‘Buyers Ought to Take into account Defensive Equities,’ Says JPMorgan; Right here Are 2 Excessive-Yield Dividend Names to Take into account

[ad_1]

Markets are up in latest periods, and year-to-date losses have moderated considerably. The NASDAQ, which has taken the toughest hits this yr, is again above 12,200, though nonetheless down 22% this yr. The S&P 500 has managed to climb again out of the bear market, is above 4,100 now, and its year-to-date loss stands at 14%. Neither index has actually examined its June low once more within the final two months, and up to date traits are upwards.

Writing for JPMorgan, world funding strategist Elyse Ausenbaugh provides abstract of present circumstances: “The Fed continues to be speaking robust on inflation, bond yields stay at or close to cycle highs, and the world’s different main economies proceed to face profound dangers… That stated, having had a while to course of the dangers we’re dealing with, buyers in mixture don’t appear to have the identical sense of ‘impending doom’ that they did a number of months again.”

Whereas the sense of doom ‘n gloom could also be receding, Ausenbaugh shouldn’t be recommending a whole-hearted bullish perspective on the a part of buyers. The strategist comes down solidly in favor of defensive equities for now, saying, “As stewards of capital, that prompts us to proceed to deal with extra defensive tilts over the subsequent yr within the core portfolios we handle.”

JPM’s inventory analysts are following the lead of the agency’s strategist, choosing out defensive shares that may add a layer of safety for buyers’ portfolios. Their accepted protection: high-yield dividend payers, a conventional play, however one which has confirmed efficient through the years. Let’s take a more in-depth look.

AT&T (T)

We’ll begin with one of many best-known ‘dividend champs’ within the inventory market, AT&T. This firm wants little introduction; it is without doubt one of the oldest names in telecommunications, and its blue brand is without doubt one of the world’s most recognizable emblems. AT&T has modified through the years, as telegraph and phone expertise has modified; the fashionable firm is a supplier of landline phone providers within the US, broadband web by way of each fiber-optic and wi-fi networks, and has made giant investments within the North American 5G rollout.

AT&T noticed $168.9 billion in complete revenues final yr. This yr, nonetheless, its first half results of $67.7 billion is down considerably from the $88 billion recorded in 1H21. The corporate’s most up-to-date quarterly report, for 2Q22, confirmed the bottom high line in a number of years, at $29.6 billion, though earnings remained pretty secure – the diluted EPS of 65 cents was in the course of the vary (57 cents to 77 cents) of the final two years’ quarterly outcomes. The corporate’s money circulation took a success within the quarter; free money circulation fell year-over-year from $5.2 billion to $1.4 billion.

On a constructive notice, the corporate added over 800,000 postpaid telephone accounts, and 300,000 internet fiber clients, making 2Q22 one of many firm’s finest for buyer additions. Administration attributed the detrimental money outcomes to larger company bills associated to 5G and to a rise within the variety of clients late on invoice funds.

By all of this, AT&T has stored up its quarterly dividend funds. The corporate has an enviable historical past of reliability; whereas it has made changes to the dividend to make sure cost, the corporate has by no means missed a quarterly cost because it began paying out frequent share dividends in 1984. The present cost was declared on the finish of June and paid out on August 1, at 27.75 cents per share. That annualizes to $1.11 and offers a yield of 6.5%. The yield is greater than triple the typical discovered amongst S&P listed companies, and is excessive sufficient to offer a level of insulation in opposition to inflation.

JPMorgan’s Phillip Cusick covers T, and he sees the inventory as a sound defensive alternative in immediately’s surroundings.

“Mobility continues to profit from sturdy postpaid telephone provides and ARPU is rising. Value will increase and the return of roaming income ought to profit service income development in 2H22, serving to offset the lack of 3G shutdown and CAF-II income. Margins needs to be up y/y in 2H22 from service income development, value financial savings and regular promotional spending… AT&T stays a really defensive enterprise and will have restricted draw back,” Cusick opined.

