Invoice Ackman says fast-food chains are an inflationary defend. Here is two he likes, and one he simply offered.

[ad_1]

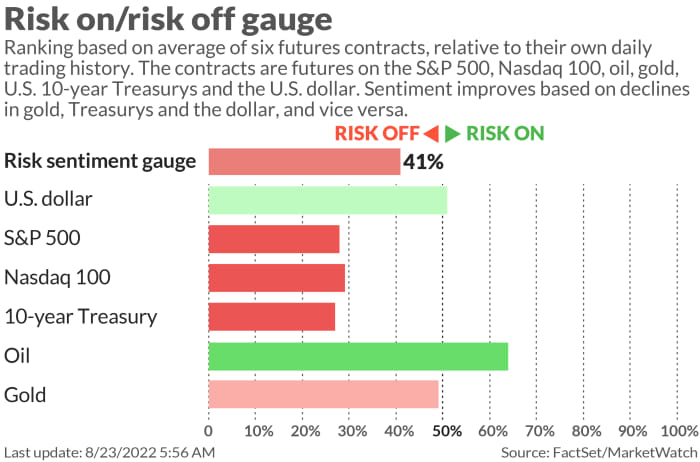

A cautious session is forward for Tuesday, following the worst smackdown since June for main indexes.

That’s as an rising variety of buyers see the Fed pivoting from charge hikes to be a tall order within the face of stubbornly excessive inflation and a world progress mess. We’ll discover out Friday when Fed Chairman Jerome Powell steps as much as the mic on the luxurious Jackson Lake Lodge in Wyoming on Friday.

Our name of the day from billionaire hedge-fund supervisor Invoice Ackman makes the case that sure U.S. fast-food chains can stand up to the warmth from inflationary pressures, as detailed within the semiannual letter for the European listed portfolio, Pershing Sq. Holdings

PSH,

Whereas not a conventional hedge fund like Ackman’s Pershing Sq., PSH continues to be managed in that vein. The closed-end fund has whittled a 26% loss on the finish of June right down to 11% in mid-August.

Cushioning a tough yr has been the portfolio’s heavy publicity to rate of interest swaptions, an choice on an rate of interest swap that bets on greater charges and hedges in opposition to world macro threat. Taking to Twitter last month, Ackman stated inflation stays the most important threat to the economic system and the Fed should keep its resolve on greater charges.

As for these firm bets, Pershing mentioned its stake in Restaurant Manufacturers

QSR,

proprietor of Burger King, Tim Hortons and Popeyes. These chains have seen comparable gross sales up 20% relative to pre-COVID ranges, and QSR stepping up with the money to “place them for long-term, sustainable progress.”

However the firm can continue to grow companies with minimal capital required its franchisees open new models. “QSR’s franchised-based royalty mannequin is especially engaging in an inflationary atmosphere. QSR’s revenues profit when its franchisees improve costs, however its value construction is just not topic to the identical inflationary pressures,” stated Pershing.

And owing to enhancing same-store gross sales progress and with sturdy unit progress, “QSR’s earnings are actually larger than previous to COVID and are rising at a sexy charge, despite important industry-level inflation and same-store gross sales which might be simply now recovering to pre-COVID ranges.”

The opposite choose is burrito king Chipotle Mexican Grill

CMG,

which “continued its spectacular efficiency in 2022 pushed by the continued restoration of in-restaurant gross sales, worth will increase to cowl value inflation, and profitable menu innovation together with pollo asado,” stated Pershing.

“We consider Chipotle is likely one of the best-positioned shopper firms for the present inflationary world,” stated the fund, noting that administration lifted August menu costs 4% to account for rising meals and labor prices, repeating a step taken in March.

“The corporate has large pricing energy because of the very good high quality of its meals

which is priced at a reduction to many rivals with inferior choices, advertising centered on meals high quality and freshness somewhat than value, and a buyer base that over-indexes to higher-income shoppers, a few of whom are buying and selling down from pricier options,” stated Pershing.

