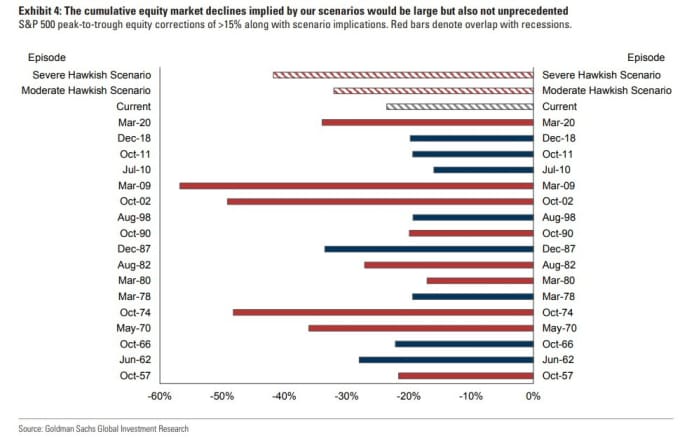

An additional 27% drop within the S&P 500 could possibly be coming if inflation hawks are proper, Goldman Sachs staff warns

[ad_1]

Not precisely TGIF this Friday.

What the sellside is slowly realizing isn’t just that the Fed goes to be aggressive in September after the most recent surprising inflation determine, however that the central financial institution must preserve charges larger, and for longer. The British pound

GBPUSD,

in some respects a proxy for monetary market situations, fell to its lowest level since 1985 vs. the U.S. greenback on Friday, shifting beneath $1.14.

In a brand new word to shoppers, Goldman Sachs chief markets economist Dominic Wilson and international markets strategist Vickie Chang crunched the numbers on what it will imply if Fed has to take a extra aggressive path than the market is forecasting.

The outcomes will not be nice. If the Fed has to hit the financial system laborious sufficient to get the unemployment charge as much as 5%, the S&P 500

SPX,

must fall 14% to beneath 3,400, the yield on the 5-year word

TMUBMUSD05Y,

must rise 91 foundation factors, and the trade-weighted greenback would rise 4%.

Within the extra extreme situation the place the jobless charge must hit 6%, the S&P 500 would fall 27%, to beneath 2,900, the yield on the 5-year Treasury would climb 182 foundation factors, and the greenback would rise 8%.

(The final dot plot from the Fed itself reveals the unemployment charge rising to 4.1% in 2024, and Goldman’s home forecast is for the unemployment charge to succeed in 4% by the tip of 2024.)

Table of Contents

The brand new Goldman projections aren’t nice, however they’re throughout the realm of previous drawdowns.

That extreme situation implies a tightening of economic situations similar to the worldwide monetary disaster of 2008, and earlier than that the recessions of the early Eighties.

“If solely a extreme recession—and a sharper Fed response to ship it—will tame inflation, then it’s possible that the draw back to each equities and authorities bonds might nonetheless be substantial, even after the injury that we’ve got already seen,” mentioned the strategists.

By the best way, Goldman headed into the brand new 12 months predicting the S&P 500 would close 2022 at 5,100.

The market

U.S. inventory futures

ES00,

NQ00,

had been pointing to a downbeat begin. The greenback

DXY,

noticed renewed power. Crude-oil futures

CL.1,

had been buying and selling round $85.

The thrill

FedEx

FDX,

shares slumped 20% in premarket commerce after issuing a warning on its fiscal first quarter and withdrawing steerage for the remainder of the 12 months. Rivals UPS

UPS,

and Deutsche Publish

DPW,

additionally fell.

Common Electrical

GE,

CFO Carolina Happe mentioned at an investor conference it’s seeing continued supply-chain pressure that can affect free money move within the third quarter.

Uber

UBER,

mentioned it’s responding to a cybersecurity incident and has contacted regulation enforcement.

NCR

NCR,

mentioned it will split into two companies, relatively than promote itself.

Germany seized the belongings of three Russian-owned oil refineries, which accounts for 12% of the nation’s oil refining capability.

The one information on faucet is the College of Michigan’s client sentiment index, due at 10 a.m. Jap, with the report’s inflation expectations studying set to be intently eyed.

The White Home issued a flurry of experiences on digital belongings as it flagged warnings to financial stability from cryptocurrency.

Better of the online

The Fed has made its last purchase of mortgage-backed securities.

The bottom-earning rank of American households are poorer than 14 European countries, together with Slovenia.

Apple

AAPL,

is evolving right into a different kind of company.

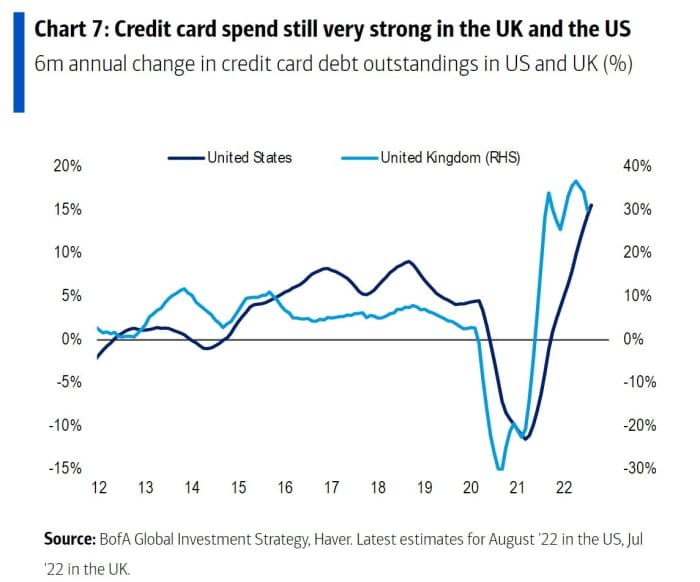

The chart

There’s excellent news and dangerous information with this Financial institution of America-compiled chart, displaying credit-card utilization hovering in each the U.S. and the U.Ok. The dangerous information, in fact, is that People, and Brits, really feel the necessity to enter debt to assist family expenditure as inflation soars. The excellent news, although, is that they’re nonetheless spending.

High tickers

Right here had been essentially the most energetic tickers as of 6 a.m. Jap.

| Ticker | Safety identify |

|

TSLA, | Tesla |

|

GME, | GameStop |

|

AMC, | AMC Leisure |

|

BBBY, | Mattress Bathtub & Past |

|

AAPL, | Apple |

|

HKD, | AMTD Digital |

|

NIO, | Nio |

|

APE, | AMC Leisure most well-liked |

|

DWAC, | Digital World Acquisition Firm |

|

AMZN, | Amazon.com |

Random reads

One other “what’s a catch” debate within the NFL after a key interception was overturned.

Males are paying six figures for the gruesome surgery to get taller.

The annual Ig Nobel was awarded for a study on knob turning.

Must Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your electronic mail field. The emailed model can be despatched out at about 7:30 a.m. Jap.

Source link