To this finish, Cusick charges AT&T shares an Obese (i.e. Purchase), seeing them poised to proceed outperforming the general market, and units a $23 worth goal to counsel a 12-month acquire of 32%. (To look at Cusick’s observe document, click here)

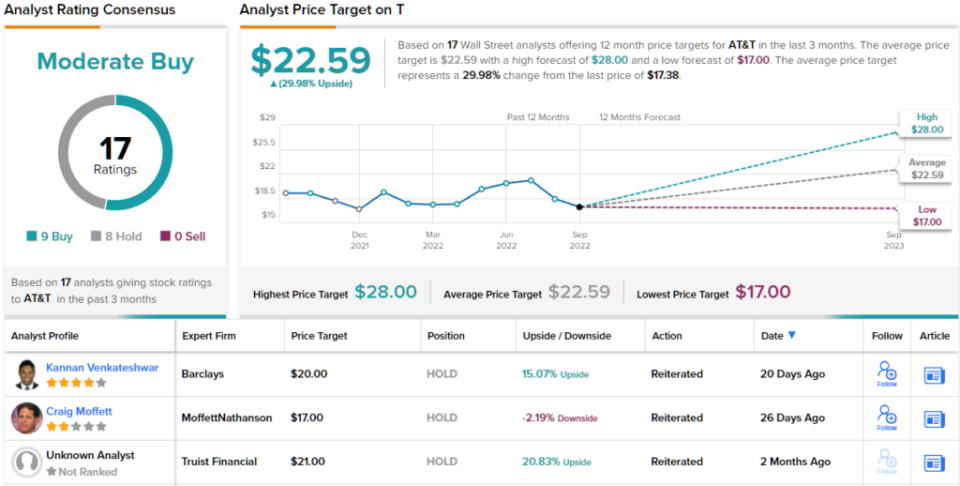

Total, AT&T shares have a Reasonable Purchase score from the analyst consensus. That is primarily based on 17 latest critiques, which break all the way down to 9 Buys and eight Holds. The inventory is promoting for $17.38 and its common goal of $22.59 implies a 30% acquire for the approaching yr. (See AT&T stock forecast on TipRanks)

Omnicom Group (OMC)

As AT&T may exhibit, profitable branding is necessity in fashionable enterprise. Omnicom Group lives in that world, offering branding, advertising and marketing, and company communications methods for upwards of 5,000 enterprise shoppers in over 70 international locations all over the world. The agency’s providers embrace promoting, media planning and shopping for, direct and promotional advertising and marketing, digital and interactive advertising and marketing, and public relations. Omnicom noticed nicely over $14 billion in income final yr, with an earnings of $2.2 billion.

With two quarters of 2022 behind us, it might appear that Omnicom is on observe to match final yr’s efficiency. 1H22 revenues matched final yr’s first half at $7 billion, as did diluted EPS, at $3.07. The corporate recorded these outcomes, described as ‘sturdy’ by administration, regardless of the identified headwinds which have hit the financial system this yr.

Omnicom declared its most up-to-date dividend cost in July of this yr, at 70 cents per frequent share. The cost shall be made on October 12. It’s annualized fee, of $2.80, provides a yield of 4%. Omnicom has stored its cost dependable since 1989, by no means lacking a scheduled cost.

In his evaluation of this inventory, JPMorgan’s David Karnovsky writes, “The ends in the quarter function one other knowledge level supporting our view that companies are working in a structurally stronger market post-pandemic, and that this could assist blunt a number of the financial softness probably forward… We see the present share worth as entry level for the longer-term investor as we count on the corporate to proceed to ultimately return to a constant mid- to high-single-digit earnings development profile, whereas a wholesome dividend supplies draw back help.”

That is an upbeat stance, and it’s accompanies by an equally upbeat Obese (i.e. Purchase) score. Karnovsky’s worth goal of $86 implies a one-year upside potential of 20%. (To look at Karnovsky’s observe document, click here)

What does the remainder of the Avenue suppose? Trying on the consensus breakdown, opinions from different analysts are extra unfold out. 5 Buys, 4 Holds and 1 Promote add as much as a Reasonable Purchase consensus. As well as, the $80.43 common worth goal signifies 12% upside potential from the present buying and selling worth of $71.53. (See Omnicom stock forecast at TipRanks)

To seek out good concepts for dividend shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your individual evaluation earlier than making any funding.

Source link