As for what isn’t working? Pershing bowed out of its stake in Domino’s Pizza

DPZ,

owing to “comparatively excessive valuation within the context of a unstable market atmosphere.” A sufferer of its personal success, Domino’s “significant enchancment” has been a driver for shares and valuation — greater than 28 instances Pershing’s estimate of subsequent 12 months’ earnings.

Table of Contents

The markets

Inventory futures

ES00,

NQ00,

are inching greater, whereas bond yields

TMUBMUSD10Y,

TMUBMUSD02Y,

are regular, the greenback

DXY,

is barely decrease and oil costs

CL.1,

BRN00,

are bouncing again. Additionally watch U.S. natural-gas futures

NG00,

which tapped $10 per million British thermal models, a contemporary 14-year excessive.

Learn: Beware of a ‘bear trap’ retreat in stocks after the big summer rally, strategists warn

The thrill

Macy’s

M,

shares are greater after earnings top estimates, although the corporate lowered steering. U.S.-listed shares of JD.com

JD,

are rising on an earnings beat. Medtronic

MDT,

additionally delivered an earnings beat. Nordstrom

JWN,

and City Outfitters

URBN,

outcomes are nonetheless forward.

Zoom

ZM,

shares are down after the web videoconferencing group cut earnings and revenue guidance. Palo Alto Networks

PANW,

inventory is surging on a strong outlook.

The U.S. manufacturing and providers buying managers indexes are due at 9:45 a.m. Jap, adopted by new dwelling gross sales at 10 a.m.

The federal government reportedly retrieved greater than 300 categorized paperwork from former President Donald Trump Mar-a-Lago home this year.

Better of the online

Standing between the world and a nuclear calamity are about 100 Ukrainian workers

In drought-stricke California, some of Hollywood’s biggest stars accused of water waste.

Some predict U.K. inflation could rise 19%. Could the U.S. see a similar fate?

Ex-Twitter exec blows the whistle on the company’s cybersecurity

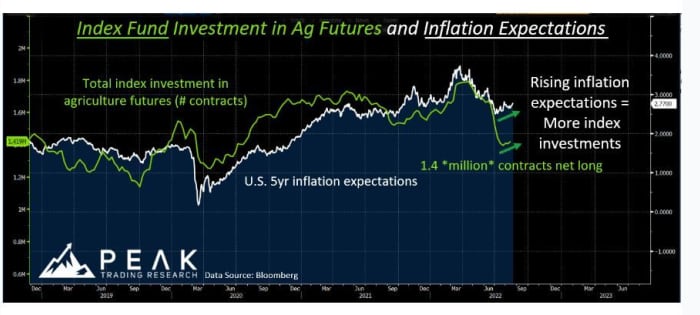

The chart

Bond markets are actually leaning towards a 75 basis-point hike on the Fed’s Sept. 21 assembly, and agriculture buyers want to concentrate. “This uptick in inflation expectations issues as a result of Index Funds – the WHALES in agriculture markets – monitor inflation metrics carefully. When inflation rises, index funds purchase,” Peak Buying and selling Analysis tells purchasers in a word.

Peak Buying and selling/Bloomberg information

The tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m. Jap Time:

| Ticker | Safety title |

|

AMC, | AMC Leisure |

|

BBBY, | Mattress Bathtub & Past |

|

TSLA, | Tesla |

|

APE, | AMC Most popular Fairness Items |

|

GME, | GameStop |

|

AAPL, | Apple |

|

GCT, | Gigacloud |

|

NIO, | NIO |

|

XPEV, | XPeng |

|

AMZN, | Amazon |

Random reads

8-year previous stumbles onto prehistoric dinosaur tooth.

Have to Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your electronic mail field. The emailed model can be despatched out at about 7:30 a.m. Jap.

Source link