked up an extra $700 million in data-center gross sales it didn’t have within the year-ago quarter. Now, Nvidia’s data-center progress is seeking to be underwhelming.

Intel was “overshipping by a large quantity,” Rasgon instructed MarketWatch. “I’ve been making that time for over a 12 months. That’s now biting them. And now they’re calling out some fairly important channel stock corrections.”

Intel is blaming supply-chain points, principally saying that producers can’t construct as many servers as a result of they will’t discover different parts, reminiscent of energy provide elements, however Intel’s points might simply come all the way down to competitors as effectively, Rasgon stated. Whereas different executives additionally point out the identical points as Intel of their earnings stories, “they’re not getting nailed practically as a lot,” the analyst stated.

“I don’t know if these provide chain points clarify Intel’s miss,” stated Rasgon, who has buy-grade rankings on AMD and Nvidia and a sell-grade score on Intel.

For extra: Which Intel CEO is to blame for the current woes? Or is it actually AMD’s CEO?

That’s why Nvidia’s earnings, due on Aug. 24, are so vital, particularly the forecast for data-center gross sales and any shade on supply-chain points. Whereas chip shares have already taken a beating this 12 months — the PHLX Semiconductor Index

SOX,

has fallen 23% in 2022, effectively forward of the 16% decline for the tech-heavy Nasdaq Composite Index

COMP,

— most are nonetheless costlier than analysts’ common value targets.

| Chips (so as of market cap) | year-to-date % | +/- % common Road goal vs present value | % acquire in pandemic (since 3/11/2020) |

| S&P 500 | -10% | — | +57% |

| SOX index | -23% | +17% | +97% |

| Nvidia | -36% | +20% | +209% |

| TSMC | -25% | +26% | +75% |

| ASML | -29% | +11% | +118% |

| Broadcom | -17% | +23% | +127% |

| Intel | -30% | +7% | +30% |

| Qualcomm | -18% | +23% | +104% |

| AMD | -30% | +21% | +121% |

| Texas Devices | -3% | -2% | +74% |

| Utilized Supplies | -31% | +23% | +109% |

| Micron | -31% | +18% | +48% |

There’s little hope that client developments will flip round quickly, even with back-to-school procuring and vacation gross sales nonetheless to return. The start of the tip for PC gross sales was evident when analysts estimated the worst quarterly unit sales drop in years, and demand from companies is predicted to say no much more.

“There’s an expectation that the underside will fall out of the PC market this 12 months as corporations pull again on spending,” Lopez stated. “There’s nonetheless some client demand, however we anticipate that to wane by Q1.”

Learn: Are chip stocks set up for a short squeeze, or just more declines? Wall Street doesn’t seem sure

The broader chip market has taken a giant step ahead in recent times, although, and isn’t anticipated to shrink considerably within the present pullback. In 2021, world semiconductor sales topped a record $556 billion, a 26% acquire from 2020’s $440 billion and topping the 2018 sales record of $469 billion, and the variety of complete items shipped in a 12 months topped 1 trillion for the primary time.

Rasgon stated that even when the sector hits a correction as it’s now, it nonetheless grows.

“We will nonetheless do one thing within the ballpark of $600 billion this 12 months,” Rasgon stated. “We would nonetheless be over $500 billion subsequent 12 months even in a reasonably stable downturn. The purpose I’m making is: Over the cycle, the business grows. And any capability they’re including now, in 5 years, we’ll in all probability be glad they added it.”

Associated: Here’s the big concern with chip makers scoring billions in funds from Uncle Sam

“Normally we’re not in peril of chip demand falling off a cliff as a result of every little thing is turning into related and clever,” Lopez instructed MarketWatch.

Source link