[ad_1]

The diktat got here from Jamie Dimon throughout a closed-door assembly at JPMorgan Chase’s headquarters in November. Dealing with rising stress from nimbler fintechs, the chief government of the most important US financial institution pushed the leaders of his two largest divisions to place apart any variations and collaborate on a brand new funds processing system.

“If I hear that any of you aren’t sharing data with one another, otherwise you’re hiding data, you’re fired,” Dimon instructed the 15 or so executives who had gathered for the assembly in New York, in keeping with two individuals with information of the remarks.

Dimon’s pronouncement was delivered in his regular wisecracking type, however it mirrored the challenges large banks face as they attempt to modernise their expertise.

The brand new system being developed by JPMorgan’s company and funding financial institution — the CIB — would allow retailers to obtain funds instantly from customers, slicing out the necessity for debit or bank cards and posing a menace to the profitable charges earned by banks and dominant card firms Visa and Mastercard.

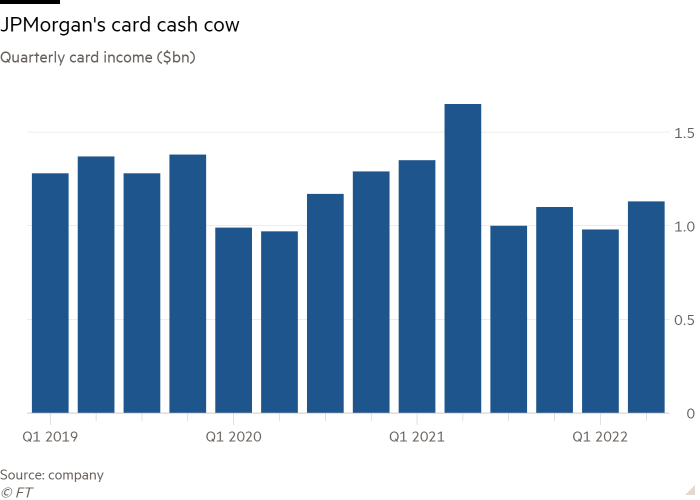

The assumption in some components of the CIB that this “pay-by-bank” product had the potential to supplant plastic created inevitable tensions with JPMorgan’s client and group banking division — the CCB — which booked greater than $5bn in card revenues in 2021.

Dimon, nevertheless, reckoned it was higher to threat present income than to permit non-bank rivals to beat JPMorgan to the punch.

It had occurred earlier than: Dimon has mentioned JPMorgan ought to have constructed its personal cellular funds platform for retailers earlier than Sq., the fintech firm co-founded by Jack Dorsey and now renamed Block.

“Jamie needs to grasp merchandise that could possibly be threats to banking establishments,” mentioned one particular person conversant in the challenge. “If [pay-by-bank] goes to be broadly adopted, the financial institution must be there. If long-term it fails, it’s a little bit of an insurance coverage coverage.”

Dialogue on the six-hour occasion final November centered on how the numerous highly effective inside curiosity teams inside JPMorgan would divvy up the pay-by-bank challenge. Executives in attendance included Daniel Pinto, the financial institution’s president and CIB head, in addition to Marianne Lake and Jennifer Piepszak, who had just lately been promoted to co-run the CCB, changing the extra highly effective Gordon Smith in 2021.

Pinto and Smith had given the looks of partaking in a pleasant rivalry, joking at firm occasions that their division was the financial institution’s largest, whereas citing completely different metrics. The 2 additionally quickly led the financial institution in 2020 after Dimon underwent emergency heart surgery.

When Smith left JPMorgan, Pinto turned sole president. Whereas Smith had been on stage footing with Pinto, Lake and Piepszak didn’t have the identical title.

The rising sport plan was to have the CIB take care of the expertise and construct relationships with retailers, whereas the CCB labored to make clear buyer protections within the occasion of misuse or fraud.

JPMorgan declined to touch upon what occurred on the assembly, which additionally touched on different funds tasks on the financial institution.

Takis Georgakopoulos, JPMorgan’s world head of funds for CIB, mentioned the financial institution had spent “an excessive amount of time” engaged on pay-by-bank via speaking to retailers and understanding client protections.

“The connection between the CCB and CIB is as shut because it’s ever been. Everyone knows that innovation in funds is likely one of the agency’s best alternatives and we’re dedicated to it,” Georgakopoulos instructed the Monetary Occasions.

JPMorgan’s transfer into pay-by-bank responded to demand from retailers, resembling Amazon and Walmart, chafing at banks and card firms hoovering up interchange charges that common 1.8 per cent per transaction within the US, in keeping with funds consultancy agency CMSPI. Within the EU, interchange charges are capped at 0.3 per cent for bank card funds and 0.2 per cent for debit playing cards.

Skimming a bit of bit from each card swipe provides up. In 2020, retailers within the US paid about $110bn in processing charges for $7.6tn price of card transactions, in keeping with the Nilson Report.

Pay-by-bank, which might allow sellers to take fee instantly from a buyer’s checking account, is a part of the rising motion in the direction of “open banking” — securely permitting customers to present monetary suppliers the flexibility to entry their monetary data.

JPMorgan already permits account holders to immediately pay each other via Zelle, a cellular software launched by the biggest US banks in 2017. Nonetheless, Zelle’s use for retail funds stays extraordinarily restricted. Bankers have mentioned that is partly as a result of it’s run by a separate firm owned by a consortium of lenders.

Financial institution switch funds have caught on in international locations such because the Netherlands and India, however US customers have been slower to take it up.

That is partly due to the nation’s clunky bank-to-bank automated clearing home, a community that settles funds in days somewhat than seconds and whose roots hint again to the Nineteen Seventies. This may increasingly change subsequent 12 months with the US Federal Reserve aiming to launch FedNow, a brand new fast funds service for large banks, and is one more reason why JPMorgan is transferring on pay-by-bank.

Within the brief time period, JPMorgan believes pay-by-bank is an alternate for hire and invoice funds in addition to money, high-priced debit and cheques, somewhat than for bank cards, in keeping with individuals concerned within the challenge.

In the long term, nevertheless, the financial institution is ensuring it’s prepared for the potential demise of bank cards.

JPMorgan shouldn’t be the primary to try to disrupt the credit score card trade. In 2012, a consortium of main US chains, together with Walmart, Goal and Greatest Purchase, tried and didn’t get a product previous a trial stage earlier than promoting it to JPMorgan in 2017.

Executives on the large card firms privately stay sceptical that pay-by-bank will dislodge bank cards within the US anytime quickly, given deeply ingrained client habits, beneficiant reward programmes and fraud protections which can be extra clearly outlined than competing fee choices.

However regardless of their confidence, card firms have taken steps to bolster their potential to facilitate direct transactions, together with the current acquisitions of fintechs Tink and Finicity by Visa and Mastercard respectively.

And banks resembling JPMorgan — lengthy incentivised to take care of the established order since they accrue the majority of interchange charges from card funds — are hedging their bets too, hoping pay-by-bank can substitute at the least a few of these threatened revenues.

That’s the reason Dimon stepped in and urged his groups to push previous the tensions and pre-empt any disruption.

JPMorgan is now aiming to take pay-by-bank reside subsequent 12 months and is in talks with at the least one fintech firm over a partnership to supply infrastructure assist, in keeping with individuals briefed on the plans.

The CIB and CCB are nonetheless collaborating on the challenge. In July, the financial institution held a “Senior Leaders Funds Offsite” the place round 40 senior executives from the 2 divisions gathered on the posh Cipriani restaurant in Manhattan.

This time, Dimon didn’t really feel the necessity to flip up, not to mention problem any warnings.

Source link