This superbull at JPMorgan who known as the summer season rally sees a comfortable touchdown forward. This is his recommendation on shares and oil.

[ad_1]

A fifth-straight win was taken off the desk after August CPI numbers shocked on the upside.

And it appears to be like like there’s nothing to sway the Fed from a 75-basis-point hike this month. Nonetheless, when it does seem like CPI is peaking, our chart of the day under has some excellent news for traders.

Onto our name of the day, which comes from one in all Wall Avenue’s staunchest bulls, JPMorgan’s Marko Kolanovic, who’s betting on a comfortable touchdown for the worldwide financial system. The chief market strategist was spot on with a name for shares to rally this summer season, and was heard final month telling investors to hang on, as the gains aren’t over.

For starters, traders must belief the information extra and obsess over central banks much less, he says.

“We preserve that financial knowledge and investor positioning are extra essential elements for dangerous asset efficiency than central financial institution rhetoric. And the information seem like more and more supportive of a comfortable touchdown (quite than international recession), given moderating inflation and wage pressures, rebounding progress indicators, and stabilizing client confidence,” Kolanovic instructed shoppers in a brand new word.

He sees a world recession as avoidable owing to expectations China and Europe will assist their needy economies. Low investor positioning and sentiment must also “proceed to supply tailwinds for dangerous property, regardless of the extra hawkish central financial institution rhetoric lately.”

Amongst these property, JPM is preserving an “aggressive chubby” in commodities and commodity-sensitive property, attributable to a supercycle thesis and to hedge for inflation and geopolitical dangers.

Kolanovic suggests shopping for the dip on vitality as there is no such thing as a resolution to Europe’s present disaster in sight and markets are but to cost in weaker prospects for an Iran nuclear deal or G-7 progress on Russian oil value caps.

He’s additionally staying bullish on equities, particularly cyclicals, small-caps and EM/China over costly defensives.

In contrast to vitality, “defensive industries have outperformed on a number of enlargement and are buying and selling at close to document premium vs. the market,” mentioned the strategist who provides that central financial institution tightening and labor resiliency could preserve charges greater for longer, capping multiples for long-duration progress and tech.

Midterms are additionally weighing into the financial institution’s equation for riskier property. “Given the lag it takes for price hikes to work by the system, and with only one month earlier than essential US elections, we imagine it could be a mistake for the Fed to extend danger of a hawkish coverage error and endanger market stability,” mentioned Kolanovic.

Table of Contents

The markets

Submit knowledge, stock futures

ES00,

NQ00,

are sliding, together with Treasury yields

TMUBMUSD10Y,

TMUBMUSD02Y,

and the greenback

DXY,

Oil costs

CL.1,

are up as gold costs

GC00,

additionally slide.

The excitement

Ouch. September CPI rose 0.1% on the month, above expectations, whereas core CPI — stripping out meals and vitality— climbed 0.6%. On an annual foundation CPI slowed to eight.3% from 8.5%. Forward of that, the newest small-business sentiment index showed a rise in confidence. The Federal price range is due later.

Oracle

ORCL,

disillusioned on earnings and its revenue forecast, due to a stronger greenback. The inventory is up slghtly.

Peloton

PTON,

inventory is down after co-founders John Foley and Hisao Kushi mentioned they are stepping down.

HBO had a giant night time on the Emmy’s sweeping previous Netflix

NFLX,

with big awards for “Succession” and “Euphoria.” In the meantime, interest has been high in Netflix’s “The Crown,” for the reason that dying of Queen Elizabeth II.

Twitter

TWTR,

shareholders are reportedly expected to approve the $44 billion takeover that Tesla’s

TSLA,

Elon Musk has been making an attempt to ditch in a gathering early Tuesday. The destiny of the deal, although, might find yourself in court. And a Twitter whistleblower will testify to Congress.

A Russian unit designed as a front-line protection towards a NATO assault has apparently been badly damaged within the newest Ukraine advance.

Better of the net

An easy daily habit to prevent dementia.

Escaping poverty, one generation at a time.

The chart

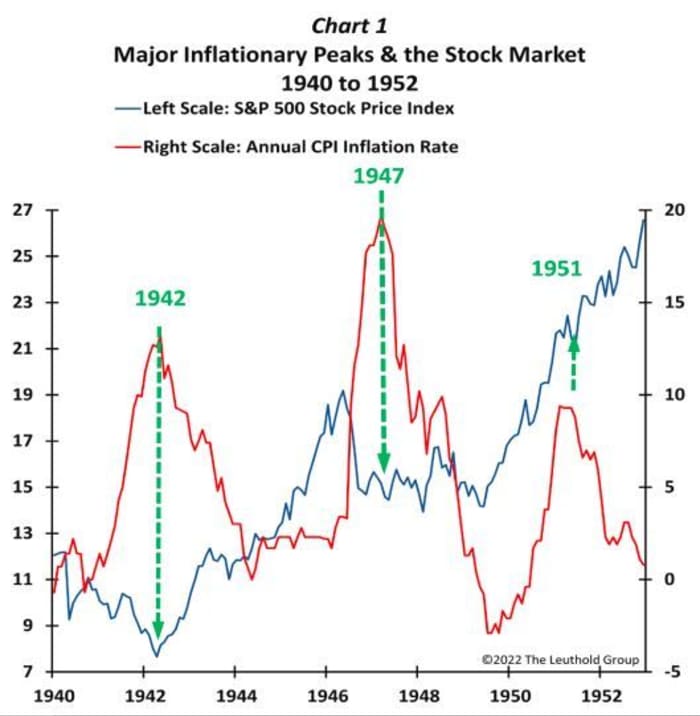

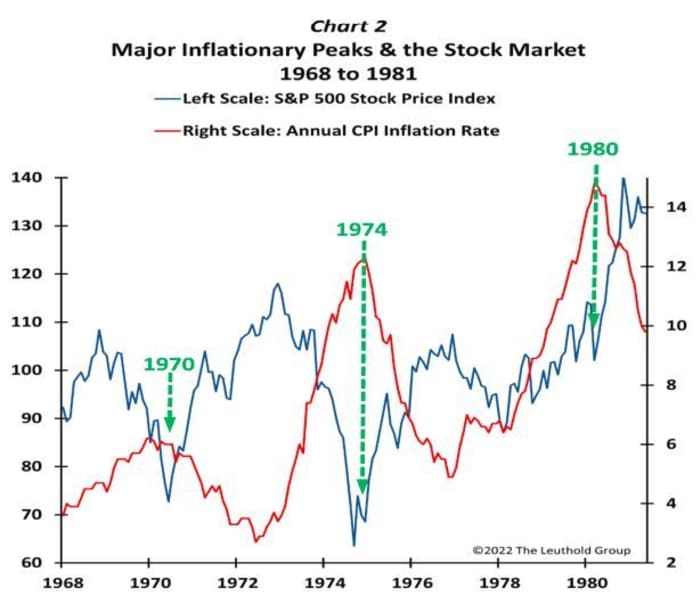

In 5 of seven historic inflationary surges, “the S&P 500 both bottomed coincident with or upfront of the final word inflation peak,” says Jim Paulson, chief funding strategist of The Leuthold Group.

Leuthold Group

Among the many exceptions, in a single occasion the inventory market moved sideways for months after that peak, although didn’t see massive strikes decrease. And in 1970, shares moved south even after that inflation excessive, although downswing was transient and the S&P 500 absolutely recovered after a couple of months, notes the strategist.

Leuthold Group

The tickers

These had been the highest searched tickers on MarketWatch as of 6 a.m. Japanese Time:

| Ticker | Safety title |

|

TSLA, | Tesla |

|

GME, | GameStop |

|

AMC, | AMC Leisure |

|

BBBY, | Mattress Bathtub & Past |

|

NIO, | NIO |

|

APE, | AMC Leisure most popular shares |

|

AAPL, | Apple |

|

NOK, | Nokia |

|

CHPT, | Chargepoint |

|

AMZN, | Amazon |

Random reads

Coffee vigilantes come to the aid of Goldman staff.

Another mysterious death hits Russian Pres. Vladimir Putin’s inside circle.

Must Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your e mail field. The emailed model will probably be despatched out at about 7:30 a.m. Japanese.

Source link